FOR PROFESSIONAL INVESTORS AND/OR QUALIFIED INVESTORS AND/OR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS. CAPITAL AT RISK. All financial investments involve taking risk and the value of your investment may go down as well as up. This means your investment is not guaranteed and you may not get back as much as you put in. Any income from the investment is also likely to vary and cannot be guaranteed.

In India, it seems everything is outsized. In 2022 the country overtook China to become the world’s largest population, with over 1.4 billion people.

It is currently engaged in the world’s biggest democratic process, as around one billion voters go to the polls in a general election. India’s economy has been growing at the fastest rate globally for the last two years and is forecast to continue to do so1. Currently the fifth largest economy in the world, it is forecast to be the fourth largest by 20272. While it is unlikely to be plain sailing – the country still faces significant poverty and high youth unemployment – the forecast growth figures are impressive.

Prime Minister Narendra Modi, who looks very likely to win a third term in office, has set a reforming business-friendly agenda over the last 10 years. This shows no signs of changing if he wins this election.

The past 10 years have seen vast changes. There have been reforms to taxation. One Nation, One Tax (GST), introduced in 2017, sought to simplify India’s complex tax structure and apply taxes uniformly across all Indian states. It creates a common market, promoting ease of doing business.

Investment in digitisation has been impressive. Building up the national identity system called Aadhaar, begun by the previous government, has laid the foundation for a payment system that 300 million Indians use every month. It has also enabled most households to get a bank account.

In addition to changing domestic policy, India has been a beneficiary of shifts in supply chains, particularly away from China. It has also benefited from its highly skilled IT workforce.

There is also huge investment in infrastructure through the government’s National Infrastructure Pipeline, with planned investments amounting to $1.4 trillion by 20253. This covers a wide range of sectors, including energy, roads, railways and urban development.

It is this last point, urban development, which underpins India’s growth trajectory and most excites investors. Currently 37% of the Indian population live in cities, compared to China’s 58%4. It was urbanisation in China that powered that country’s growth over the last few decades. India is set to benefit from the same trend.

But all of this comes at a price…

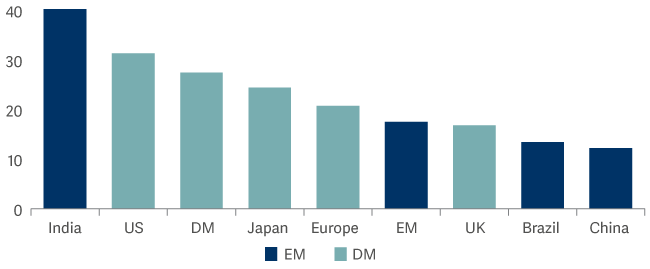

It’s not just population and economic growth figures that are outsized in India – so are equity valuations. In terms of Shiller P/E (a long-term measure of valuation that uses 10-year earnings figures), India is the most expensive equity market in the world, surpassing even the US.

Shiller P/E by region

Source: Bloomberg as at 31 March 2024. Shiller P/E is the long-term price earnings ratio computed by dividing price by 10-year average real earnings per share. Real earnings per share is computed by adjusting the EPS ratio for the country’s consumer price index.

This is largely due to a burgeoning domestic investor base. Increased wealth has led Indian consumers to invest in shares, which has driven up prices.

Foreign investors have also been attracted by India’s growth characteristics and have been prepared to pay a premium. As a result, the Indian stock exchange recently overtook Hong Kong’s to be the fourth largest globally.

Although we acknowledge India’s attractive growth characteristics, high starting valuations mean that any disappointments can potentially lead to big setbacks. We would also caution that performance has been driven by P/E multiple expansion rather than growth in earnings.

To put these valuations into context, we offer this comparison of very similar fast-food companies in India and China:

Source: Artemis, Bloomberg as at 31 March 2024. Image source: brandsoftheworld.com

Yum China operates the franchises on Pizza Hut, KFC and Taco Bell and has 13,000 restaurants. It is trading on 18.5x earnings. In India, there are two equivalent businesses that do exactly the same thing. They run the same brands and there are only 2,000 restaurants between the two of them. And both those companies are trading on over 100x earnings. These Indian businesses are immature and can potentially grow very quickly. But they may also face challenges and a valuation of over 100x does not leave room for disappointments.

Where are we finding opportunities in India?

Despite much of the market being richly valued, we still have around 10% of the Artemis SmartGARP Global Emerging Markets Fund invested in India. Here are some examples of our holdings – all businesses with strong growth drivers but still trading on reasonable valuations.

As mentioned above, Modi’s government has been investing heavily in infrastructure of all types, including roads, railways, airports and digital connectivity. A couple of our holdings benefit directly from this. One is NMDC, India’s largest producer of iron ore and steel, which is experiencing strong demand because of the government’s spending programme. Another is Indus Towers, India’s largest mobile tower installation company – and one of the largest in the world. According to the company, three out of five calls made in India are through an Indus site.

The Indian government has also been focused on electrification and the broader transition to cleaner energy. We hold Power Grid, the government-appointed central power transmission utility. The company is one of the largest transmission utilities in the world, with more than a 50% market share in India. Economic growth, urbanisation and industrialisation are expected to increase India’s energy demands in the next few decades. Power Grid is also a beneficiary of the push towards renewables. A high proportion of its capital expenditure is committed to transmitting renewable energy.

We also hold Amara Raja, a technological leader and one of India’s largest manufacturers of lead-acid batteries for automotive and industrial use. In response to the clean energy transition, it is also diversifying through its ‘new energy’ business, which deals with lithium-ion technologies.

Looking ahead…

While we acknowledge India’s growth potential, we are mindful of its rich equity valuations. Our investment process focuses on companies’ fundamentals - such as earnings and cashflow growth - combined with a strict discipline around valuations. We are confident that this process will uncover interesting opportunities in the months and years to come.

1India’s economy follows China to reach rapid take off | Reuters

2IMF: India overtakes UK as the world's fifth-largest economy | World Economic Forum (weforum.org)

3India Aims to Spend $1.4 Trillion Building Infrastructure - Bloomberg

4Politics, Productivity & Population: Why The Chinese Economy Flew and India's Just Grew (forbes.com)

FOR PROFESSIONAL INVESTORS AND/OR QUALIFIED INVESTORS AND/OR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS.