02 Jun 2023

We take a visual approach to explain what’s happening with banks.

Read this article to understand:

In 1873, one of the biggest banks in New York City, Jay Cooke & Company, went bankrupt. When people saw such a large institution fall, they ran to their own banks to demand their money back. The panic spread and at least 100 banks failed.1

Fast-forward to 2023, and anxious customers no longer need to queue at a branch to get their cash back – they can simply press a button on their banking app. This year, the quick withdrawal of deposits enabled by technology hastened the demise of US lenders Silicon Valley Bank (SVB) and Signature Bank. Amid the global fallout, Swiss banking giant Credit Suisse also faltered and was eventually acquired by domestic rival UBS.

Anxious customers can simply press a button on their banking app to withdraw cash

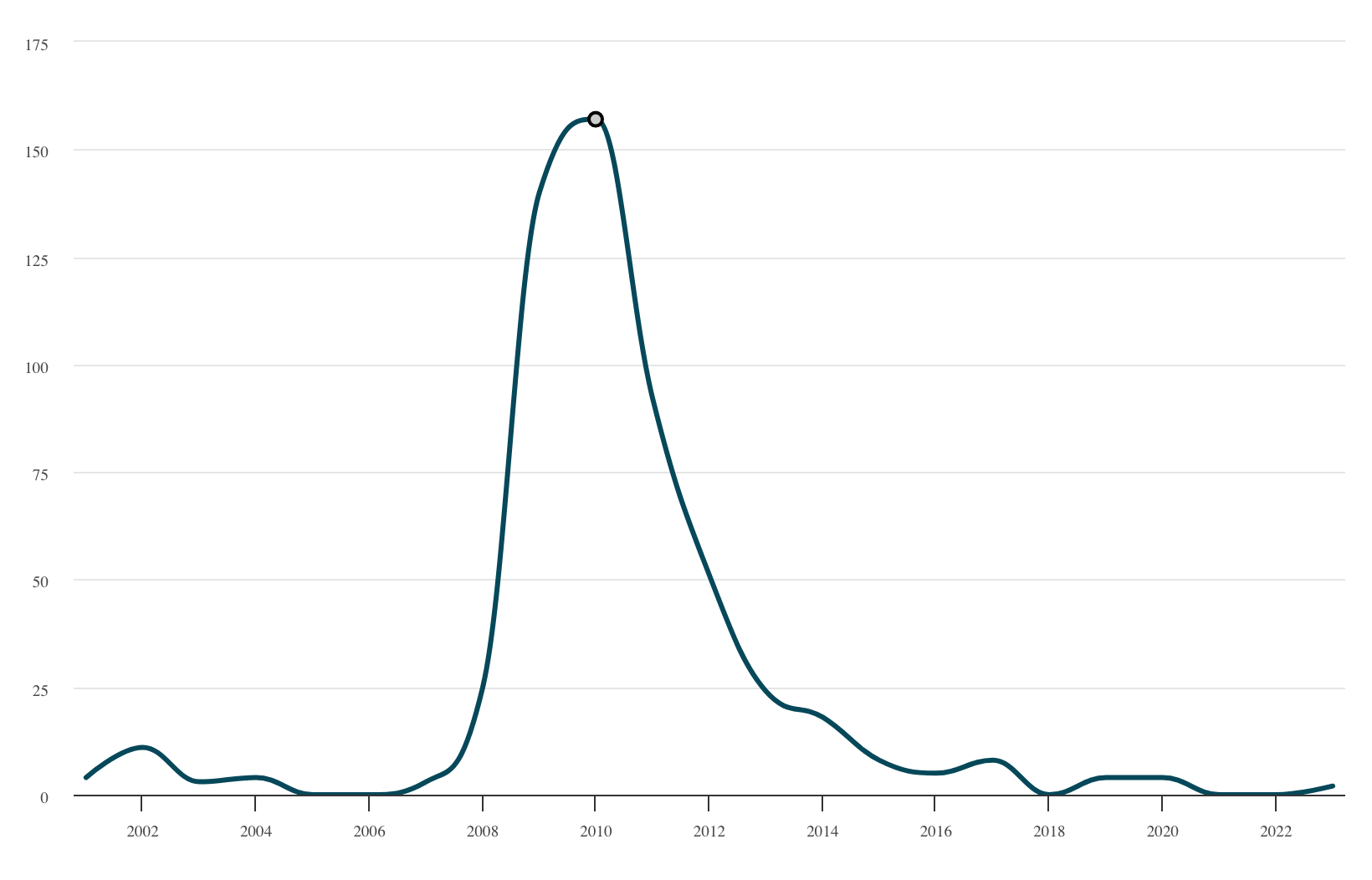

According to the Federal Deposit Insurance Corporation (FDIC), there have been 563 US bank failures between 2001 and 2023. Unsurprisingly, most happened during and just after the Global Financial Crisis (GFC), with the highest number in 2009 and 2010 – 140 and 157 respectively.

Figure 1: Number of US bank failures per year (2001–2023)

Source: Aviva Investors, FDIC, March 20232

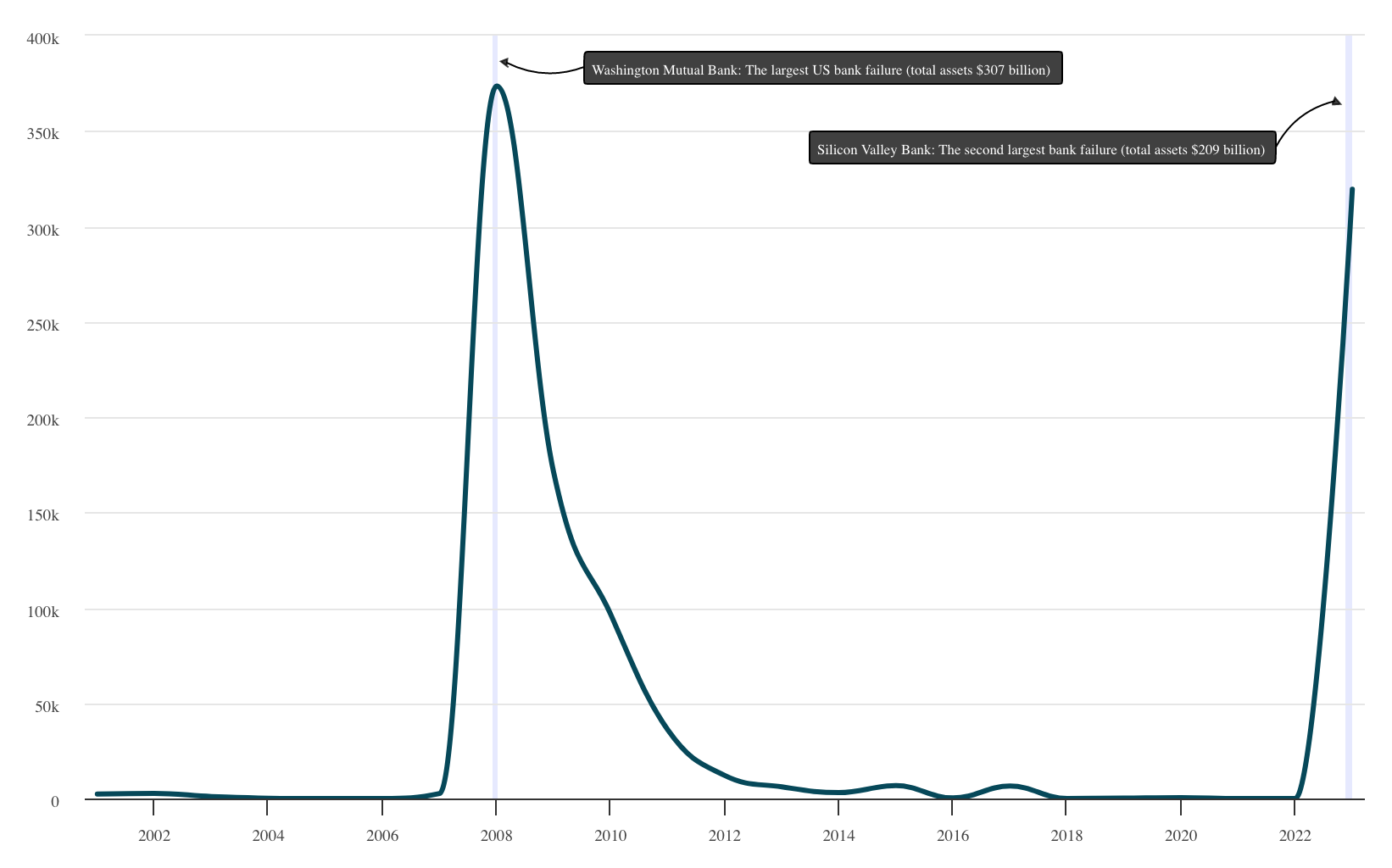

While 2023 has seen only a handful of US bank failures, total assets of the failed banks was not far off the total for 2008. This is because SVB was the 16th largest bank in the US; its failure was the second-largest bank failure in US history. The largest happened in 2008, when Washington Mutual Bank collapsed (see Figure 2).

Figure 2: Approximate total assets of failed US banks (million dollars)

Source: Aviva Investors, FDIC, March 20233

This begs some key questions: Will there be a lasting impact on markets? Will lending standards tighten in the US (and elsewhere)? And if lending does tighten, how will this affect the wider economy?

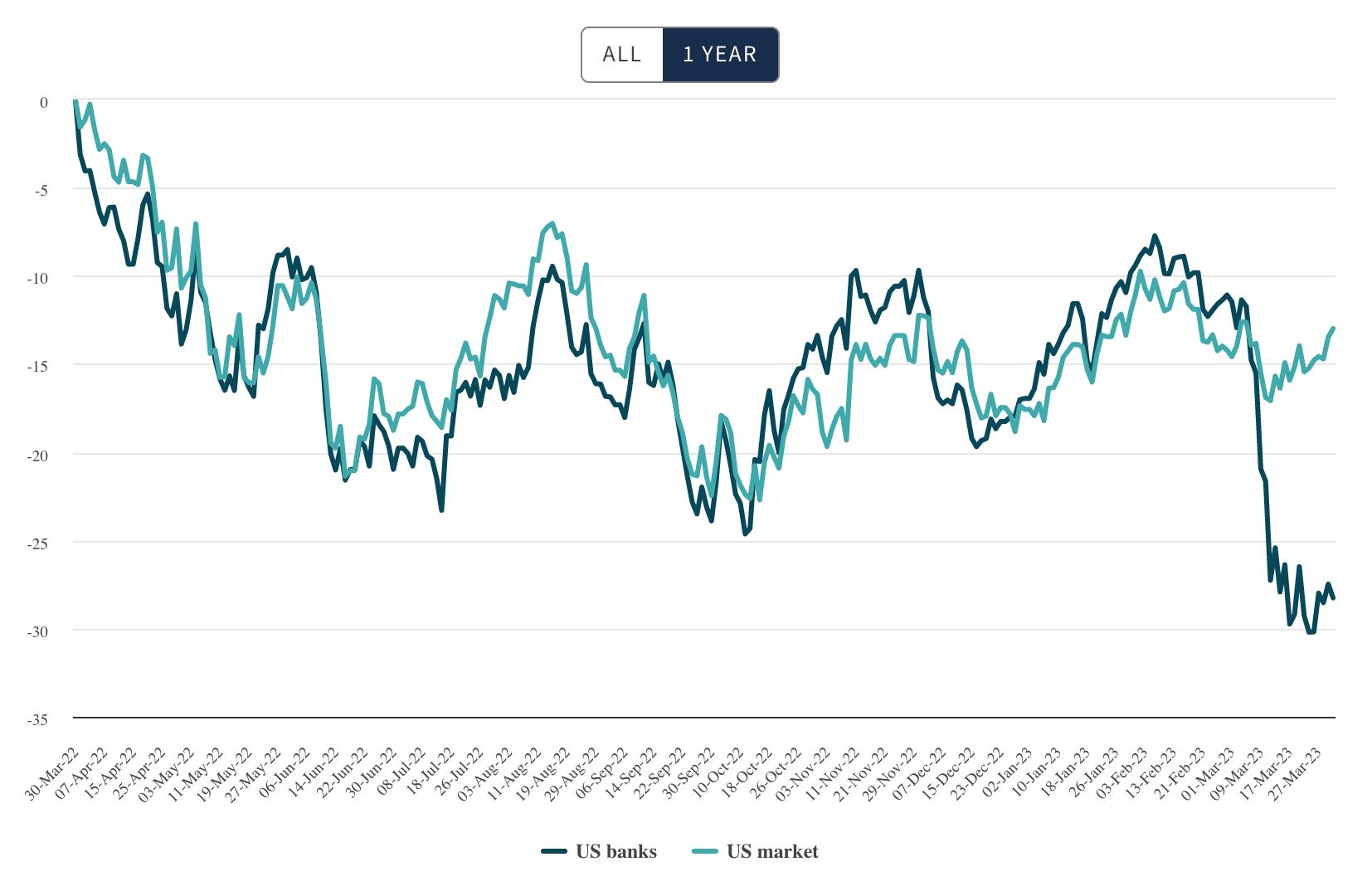

Since the GFC, the banking sector has lagged the broader US equity market by a staggering 147 per cent (Figure 3).

Zooming in on performance over the last year, while banks initially tracked the overall market quite closely, things changed sharply in March after SVB's failure.

Figure 3: US financials versus US market (per cent)

Source: Aviva Investors, Eikon. Data as of March 31, 2023

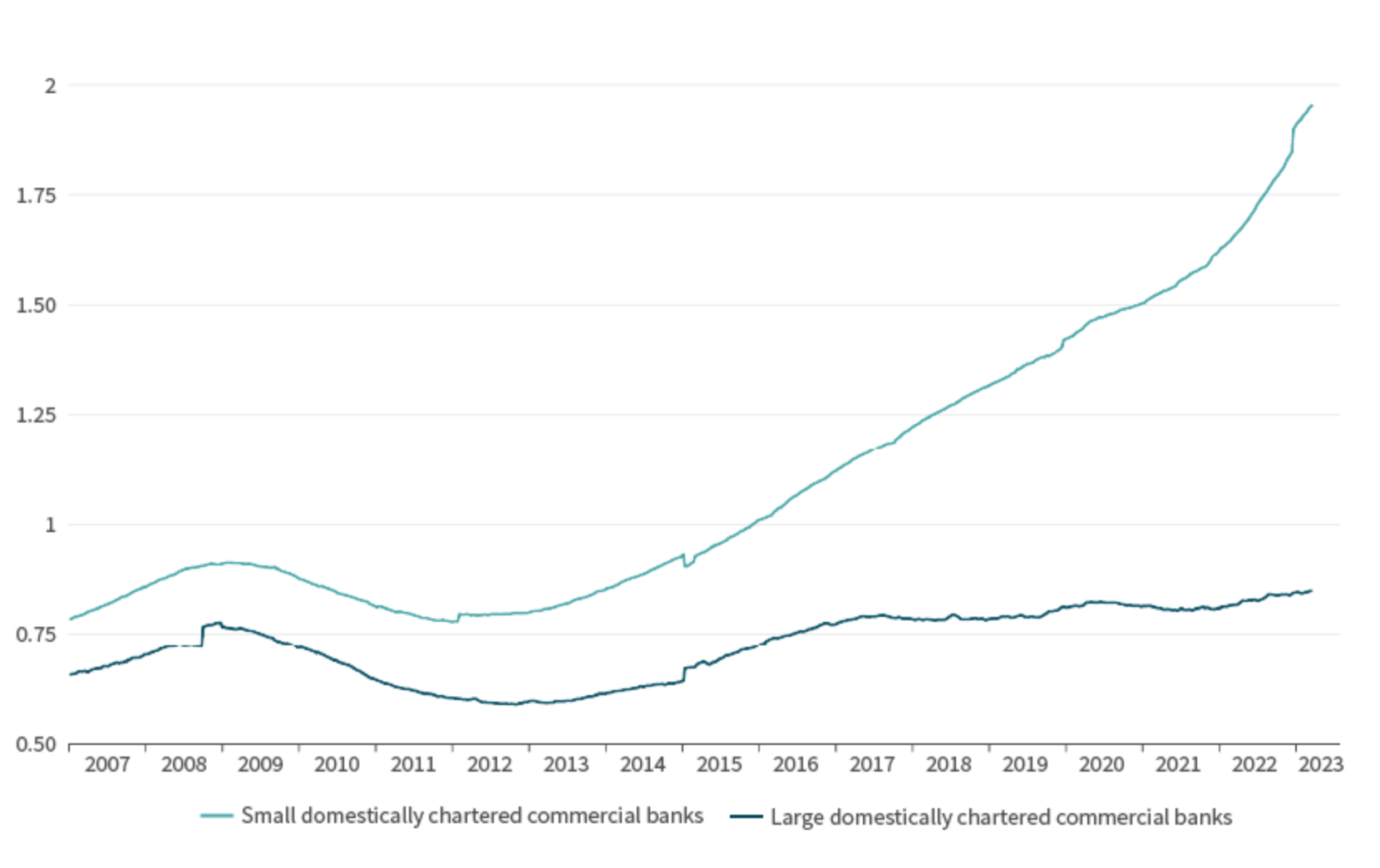

Small banks pay a big role in the US economy, with Figure 4 highlighting the enormous gap between smaller banks’ lending and that of their larger counterparts.

Figure 4: Large versus small US banks’ lending amounts (US$ trillion)

Source: Macrobond, March 2023

Now, after the collapse of SVB and Signature Bank, a pullback in lending among small banks is underway. Will stricter lending standards slow economic growth?

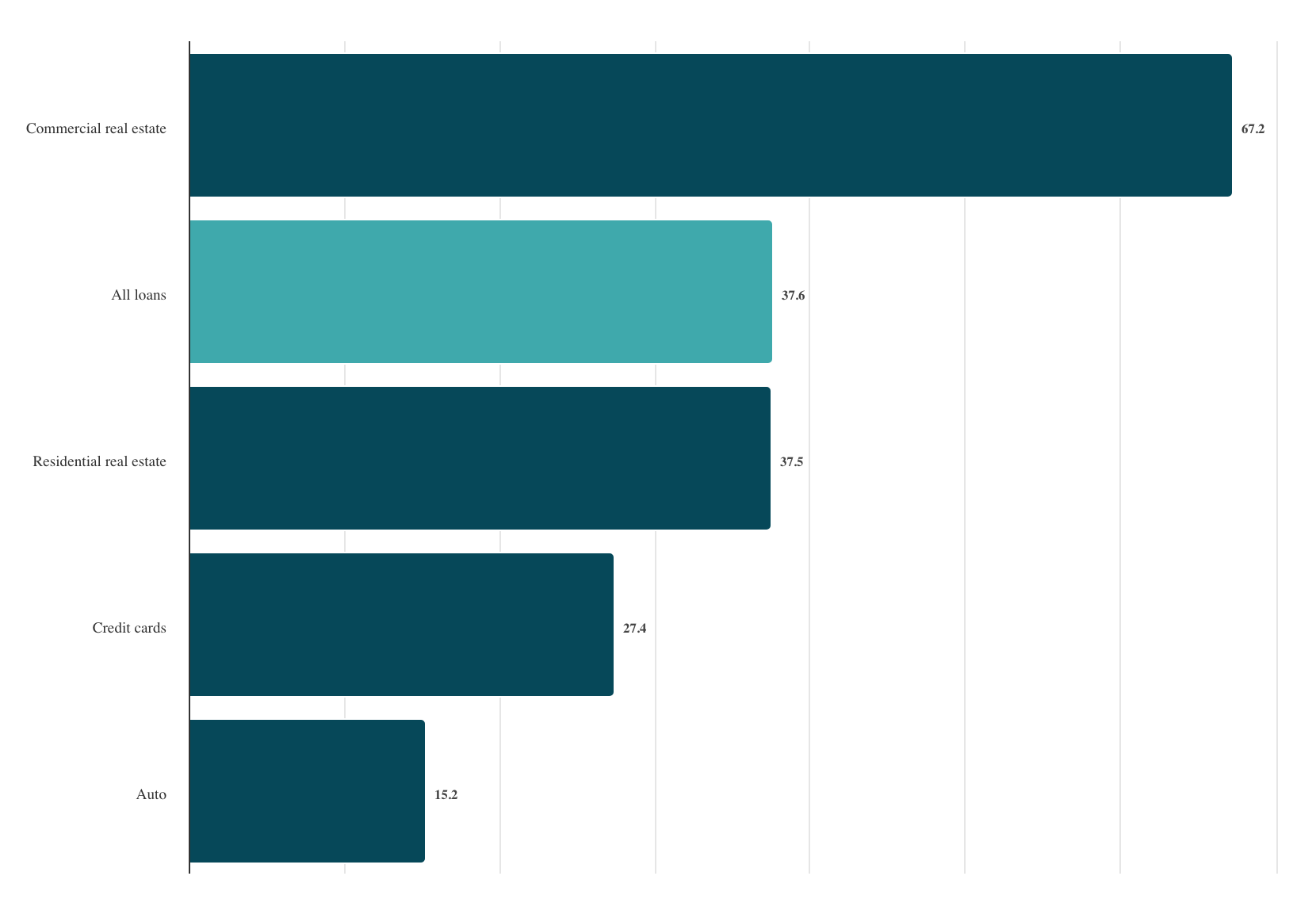

Currently, attention is largely focused on banks' exposure to the US commercial real estate sector, which has been hit by raising interest rates (Figure 5).

Figure 5: Share of loans held by small domestic banks, by sector (per cent)

Source: Aviva Investors, Federal Reserve. Data as of March 8, 2023

References

1 “Financial panic of 1873”, U.S. Department of the Treasury, as of April 2023

2 “Bank failures in brief – summary 2001 through 2023”, Federal Deposit Insurance Corporation, March 14, 2023

3 “Bank failures in brief – summary 2001 through 2023”, Federal Deposit Insurance Corporation, March 14, 2023

THIS IS A MARKETING COMMUNICATION

Except where stated as otherwise, the source of all information is Aviva Investors Global Services Limited (AIGSL). Unless stated otherwise any views and opinions are those of Aviva Investors. They should not be viewed as indicating any guarantee of return from an investment managed by Aviva Investors nor as advice of any nature. Information contained herein has been obtained from sources believed to be reliable, but has not been independently verified by Aviva Investors and is not guaranteed to be accurate. Past performance is not a guide to the future. The value of an investment and any income from it may go down as well as up and the investor may not get back the original amount invested. Nothing in this material, including any references to specific securities, assets classes and financial markets is intended to or should be construed as advice or recommendations of any nature. Some data shown are hypothetical or projected and may not come to pass as stated due to changes in market conditions and are not guarantees of future outcomes. This material is not a recommendation to sell or purchase any investment.

The information contained herein is for general guidance only. It is the responsibility of any person or persons in possession of this information to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. The information contained herein does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorised or to any person to whom it would be unlawful to make such offer or solicitation.

In Europe, this document is issued by Aviva Investors Luxembourg S.A. Registered Office: 2 rue du Fort Bourbon, 1st Floor, 1249 Luxembourg. Supervised by Commission de Surveillance du Secteur Financier. An Aviva company. In the UK, this document is by Aviva Investors Global Services Limited. Registered in England No. 1151805. Registered Office: St Helens, 1 Undershaft, London EC3P 3DQ. Authorised and regulated by the Financial Conduct Authority. Firm Reference No. 119178. In Switzerland, this document is issued by Aviva Investors Schweiz GmbH.

In Singapore, this material is being circulated by way of an arrangement with Aviva Investors Asia Pte. Limited (AIAPL) for distribution to institutional investors only. Please note that AIAPL does not provide any independent research or analysis in the substance or preparation of this material. Recipients of this material are to contact AIAPL in respect of any matters arising from, or in connection with, this material. AIAPL, a company incorporated under the laws of Singapore with registration number 200813519W, holds a valid Capital Markets Services Licence to carry out fund management activities issued under the Securities and Futures Act (Singapore Statute Cap. 289) and Asian Exempt Financial Adviser for the purposes of the Financial Advisers Act (Singapore Statute Cap.110). Registered Office: 1 Raffles Quay, #27-13 South Tower, Singapore 048583.

In Australia, this material is being circulated by way of an arrangement with Aviva Investors Pacific Pty Ltd (AIPPL) for distribution to wholesale investors only. Please note that AIPPL does not provide any independent research or analysis in the substance or preparation of this material. Recipients of this material are to contact AIPPL in respect of any matters arising from, or in connection with, this material. AIPPL, a company incorporated under the laws of Australia with Australian Business No. 87 153 200 278 and Australian Company No. 153 200 278, holds an Australian Financial Services License (AFSL 411458) issued by the Australian Securities and Investments Commission. Business address: Level 27, 101 Collins Street, Melbourne, VIC 3000, Australia.

The name “Aviva Investors” as used in this material refers to the global organization of affiliated asset management businesses operating under the Aviva Investors name. Each Aviva investors’ affiliate is a subsidiary of Aviva plc, a publicly- traded multi-national financial services company headquartered in the United Kingdom.

Aviva Investors Canada, Inc. (“AIC”) is located in Toronto and is based within the North American region of the global organization of affiliated asset management businesses operating under the Aviva Investors name. AIC is registered with the Ontario Securities Commission as a commodity trading manager, exempt market dealer, portfolio manager and investment fund manager. AIC is also registered as an exempt market dealer and portfolio manager in each province of Canada and may also be registered as an investment fund manager in certain other applicable provinces.

Aviva Investors Americas LLC is a federally registered investment advisor with the U.S. Securities and Exchange Commission. Aviva Investors Americas is also a commodity trading advisor (“CTA”) registered with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National Futures Association (“NFA”). AIA’s Form ADV Part 2A, which provides background information about the firm and its business practices, is available upon written request to: Compliance Department, 225 West Wacker Drive, Suite 2250, Chicago, IL 60606.