08 Jun 2023

What comes to mind when you think of income investing? Probably mature companies, legacy industries, developed markets, and low growth.

While a traditional developed market equity income strategy still has its place in portfolios, we believe there is a compelling case for diversification into emerging markets (EM).

Once seen as offering slim pickings for dividend investors, today’s EM universe provides an incredibly varied and attractive income hunting ground as its capital markets deepen.

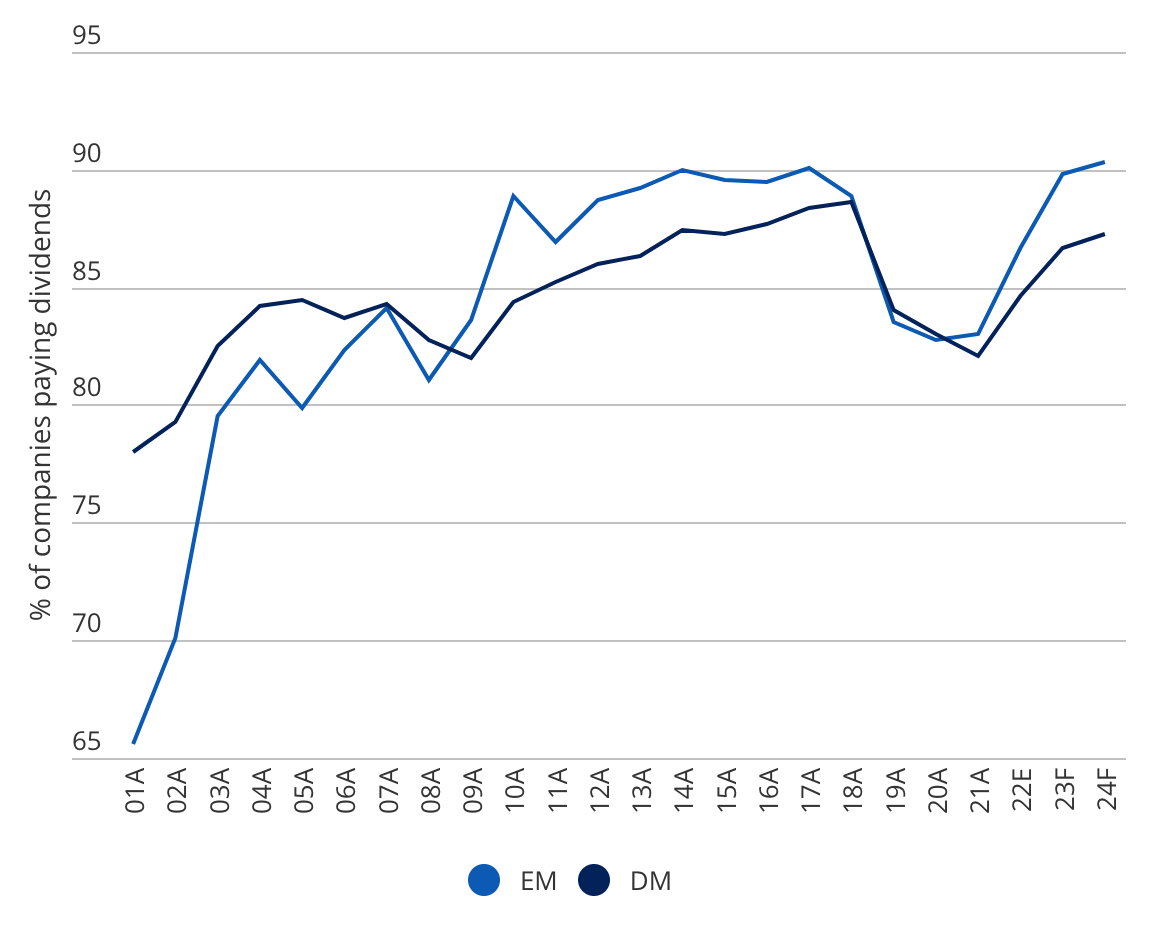

The number of EM companies paying a dividend grew significantly in the ten years from 2001-2011*. In fact, 90% of companies in EM now pay dividends*.

As you can see in Chart 1, there are now more companies paying dividends in EM than developed markets (DM) (Jefferies, March 2023). Perhaps more significantly, nearly 40% of companies in EM pay a dividend of over 3% (Bloomberg, March 2023).

Chart 1: MSCI universe – companies paying dividends

The proportion of EM companies with dividends increased significantly during the start of the previous decade

Using MSCI universe as it existed in the past. Based on local currency performance. Gross reinvested dividends without considering the impact of taxes. For illustrative purposes only. Source: FactSet, Jefferies Equity Research, March 2023

In our view, paying a dividend signals a shareholder-driven mindset on the part of company management, and a discerning approach to capital allocation.

It's not uncommon for investors to assume that because income strategies are sometimes associated with mature companies, dividend investing means missing out on growth opportunities.

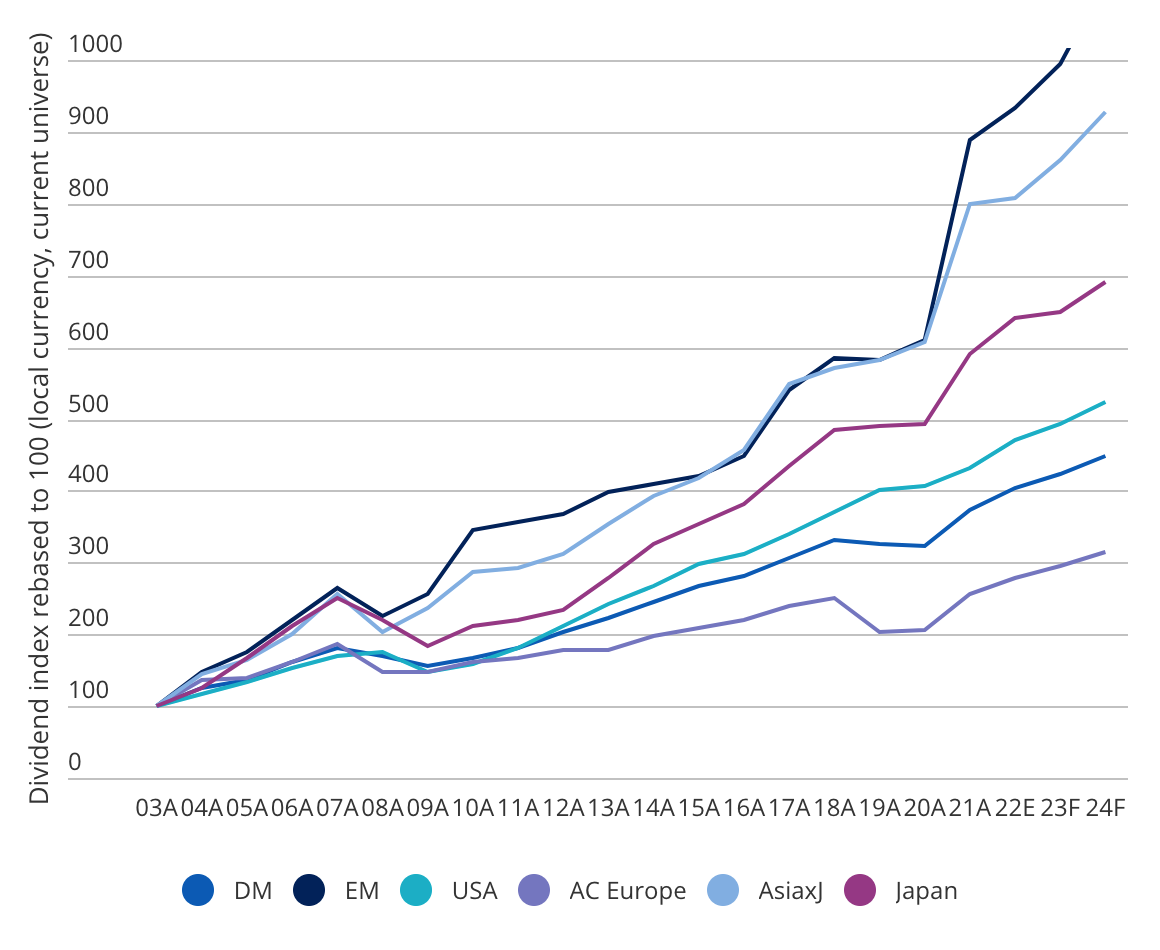

However, we believe that in EM this is not the case. Strong corporate fundamentals and good underlying economic growth mean dividends have grown twice as fast in EM versus the rest of the world since 2000.

This has resulted in a compound annual growth rate (CAGR) of c.13% over the last 19 years, as illustrated in Chart 2.

Chart 2: MSCI regions - dividend growth since 2003

Last 19 years dividend CAGR (03A-22E):

DM = 7.6% EM = 12.5% USA = 8.5% AC Europe = 5.5% AsiaxJ = 11.6% Japan = 10.3%

Dividend index rebased to 100 (local currency, current universe). Bottom-up aggregated with free float adjustment in a year-on-year like-to-like basis for the current MSCI universe. Source: FactSet, Jefferies Equity Research, March 2023. For illustrative purposes only

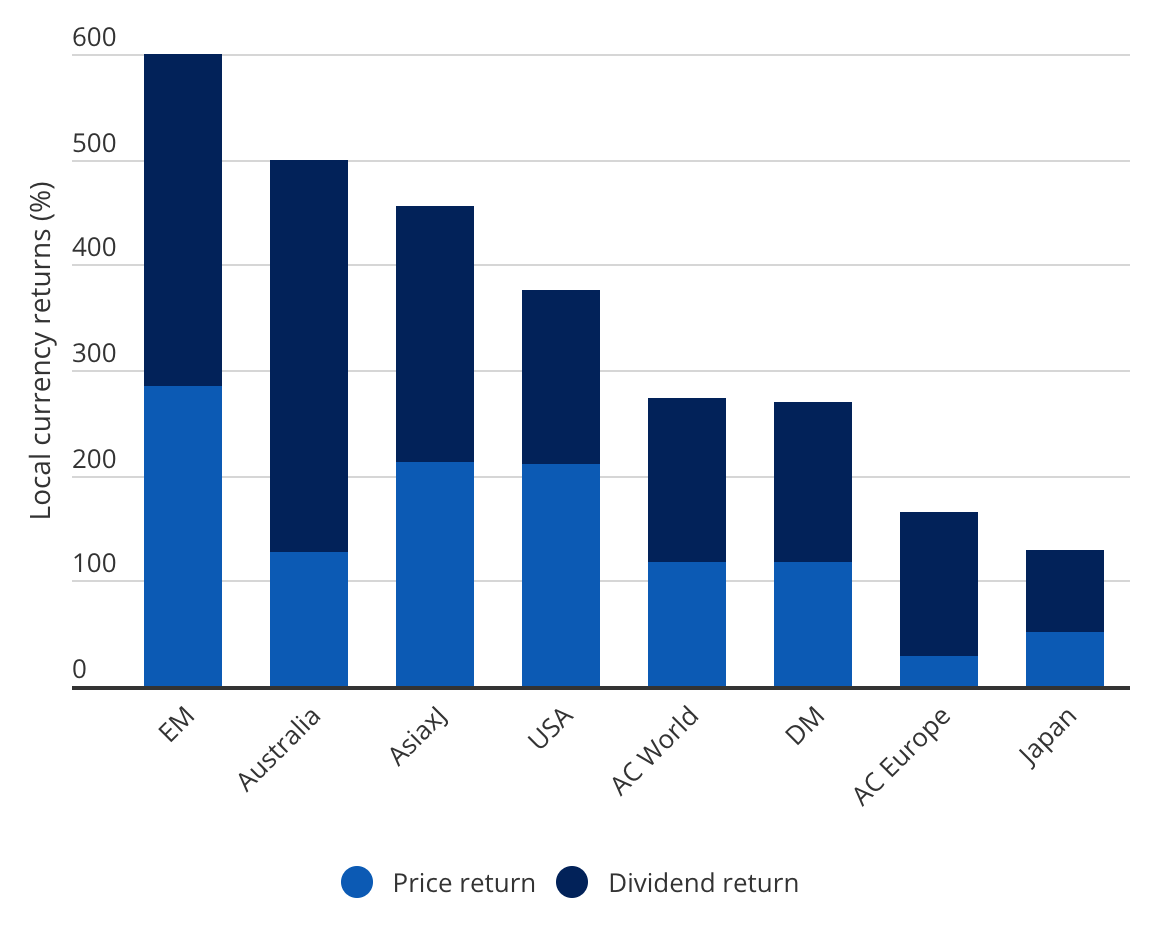

Although it's well understood by many investors that income is a critical part of returns over time, this is something that may have been given less consideration in an EM context.

Nonetheless, the opportunity is just as relevant for companies in EM as it is for DM. Chart 3 displays the two components behind the MSCI EM Index’s total return over the last 20 years - earnings growth (i.e. price return) and dividends.

Dividend returns in emerging markets since 2000 have been the best relative to other regions.

The chart shows that dividend returns in EM since 2000 have been the best relative to other regions. The price return component representing half of investor returns is dominated by earnings growth which in turn drives dividend growth. The other half of investor returns has come from the compounding effect of dividend payments.

The growth of earnings and the compounding of dividends in EM means active investors can combine dividend growth and high income, sometimes in a single stock. The superior growth characteristics of EM dividends (both from underlying growth of cash flows, plus rising pay-outs) is a trend we expect to continue.

Additionally, the coverage of dividends in EM tends to be superior, with healthier balance sheets providing further support for the growth of pay-out ratios.

Chart 3: MSCI regions - % local currency total returns since December 2000

EM, Asia ex-Japan and Australia have the highest dividend contribution to their total return since Dec 2000

Using MSCI universe as it existed in the past. Based on local currency performance. Gross reinvested dividends without considering the impact of taxes. Source: FactSet, Jefferies Equity Research, March 2023.

We believe the EM universe offers diverse income opportunities across sectors and geographies, as well as dynamic companies with the potential to generate valuable investment outcomes for clients.

What’s more, the trends discussed in this article would seem to further strengthen the investment case, suggesting the asset class might be particularly attractive for active income investors seeking a strong total return.

*Source: Jefferies, March 2023

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis, should not be taken as an indication or guarantee of any future performance analysis forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI” Parties) expressly disclaims all warranties (including without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages (www.msci.com).

Author: Matt Williams, Senior Investment Director