You are currently viewing content and services provided by RSMR Portfolio Services Limited.

Supporting your client outcomes and regulatory requirements

For UK financial professionals only

Thorough due diligence an all aspects of your client proposition is vital to achieving good outcomes for your clients. For the FCA, this has been an area of general concern for many years, including more recently as part of the Consumer Duty.

Rayner Spencer Mills Research Limited (RSMR) was formed in 2004, and in 2018 a subsidiary company was launched, RSMR Portfolio Services Limited (RSMR PS). This document provides due diligence information on both companies.

This document is designed to help UK advice businesses conduct a review of RSMR and/or RSMR PS as part of their own due diligence process. Since 2004, RSMR has been working with UK advice businesses on a range of independent services and due diligence including fund research, fund lists, model portfolios, investment committee membership, CIP advice, asset allocation models and DFM research. Under RSMR PS, we offer a Managed Portfolio Service built in the main from RSMR rated funds, having received discretionary permissions from the FCA in 2018.

We have made this due diligence document as comprehensive as possible, based on the work we have done and the wide range of due diligence questions we have been asked. If you have any additional questions, please contact us direct at enquiries@rsmr.co.uk, call 01535 656 555 or ask your usual RSMR representative.

Rayner Spencer Mills Research Limited is a limited company registered in England and Wales under Company Registration Number 5227656. Our registered Office is Number 20, Ryefield Business Park, Belton Road, Silsden, West Yorkshire, BD20 0EE. We have been trading since 2004 and were established to meet the needs of advice businesses and asset managers, our core business being fund research and ratings. RSMR is a registered Trademark.

In December 2018, Benchmark Capital Limited (BMC) became a 49% shareholder in Rayner Spencer Mills Research Limited. BMC is wholly owned by Schroders plc . Schroders have no operational or strategic input in the day to day running of RSMR, and do not sit on the Company Board or any of the internal governance committees. Any Schroder funds that are rated or included in portfolios are subject to the same rigorous research that we apply to all the funds we rate, thereby ensuring we maintain our impartiality in our rating and selection processes and can demonstrate this to the wider marketplace. On 16th July 2024 it was announced that BMC has agreed to sell its 49% shareholding to Fintel plc. The overall deal is still subject to regulatory approval.

RSMR Portfolio Services Limited was formed in 2018 and is wholly owned by Rayner Spencer Mills Research Limited. RSMR Portfolio Services is authorised and regulated by the Financial Conduct Authority under number 788854. A formal Services Agreement exists between RSMR and RSMR Portfolio Services Limited for the supply of support services. A copy can be provided if required.

RSMR Portfolio Services offers its services exclusively to financial advisers, who use the firm’s discretionary portfolio management services for their clients. RSMR Portfolio Services creates and manages the portfolios, and the adviser carries out all KYC checks and satisfies suitability directly with their clients. The adviser takes responsibility for the suitability of the discretionary portfolio service offered, to ensure it meets the needs of their clients. Our Managed Portfolio Service (MPS) is operated under the ‘Agent as Client’ rules.

RSMR Portfolio Services has the following regulatory permissions:

Investment types in which RSMR Portfolio Services deals for its clients are:

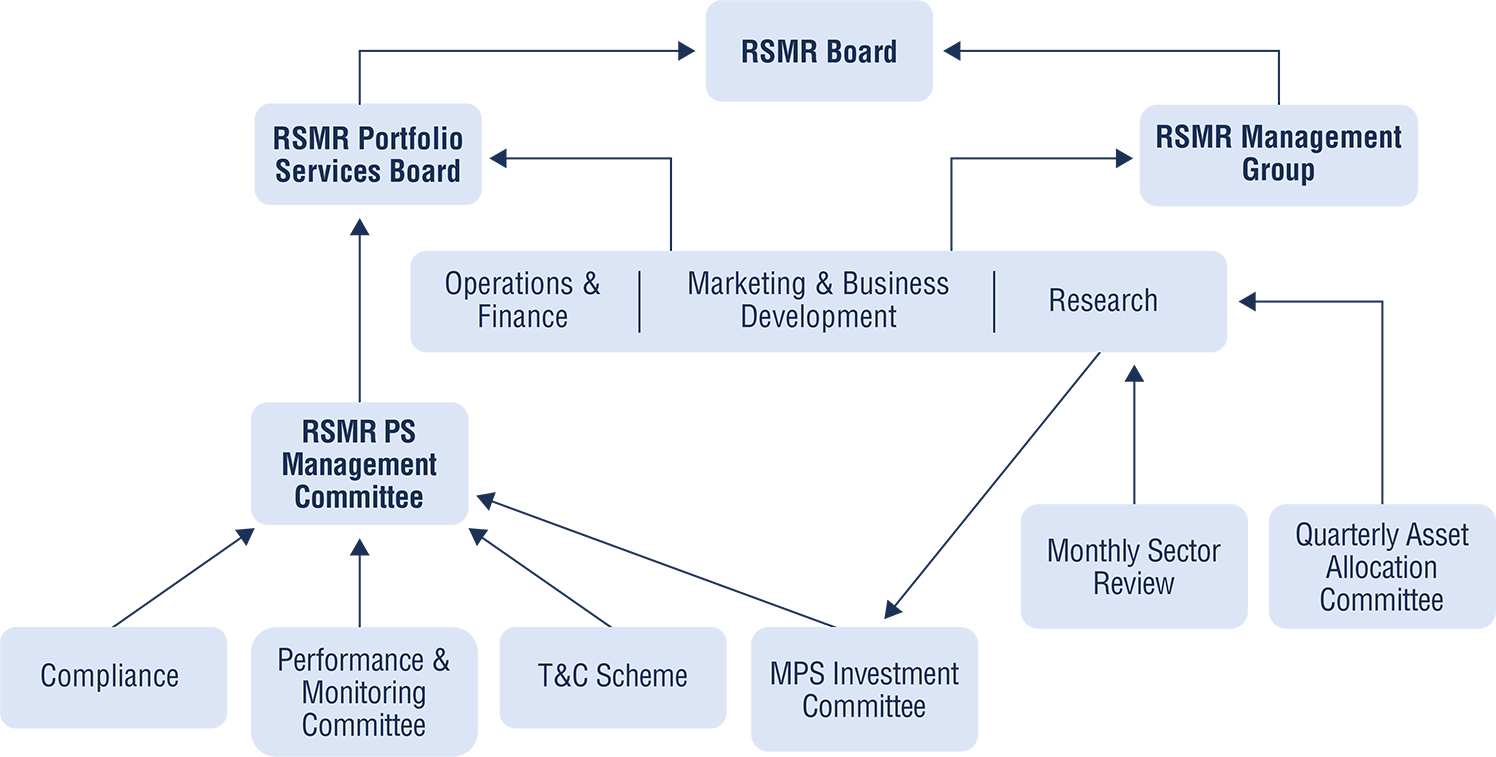

RSMR Portfolio Services is managed and controlled by a monthly Management Committee and a Board that meets quarterly. RSMR Portfolio Services uses the services of an independent compliance consultant.

The RSMR Board oversees risk management for both RSMR and RSMR PS, including internal and external risks, considering those that may adversely affect the company and its clients. The RSMR Board includes our CEO and currently four non-Executive Directors, one of which is our independent Chairman. Details of current Board members including biographies are available at www.rsmr.co.uk/about-us.

Operational and compliance risks are controlled through the use of robust policies, procedures, internal reviews and systems controls. We recognise that availability of qualified and experienced resource is a key risk to us and client firms. For this reason, information and communications are shared internally, to ensure that normal service can be continued during planned or unplanned absences.

The financial accounts and business plans for both RSMR and RSMR PS are overseen by the Board and subject to annual scrutiny and approval. The report and accounts for both companies are available on request.

A Management Group comprising the CEO and 4 senior executives manages both businesses on a day to day basis.

Our Governance and Risk Management structure chart is shown below.

RSMR has a culture of inclusivity, respect and support. This applies to our team and the organisations we choose to work with. We have a fairly flat management structure and are relatively small, so any issues or potential issues can be dealt with swiftly.

We are a small company but are fully behind the environmental ethos of corporate responsibility and where possible adopt the broader initiatives required by larger company legislation.

RSMR has taken steps to reduce carbon footprint by using public transport instead of cars where appropriate, to car-share where appropriate and to consider video conferencing instead of face to face meetings to reduce travel. RSMR also operates a Cycle to Work scheme to encourage carbon free commuting.

Since 2022 RSMR has been a corporate partner of Rewilding Britain (www.rewildingbritain.org.uk). This forms part of RSMR’s contribution to and engagement with the world around us.

The services of both RSMR and RSMR PS are based on our robust fund research, with consideration of the fund universe, which we define using the Investment Association (IA) sectors. We consider all the funds in the main IA sectors, and then apply a detailed methodology looking at a range of quantitative and qualitative screens. We consider a range of measures, looking at performance and risk, together with gaining a thorough understanding of the fund management process.

Quantitative data is sourced from FE Analytics or Morningstar, and qualitative information is sourced initially from a questionnaire completed by the fund management team, and then from detailed and focussed meetings with fund management teams.

Our fund research works to a robust documented methodology. By using the IA sectors as our starting point we ensure that we are looking at the whole of the market and we then use a series of screens to narrow this down. Our internal processes and any that we implement on behalf of clients are independent of fund management groups. Our Conflict of Interest policy document is available on request.

In addition to a detailed methodology for fund reviews, our fund research team meet formally on a monthly basis at the Sector Review Committee to discuss views on funds, focussing on any changes. This overview ensures that we react to market changes in a timely manner and the collaborative approach ensures our process is independent and without bias.

An experienced independent investment consultant participates in our formal fund research and asset allocation meetings. His role is to contribute and also challenge views and decisions where appropriate.

The specific methodologies used for both RSMR and RSMR PS are available on request.

Where a client firm or potential client has particular needs or preferences we can provide bespoke services as required through either business. This would be done following detailed meetings to agree the scope of the work and we then adopt a structured but flexible approach ensuring we deliver to their expectations. All output is checked by a senior team member before delivery, and we have regular contact with client firms to ensure that they are happy with the level of service and the quality of information they receive.

Our investment research team meet with fund managers regularly and attend investment conferences where they hear the views of managers, economists and market commentators. They also monitor the press and other information sources to ensure that they have a full and current understanding not just of the funds that we approve for use, but also of market conditions and how these affects individual assets.

The team also take industry related qualifications to improve their knowledge and skills and meet the specified CPD requirements for relevant professional bodies.

We have a robust challenge process to ensure we take account of the views of all members of the investment team. We are honest and upfront with our clients, allowing for challenging dialogue if necessary.

We monitor both regulatory and industry change and participate in debate directly with the industry where we think appropriate. In addition, our involvement on a number of clients’ investment committees means that we are updated on regulatory and other issues affecting the investment world.

We adapt our solutions and develop our research approach to encompass major trends and changes in industry thinking but do not make changes based on short term trends or market noise . We have a continual research and monitoring process that looks at both current and ongoing research practices to ensure we incorporate appropriate changes in our methodology. We have an open-minded approach to change supported by the significant experience of our team.

We have a Business Development team supporting both businesses. The mobile numbers and email addresses of our Business Development team are published on our website at www.rsmr.co.uk/about-us. In addition, our main phone number, 01535 656555, is always answered during office hours. Alternatively, our general email address enquiries@rsmr.co.uk is continually monitored during office hours.

Upon receipt of general queries, we aim to respond within 24 hours either with an answer, or with a timescale for an answer if the issue is more complicated.

We publish more detailed information about the RSMR team including experience at www.rsmr.co.uk/about-us. Detailed information about team capabilities is also available on request.

As well as our fund ratings (RSMR) and MPS services (RSMR PS) we provide bespoke services, tailored to individual advice businesses. For this work, we are rigorous in seeking to understand the detailed requirements. This could include practical features such as implementation dates and any technical format requirements for the supply of data. If necessary, we challenge constructively or advise on requirements, based on the client firm’s objectives and our knowledge and experience.

We are happy to work with client firms to find the best way of taking new solutions and integrating them into the advisory process in conjunction with any other supplier(s). Part of this would be ensuring a full understanding by a client firm’s advisers as to how the information is put together in order to ensure their continued confidence in the process and solutions given. Key to the implementation is a thorough understanding of the requirements and the key deliverables. We ensure that this is fully documented and agreed.

We provide a range of reports, depending on the services used.

For our MPS business, on a quarterly basis RSMR PS issues an investment bulletin which looks at the main markets (both geographical and asset type) and provides commentary on how they have performed over the previous quarter and identifies the key issues ahead. We are able to provide a shorter, less technical version of this in a language and format that can work with end investors, however we cannot take responsibility for compliance approval for end investor material – this is the responsibility of the client firm.

For our bespoke clients, either company can provide an investment review which looks at the bespoke portfolios and other solutions or products and provides commentary on how they have performed against expectation over the previous quarter. The review will also highlight any suggested changes.

We also have a studio and editing capabilities and facilities for the production of podcasts and videos. Tailored reporting using these media is available, with the client firm’s branding if required.

All our reporting content is reviewed by a senior member of the team before external distribution. Reporting for our Managed Portfolio Service qualifies as a Financial Promotion and is processed and approved accordingly.

We do not hold any investor data. The information we hold on our client companies is limited to contact details and information relating to the services we provide.

Information held is stored and managed securely and digitally, using the latest security systems and cloud-based technology. We use proven specialist partners for this, for our proprietary systems and also our website and microsites. We have carried out our own due diligence on them and information about them is available on request.

Our Privacy Policy is available at the foot of every page of our website www.rsmr.co.uk. Both businesses are registered with the Information Commissioner’s Office; under ICO number Z8963509 for Rayner Spencer Mills Research Limited and under ICO number ZA258597 for RSMR Portfolio Services Ltd.

Our Employee Handbook covers appropriate use of computers and systems as part of our rigorous standards of confidentiality. We use Multi Factor Authentication across the business to protect data and information. Adherence to the policies related to computer and data use is overseen by line management as part of the ongoing monitoring of staff. Policies and procedures are updated as required and compliance with the policies is monitored as part of our normal staff supervision.

Full references are taken as part of our recruitment process. Staff are required to comply with the procedures set out in the Employee Handbook. Employees will sign a confidentiality agreement if required for a specific project.

Documents are generally in electronic format and are stored on a secure cloud-based server. Information that we have delivered to client firms and supporting research is kept for at least seven years. It is then deleted or shredded. Information is deleted from old computers by our IT partners who wipe any hard drives for us.

Any information relevant for staff with regard to Data Protection is included as part of the induction training and detailed in the Employee Handbook, with knowledge validated and any misunderstanding identified as part of normal staff supervision.

Doors and windows are locked at our Silsden headquarters and we have a security alarm system. All computers and RSMR issued mobile phones are protected by Multi Factor Authentication. All files are stored on a secure cloud-based server which is backed up. Firewalls are in place on all static and laptop computers, as is comprehensive anti-virus / malware software.

We have appropriate insurance in force at all times.

We have a documented Business Continuity Plan, a copy of which is available on request. It is included in our induction programme and referred to in our Employee Handbook. The Plan was implemented during COVID 19 and there were no issues.

Our fund information and all our other documentation and information is backed up and stored offsite and could be accessed from an alternative site once activated by our IT partner.

RSMR does not have a formal internal audit process, however we do have certain processes in place which ensure our services are delivered to the required standards, as described elsewhere in this document. We are regularly and independently audited by some of our clients with no major issues.

RSMR Portfolio Services is subject to an annual independent compliance audit.

We encourage feedback, whether it is negative or positive. In the event of a formal complaint, our process is to understand the nature of the issue and the background to it and gather all the relevant details. Depending on the nature of the issue, we would initially look at how we could resolve the situation and at measures to ensure the situation did not arise again. The timescales for complaint handling depend on the nature of the issue but would be communicated at the outset. Any complaint is dealt with personally by a Director. To date we have had no complaints.

We carry Professional Indemnity Insurance covering both companies.

Contact us

RSMR, Number 20, Ryefield Business Park, Belton Road, Silsden, BD20 0EE

Tel: 01535 656555

Email: enquiries@rsmr.co.uk

July 2024