Following the US election, US smaller companies rose on Trump’s domestically focused agenda. Is this the start of a broader rally? Artemis’ US team give their views.

FOR PROFESSIONAL INVESTORS AND/OR QUALIFIED INVESTORS AND/OR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS. CAPITAL AT RISK. All financial investments involve taking risk and the value of your investment may go down as well as up. This means your investment is not guaranteed and you may not get back as much as you put in. Any income from the investment is also likely to vary and cannot be guaranteed.

The dust has settled on the US election and Donald Trump has a clean sweep of both houses, giving him a clear mandate for his pro-business agenda. What does this mean for US smaller companies?

While the S&P 500 is dominated by large global stocks, the US smaller companies index is much more domestically focused – the Russell 2000 derives the majority of its revenues (around 80%1) from the home market. So it should benefit disproportionately from ‘making America great again’.

Indeed, in the wake of the election results, US smaller company shares have rallied, with the Russell 2000 hitting a record high late in November. But does this rally have further to run? We believe it is only the beginning.

Positive themes for US stocks likely to persist under Trump

Healthy economic growth: Trump has had the good fortune to inherit a robust economy. GDP grew by 2.8% in the most recent quarter2. Inflation appears to be contained and the Federal Reserve is on a rate-cutting cycle, albeit a more gradual one than originally expected.

Government infrastructure spending: Investment in America’s crumbling infrastructure has bipartisan support through the $1.2 trillion Infrastructure Investment and Jobs Act (2021). We expect the repair of America’s road, bridge and water infrastructure, as well as investment in public transport and high-speed internet access to continue.

Post-Covid recovery: Supply chain disruptions are still working their way through various industries, in particular healthcare. The recalibration of supply/demand dynamics within these industries presents lots of opportunities.

AI investment boom: AI-related expenditure, in particular the build-out of AI infrastructure, shows no sign of stopping. In a ‘winner takes all’ race, the risks of underspending are potentially greater than overspending. This area has massive backing from some of the people who now rank among the president-elect’s closest confidants.

Onshoring of production: The reshoring of supply chains and – to a degree – deglobalisation will accelerate under Trump, who will look to impose tariffs to protect domestic America. This should be supportive to smaller companies relative to large ones, although it is likely to cause volatility in the short term.

What will change under Trump for US smaller companies…

From regulation to deregulation: A cornerstone of Trump’s policy, with the help of Elon Musk (as leader of the Department of Government Efficiency), will be to remove red tape. Making it easier to do business will undoubtedly be supportive for smaller companies. In this endeavour the government will be supported by the courts after the Supreme Court struck down the Chevron Doctrine, which had mandated that federal courts defer to government agencies in the interpretations of ambiguous laws.

Tariffs: It remains to be seen how much of the talk about tariffs was campaign rhetoric and how much of it will be enforced. We believe tariffs will be used as a ‘stick’ to strike deals around the world but could potentially be inflationary.

Tax cuts: Trump has pledged to cut taxes – we don’t yet know by how much. What we do know is that taxes are not going to increase, as they would have done under the Democrats.

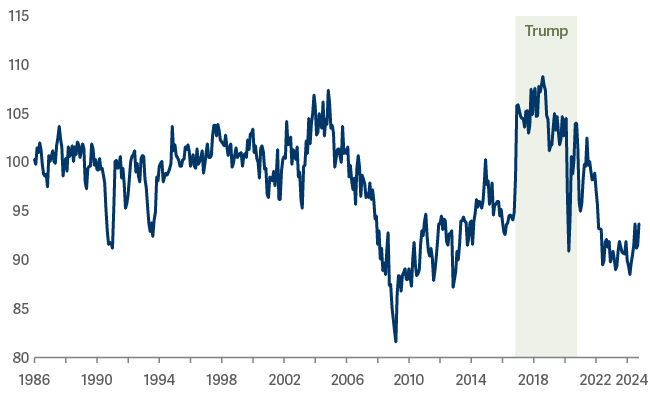

We expect all the above to be a net positive for US smaller companies. As a measure of this, a key indicator we are looking at is business confidence. When Trump was elected for his first term, there was a significant uplift. Consumer confidence has already risen post the election and we would expect business confidence to follow suit.

NFIB Small Business Optimism Index

Source: Datastream as at 15 October 2024.

Source: Datastream as at 15 October 2024.

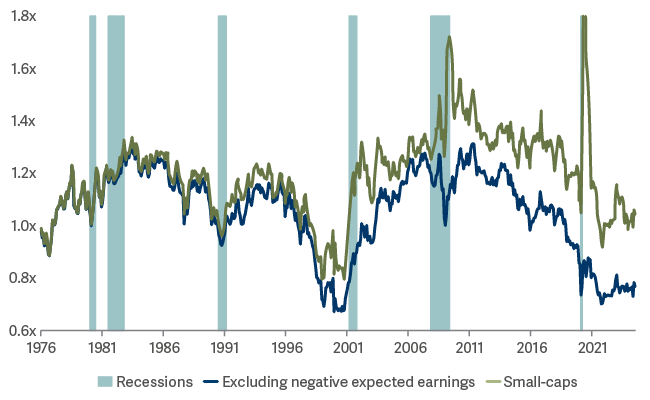

Valuations look attractive, especially for profitable US small caps…

There is also a compelling valuation argument for investing in US smaller companies. Over recent years, as the market has become increasingly focused on large-cap companies, smaller companies have significantly derated. We would note that profitable, smaller companies – the type of stocks in which we invest – are particularly cheap relative to large-cap stocks.

US smaller companies’ valuation relative to larger companies

Source: Empirical Research Partners as at 31 August 2024.

Source: Empirical Research Partners as at 31 August 2024.

Make America great again

In short, we think Trump’s domestically focused policy, together with a robust economy, provide a very beneficial backdrop for US smaller companies. We see plenty of attractive opportunities to invest in some of the most innovative companies in the world that have the advantage of access to the largest domestic market in the world.

1How American is your US equity portfolio? | LSEG

2Gross Domestic Product, Third Quarter 2024 (Second Estimate) and Corporate Profits (Preliminary) | U.S. Bureau of Economic Analysis (BEA)

FOR PROFESSIONAL INVESTORS AND/OR QUALIFIED INVESTORS AND/OR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS.