08 Jul 2022

Great progress has been made in measuring ESG factors at companies, but details are often lost. Grace Le explains how the fixed income team does its own groundwork to decide which companies are investable.

FOR PROFESSIONAL AND/OR QUALIFIED INVESTORS ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS. CAPITAL AT RISK. All financial investments involve taking risk which means investors may not get back the amount initially invested.

Quantifying the unquantifiable was always going to be difficult. ESG rating agencies have tried to simplify investors’ lives by condensing complex matters into a single-letter rating – a task which was always going to be fraught with challenges.

As fixed income managers, we do not give an explicit internal ESG rating to a holding, in the same way we do not assign an explicit fundamental, technical or valuation rating to the bonds we own. Assigning an alpha or numerical rating, in our view, risks over-simplifying the often-complex nature of these factors.

We have previously written about the dangers of this, so in this article we discuss how it is possible to integrate ESG into fixed income investing.

.png)

We believe that ESG factors need to be considered alongside fundamental, technical and valuation factors traditionally considered by fixed income investors.

Combining these leads to decisions that can help improve performance and augment the assessment of potential risks. All of these factors interact, but some will have higher importance depending on the sector, company or specific bond.

We don’t look at how many ESG policies a company has or whether it is signatory to a particular initiative. These are ‘measures’ that can be susceptible to manipulation. We prefer to focus on where poor business practices or exploitative social and environmental activities could threaten sustainability of cashflows. Or which technologies and developments risk making certain sectors redundant.

And instead of looking at whether a company has an explicit policy on energy use, we prefer to look at how much carbon it emits – and, more importantly, the trajectory of such emissions and whether these could threaten the sustainability of cashflows further down the line.

Not only do we look at ESG on a bond-by-bond basis, but we also look at it from a portfolio perspective with an intention to reduce our portfolios' carbon footprints.

Our engagement focuses on larger, longer-term holdings where there are significant ESG risks which have been identified through analysis. This could include practices in specific industry sectors, existing controversies or where a company’s ESG performance lags best practice. We have a number of common holdings with our equity colleagues, and we leverage the connections they have with companies.

ESG investing has come a long way in a relatively short space of time – but maybe not so far as some could have us believe.

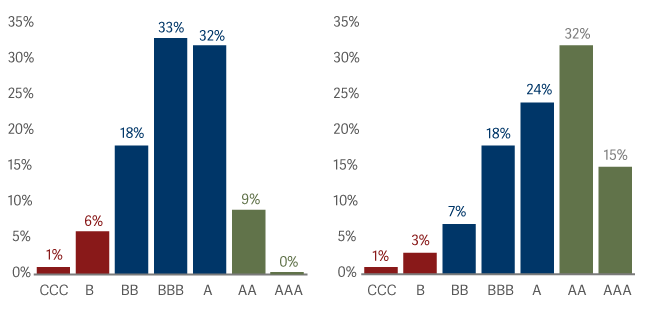

The charts below show the rating distribution of ~32,000 funds which are assigned an MSCI ESG rating. Whereas around 10% of funds used to be rated AA-AAA a year ago, nearly half of the universe can now claim to have such a high rating.

Source: MSCI as at 30 April 2022

Source: MSCI as at 30 April 2022

Could it really be that half of all funds have become ‘very good’ ESG practitioners in this short space of time? Or is something else at play? I have no doubt that stakeholder pressure has encouraged funds to focus on their ESG issues. But at the same time, I am sceptical that poor business activities or exploitative social and environmental activities have been resolved on such a wide scale in this short timeframe.

Improvement is happening – and great headway has been made in terms of what information investors have access to. As well as from companies themselves, a range of initiatives, institutions, market participants and data providers have played a key part in this improvement.

This enables us to make more informed decisions about what is important – and to make judgements based on this enriched information. We are encouraged by this trend and will continue to support the drive for increased transparency on financial as well as ESG factors. But regrettably, there is no shortcut to considering ESG.

To find out more about Artemis visit the website at www.artemisfunds.com.

FOR PROFESSIONAL AND/OR QUALIFIED INVESTORS ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS. This is a marketing communication. Refer to the fund prospectus and KIID/KID before making any final investment decisions. CAPITAL AT RISK. All financial investments involve taking risk which means investors may not get back the amount initially invested.

Any research and analysis in this communication has been obtained by Artemis for its own use. Although this communication is based on sources of information that Artemis believes to be reliable, no guarantee is given as to its accuracy or completeness.

Any forward-looking statements are based on Artemis’ current expectations and projections and are subject to change without notice.

Issued by: Artemis Investment Management LLP which is authorised and regulated by the UK Financial Conduct Authority.