The fund industry has several agencies which analyse funds and rate them, or their manager, based on the fund’s performance prospects - but what happens in the ratings process?

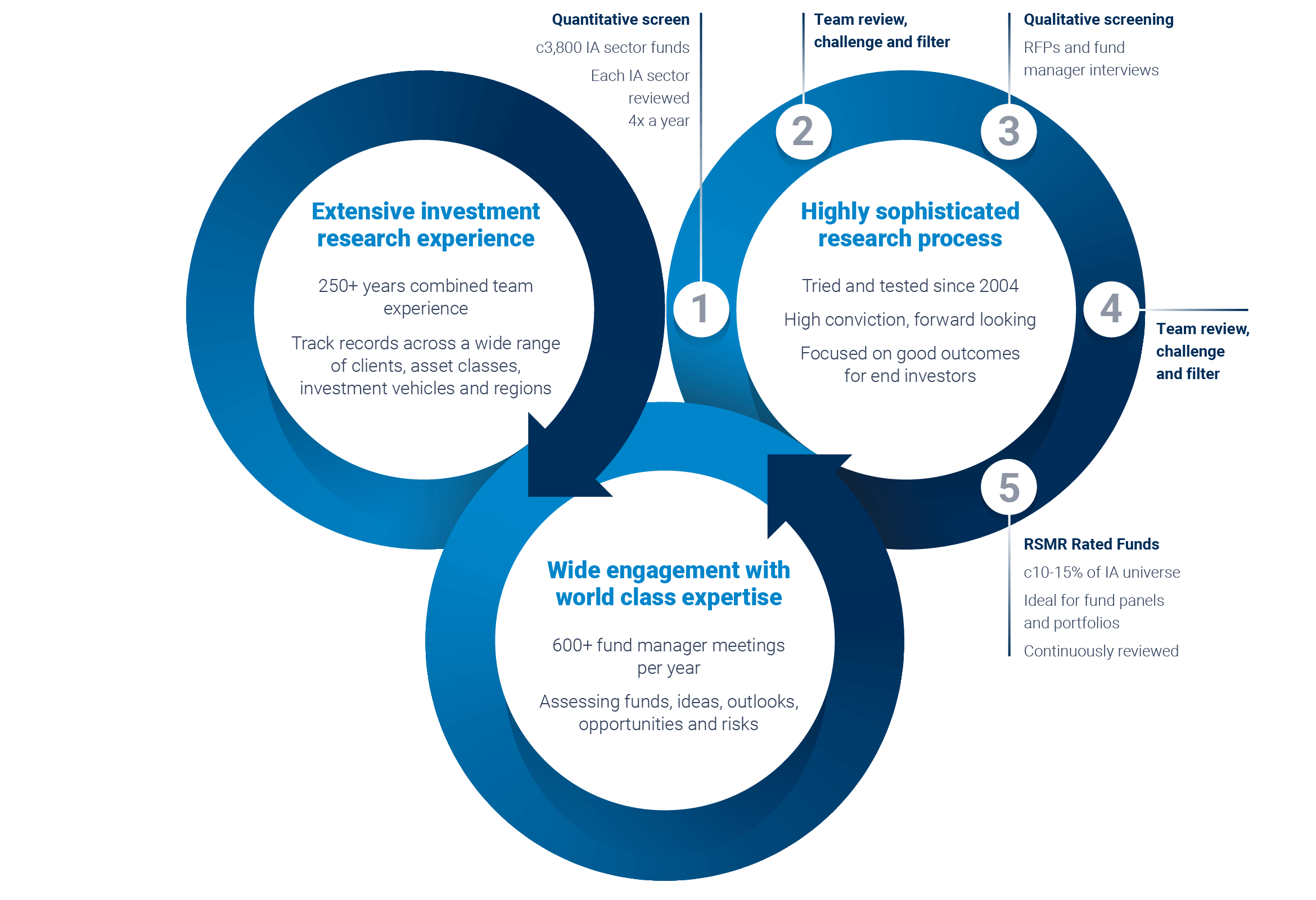

Ratings are often used by financial advisers when they choose funds for their clients and can also be a useful indicator for investors’ own decisions. Part of our work analyses fund performance and associated risks then makes a predictive assessment after a detailed discussion with the fund manager. Others rely solely on the past performance while we focus on the ability of the manager to perform in future. Here’s how we go about it.

Fund manager meetings are central to rating funds. They improve understanding of the fund, how it operates and enable us to ask the questions that investors want answers to – rather than those that fund managers prefer to answer. Preparation for these meetings is crucial. The questions must be practical, insightful, timely and focus on important areas of fund management and performance.

Gaining an understanding of the fund manager’s career background is crucial, including why they were attracted to fund management and their previous roles.

As well as assessing the lead manager’s performance, we ask about their team’s track record. This helps us understand the fund manager’s style and motivations and if they have a passion for the job. We also find out about their other responsibilities and how much time they devote to the fund in question.

We ask what the manager believes they can achieve with their portfolio as this reveals the fund’s real investment objective which could differ from many of its peers.

Liquidity – the level of buying, selling and the associated costs - can affect a fund’s performance, especially if it invests in smaller companies or less fluid markets. We establish the size of the fund and total monies invested. If the Assets Under Management (AUM) is too large, the fund may lose the advantage of being nimble.

When considering performance, it’s necessary to scrutinise the longer-term strategy on an annual basis. This helps to identify if the manager has a strong style bias, or if particular market or economic conditions suit how money is managed. It will also reveal if a fund has consistently performed better than its benchmark index, or has simply benefitted from one or two strong years’ performance. This helps us understand if and when the fund might struggle. Use of currency hedging could also exaggerate a fund’s performance so it appears far better, or worse, than would otherwise be the case.

We find out how the investment team’s responsibilities are allocated, and how this fits with research and portfolio construction. We also ask how long the process has been in place as this will demonstrate if it has been tempered through an economic cycle.

Discovering a fund manager’s objectives is crucial. Targeted alpha, an investment’s performance against its market index, can vary between country and sector and individual company stock selection. We establish what the manager considers important in individual businesses. This includes finding out what their selling discipline is as many find selling harder than buying. Some portfolio managers are prepared to hold cash for allocation to assets, while others prefer to be fully invested. In each case, we ask what they believe their competitive edge is.

Both formal and informal risk management systems are examined. Risk controls can exist at country, sector, stock or market capitalisation levels, or they may cross different asset classes and sectors. It is also important to establish whether managers apply tracking error or VAR (Value at Risk). Investors can do their own ‘common sense’ check by looking at minimum/maximum stock positions or seeing if leverage is used in portfolio construction.

We focus on a manager’s current strategy and the types of investment positions held in the portfolio and then check that these fit within the central aims. It is also interesting to check if the fund’s worst performers during the last 12 months are still held, and if so, why.

Fund turnover costs money, but some managers can implement highly-successful trading strategies to offset this. However, if turnover shoots up when a manager is underperforming, it can be a sign of indecision and herald further underperformance.

The approach detailed above enables us to judge if we should rate a fund or not. We are thorough because in doing so, we put our name to a fund, and with that, our reputation.

Geoff Mills has worked in financial services for more than 40 years. In 2004, he, along with Ken Rayner and Caroline Spencer, established RSMR, which is now among the UK’s best-respected fund rating agencies.

RSMR offers the widest set of recognised and respected ratings in the marketplace. Over 15,000 advisers across the UK use our market-leading fund ratings and portfolios, which are underpinned by rigorous research, extensive experience and thorough analysis.

Head of Research

Head of Managed Portfolio Services

Senior Investment & Research Manager

Investment Research Manager

Investment Research Manager

Investment Research Manager

Investment Research Support Manager

Investment Research Manager

Senior Investment Analyst

Investment Analyst

Head of Marketing & Business Development

Client Engagement & Marketing Manager

Key Accounts Manager

Business Development Manager (North)

Business Development Manager (South)

Business Development Manager (Provider relationships)

Marketing Liaison Officer (Provider relationships)

RSMR are proud to support Rewilding Britain in their mission to restore ecosystems to the point where nature can take care of itself.