09 Jun 2023

A holistic approach

Multi-strategy portfolios have come a long way in embedding ESG into the investment process, but there are gaps to fill, as Jennie Byun explains.

Read this article to understand:

There is a common perception environmental, social and governance (ESG) considerations are difficult to incorporate in multi-strategy investments due to the multi-faceted aspects of running such portfolios. The world has changed. While there are still challenges, there have also been great strides in embedding ESG for risk management and as a potential source of alpha.

This is recognised by the EU’s Sustainable Finance Disclosure Regulation (SFDR), where our own AIMS Target Return strategy is classified as Article 8 (defined as strategies that promote investments with positive environment or social characteristics).1

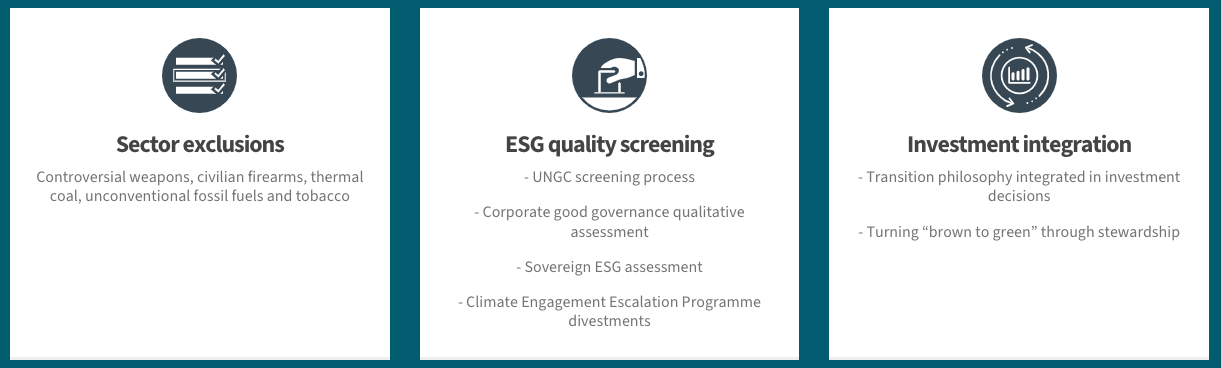

Our approach to meeting the classification required the introduction of binding ESG characteristics at a fund level, strengthening the integration of ESG considerations in our investment process and embedding our transition philosophy into investment decisions (Figure 1). While the classification is specific to European investment vehicles, the principles are applied at a strategy level.

Figure 1: Aviva Investors Multi-Strategy responsible investment policy

Source: Aviva Investors, February 2023

In this article, we set out the key aspects of the framework used to integrate ESG throughout the AIMS investment process.2 For transparency, we also highlight gaps we are seeking to address, particularly around the use of leverage in the strategy.

Integral to our progress has been strong collaboration across the business

Strong collaboration across the business has been integral to our progress. This has allowed the AIMS investment teams to extract best practices from individual asset classes and provide perspectives in addressing areas of commonality, as the issues around derivatives and shorting are not exclusive to AIMS.

By dint of covering an unconstrained universe across multiple asset classes and instruments, it can be argued multi-strategy portfolios are well positioned to facilitate a robust and holistic framework, relevant across equities, fixed income and multi-asset.

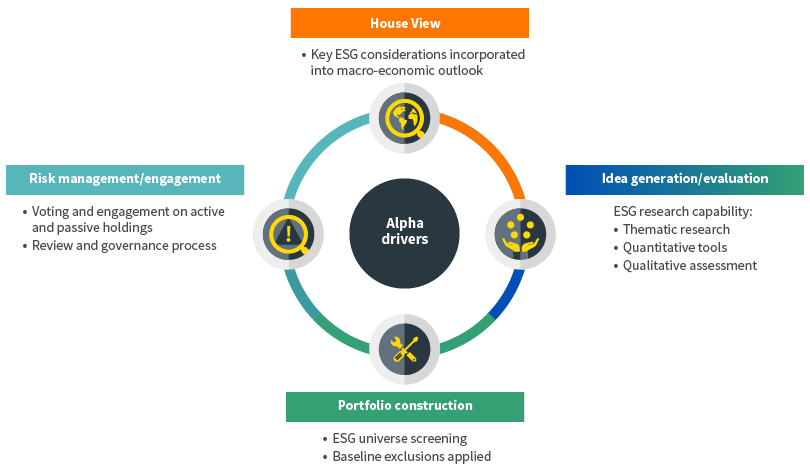

There are multiple stages to the AIMS investment process, but they can be grouped into two key areas: the generation of best-in-class investment ideas, which are encompassed within the House View; and the idea generation/evaluation segments of the ESG integration diagram in Figure 2. These ideas are then fed into a robust portfolio construction process, which incorporates risk management and engagement.

Figure 2: ESG integration in AIMS

Note: For illustrative purposes only. Beyond any binding ESG constraints in the strategy and baseline exclusions policy, the investment manager retains discretion over final investment decisions, taking into account wider risk factors. Source: Aviva Investors, February 2023

The investment process begins with the formation of our House View, where key stakeholders from across the business come together to formulate our macroeconomic views and likely risk scenarios within a medium-term investment timeframe.

Our dedicated ESG team of more than 40 professionals is a key component in this process, ensuring material ESG factors are considered in determining the firm-wide macroeconomic outlook.

40 Dedicated ESG professionals help ensure material ESG factors are considered in determining our macroeconomic outlook

Themes such as the implications of global climate negotiations, populism and nationalism, and governance and social reform across key markets have helped form the base-case outlook. For example, ESG considerations were a driving force behind our low exposure to Russia before its invasion of Ukraine.

Climate change is another critical theme. Leading up to and following the ground-breaking Paris Agreement in December 2015, we have tracked the progress countries have made against their climate action plans, as well as the implications of policy changes by governments in making the shift towards net zero.

Our most recent 2023 House View Outlook takes a “systems view” on the low-carbon transition. In other words, transition will not be achieved through a single company or industry but by synchronised collaboration of multiple, interdependent systems across private and public sectors globally.

Only by taking a more holistic approach can we identify critical connections and address challenges to facilitate the creation, adoption and acceleration of climate solutions.3

Once the central macroeconomic outlook is set, attention turns to idea generation. All investment ideas must consider not only traditional fundamental and technical drivers, but also ESG risks and opportunities.

In many respects, this was already being done (think bad corporate governance practices or state-level corruption), but by formalising it within the investment process, we ensure consistency and discipline in the evaluation of all ideas. It is a standard, yet essential, part of risk management.

It gets interesting when ESG is the driving force behind an idea

Where it gets interesting is when ESG is the driving force behind an idea. For example, the ability to implement views via a bottom-up relative-value long/short strategy should help the portfolio managers extract alpha around a particular ESG theme through the long leg, and remove a large part of the beta, or market exposure, through the short leg. The ability to harness ESG factors in this way can provide another stream of returns and enhance portfolio diversification.

As mentioned, climate change is a central theme in our House View. Within AIMS, we had a longstanding position around smart cities, specifically the trend towards increased building efficiency. This is a big focus of governments and the private sector, given 40 per cent of emissions from energy use are associated with buildings.4

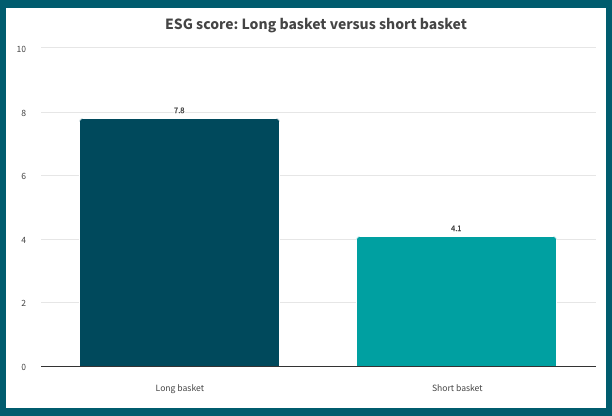

To express the idea, we constructed a long basket of companies we believe are well positioned to service those needs, including LED lighting and energy efficient heating and insulation manufacturers. Conversely, we added a short basket of names for a market-neutral, relative-value equity exposure on what we believe will be a long-term structural shift towards building efficiency (Figure 3).

Figure 3: ESG driving investment ideas – building efficiency equities relative value

Strategy rationale

Tackling climate change is a key theme, with building efficiency a key mechanism to address this. Companies that are better-placed with regards to this theme will likely outperform as they gain market share.

Note: Position example for illustrative purposes only, not intended to be an investment recommendation. Source Aviva Investors, February 2023

Other ideas generated from the climate change theme include exposure to the electric-vehicle (EV) market. This was expressed via an equity relative-value position as well as exposure to copper, a key material in EV manufacturing.

We were one of the first institutional asset managers to invest in the European Union’s carbon credit markets

Utilising its unconstrained mandate, and through close collaboration with the ESG team, we were one of the first institutional asset managers to invest in the European Union’s carbon credit markets. We felt the carbon allowance price did not reflect the positive momentum behind the EU’s climate policies or the price needed to meet the bloc’s emissions reduction targets.

Investing in ESG themes is a powerful expression of conviction. In our view, ESG credentials will be judged over the long term by the extent to which money is allocated to positive ESG themes over and above the application of standard hygiene factors such as excluding “bad” names. Ultimately, this is what will drive positive developments in the real economy.

As highlighted in the building efficiency example, ESG factors are considered during our portfolio construction process, with the implementation of approved ideas geared to improve their ESG characteristics while adhering to the scope of the investment thesis.

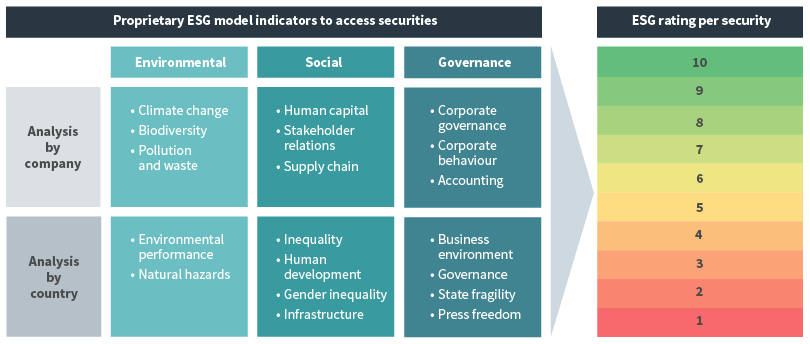

What does that look like within AIMS portfolios? Let’s take an area many will already be familiar with, corporate ESG analysis. Here, we utilise a proprietary quantitative ESG scoring tool for a wide universe of listed companies. In addition, ESG analysts conduct qualitative research to assess good governance and forward-looking ESG momentum of companies, which would not be reflected by looking at the quantitative scores alone.

We have a sovereign quantitative-scoring model that generates ESG scores for over 150 countries

Similarly, we have a sovereign quantitative-scoring model that generates ESG scores for over 150 countries. To complement this, we overlay qualitative analysis, providing real-time judgement on a country’s ESG momentum and material risks and opportunities that may be mis-priced by the market. This is particularly relevant in sovereign analysis, where the availability of metrics typically has a longer lead time than those of companies.

Having both corporate and sovereign metrics means aggregate ESG scores for all physical assets can now be tracked. As the saying goes, “what can be measured can be improved”.

These considerations have been particularly helpful in the construction of our bottom-up equity relative-value positions, where we collaborate with the ESG team to pick best-in-class names from both a financial return and ESG perspective. Examples include the previously mentioned long building efficiency equities trade as well as a long energy equities relative-value position, where we selected companies we believed would outperform while also demonstrating progress in the low-carbon transition through our engagement initiatives (Figure 4).

Figure 4: ESG proprietary scoring framework for corporates and sovereigns

Note: For illustrative purposes only. Source: Aviva Investors, February 2023

In addition to applying Aviva Investors’ baseline ESG exclusion policy, we overlay a combination of quantitative and qualitative screens all investments must meet to be included in the portfolio. Exceptions may be allowed, but this requires a credible case around the security’s engagement and ESG momentum to be made and approved by the head of AIMS.

Our baseline ESG exclusion policy also applies to derivatives. Specifically, derivatives exposure to individual corporate equities as well as corporate and sovereign bonds are part of the policy. Where we take index derivatives exposure, a threshold is applied by which the delta-weighted notional exposure cannot be exceeded.

A security’s ESG profile is monitored through the strategic investment group forum where all AIMS ideas are presented, discussed, approved and tracked.

Comprehensive ESG integration and analysis requires more than rote mechanical filters and exclusions

Comprehensive ESG integration and analysis requires more than rote mechanical filters and exclusions. Undertaking thorough qualitative analysis and engagement allows for additional perspectives that may not be captured through standard quantitative ESG metrics, which tend to be more historic by nature.

Discernibly, this requires significant investment in resources. With a team of 40 full-time dedicated members, we have a large and dedicated ESG team with wide-ranging expertise that is fully embedded within our liquid markets platform.

Engagement can be an effective way to effect change, which largely requires physical holdings. Given the dynamic asset-allocation potential of the AIMS strategy, physical equity and corporate bond holdings have ranged between 15 to 40 per cent of the market capitalisation of the portfolio, all of which are subject to voting and engagement initiatives. Collateral and cash holdings held in short-term corporate securities also undergo their own ESG screening process. Incorporating those assets raises the physical ESG-rated exposure to 90 per cent.

Another step to maximise our company engagement includes the retention of full voting rights within our passive index holdings.

So, what does it look like in practice? A key theme within the AIMS strategy has been the importance of energy post the economic recovery from COVID-19 and the ongoing transition to a low-carbon economy.

A key theme within the AIMS strategy has been the importance of energy post the COVID-19 economic recovery

The holdings we have within our long energy versus market equity relative-value position are part of our Climate Engagement Escalation Programme, where we are engaging with 30 systemically important carbon emitters in the oil and gas, metals and mining, and utilities sectors. Through this programme, we expect to see measurable progress in their climate transition plans over a three-year period. A failure to meet our expectations will lead to divestment.

In the sovereign universe, we have used our ownership of physical government bonds to engage for better ESG practices at a country level. In Brazil, an open letter by a consortium of investors, including Aviva Investors, on a bill to legalise private occupation of public lands has led to ongoing engagement with Brazilian policymakers to address deforestation of the Amazon.

There is more to be done, but these measures have allowed us to augment our business’ long heritage in holding companies and sovereigns to account.

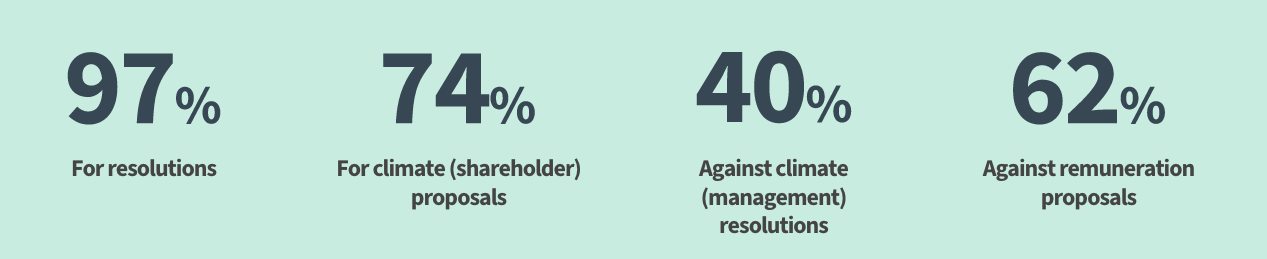

Figure 5: AIMS voting track record: Voting for impact

Note: Includes voting activity across the pooled and segregated mandates for AIMS Target Return. Based on 12-month activity ending December 31, 2022. Source: Aviva Investors, February 2023

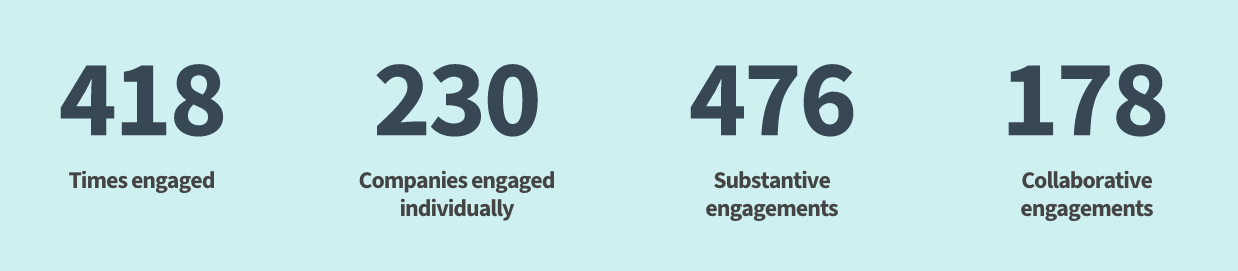

Figure 6: AIMS engagement track record: Engaging for impact

Note: Includes engagement activity across the pooled and segregated mandates for AIMS Target Return. Based on 12-month activity ending December 31, 2022. Source: Aviva Investors, February 2023

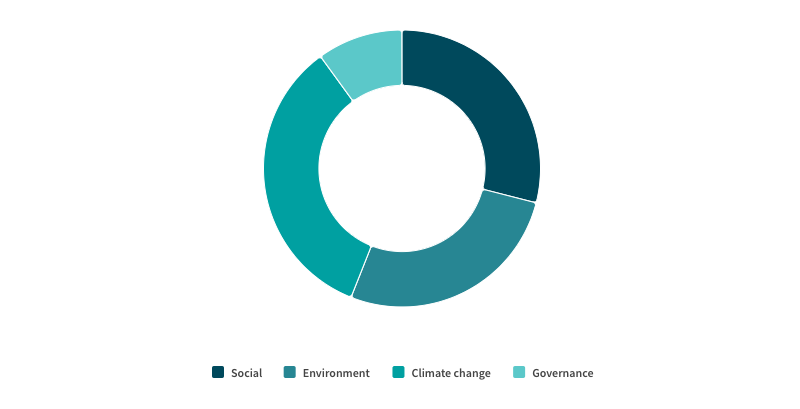

Figure 7: AIMS engagement track record: Substantive engagements (focus areas)

Note: Includes engagement activity across the pooled and segregated mandates for AIMS Target Return. Source: Aviva Investors, February 2023

Looking ahead, we intend to expand the application of ESG tools and metrics to our AIMS portfolio. Due to the nature of such strategies, particularly their use of leverage and ability to short securities, AIMS has never fallen neatly within the traditional asset-allocation approach.

There are many nuances that need to be factored into the scoring methodology, not only with regards to derivatives but also fixed income duration. These are being worked through and, once completed, will allow for a more comprehensive ESG view aligned to how the AIMS portfolio is managed.

There is a need for further integration of climate risk analysis into the investment process

Additionally, there is a need for further integration of climate risk analysis into the investment process. Currently, we incorporate climate change impact at a high level in our House View, sector deep dives and inputs into our proprietary ESG sovereign and corporate ESG scores.

However, this needs to be complemented by actuarial and climate modelling and stress testing to further inform our macroeconomic outlook and apply it to our risk management framework.

Some of this is uncharted territory. However, we have in our favour first-hand experience of ESG integration within equities and credit. This provides insights we can overlay with our macro expertise to create a standard that is not only aligned with more traditional corporate ESG practices, but with practical application for the less-travelled ESG roads of fixed income and derivatives. We will share more of these insights as we travel further along this journey.

1 “Aviva Investors – Article 8 “House View” approach”, Aviva Investors, May 2022

2 ESG factors are integrated into the investment process, but the investment manager retains discretion over asset or stock selection in accordance with the baseline exclusions policy and objectives of the strategy

3 “House View 2023 Outlook”, Aviva Investors, December 2022

4 Source: Morgan Stanley Research, European Commission, European Building Stock Observatory

THIS IS A MARKETING COMMUNICATION

Except where stated as otherwise, the source of all information is Aviva Investors Global Services Limited (AIGSL). Unless stated otherwise any views and opinions are those of Aviva Investors. They should not be viewed as indicating any guarantee of return from an investment managed by Aviva Investors nor as advice of any nature. Information contained herein has been obtained from sources believed to be reliable, but has not been independently verified by Aviva Investors and is not guaranteed to be accurate. Past performance is not a guide to the future. The value of an investment and any income from it may go down as well as up and the investor may not get back the original amount invested. Nothing in this material, including any references to specific securities, assets classes and financial markets is intended to or should be construed as advice or recommendations of any nature. Some data shown are hypothetical or projected and may not come to pass as stated due to changes in market conditions and are not guarantees of future outcomes. This material is not a recommendation to sell or purchase any investment.

The information contained herein is for general guidance only. It is the responsibility of any person or persons in possession of this information to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. The information contained herein does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorised or to any person to whom it would be unlawful to make such offer or solicitation.

In Europe, this document is issued by Aviva Investors Luxembourg S.A. Registered Office: 2 rue du Fort Bourbon, 1st Floor, 1249 Luxembourg. Supervised by Commission de Surveillance du Secteur Financier. An Aviva company. In the UK, this document is by Aviva Investors Global Services Limited. Registered in England No. 1151805. Registered Office: St Helens, 1 Undershaft, London EC3P 3DQ. Authorised and regulated by the Financial Conduct Authority. Firm Reference No. 119178. In Switzerland, this document is issued by Aviva Investors Schweiz GmbH.

In Singapore, this material is being circulated by way of an arrangement with Aviva Investors Asia Pte. Limited (AIAPL) for distribution to institutional investors only. Please note that AIAPL does not provide any independent research or analysis in the substance or preparation of this material. Recipients of this material are to contact AIAPL in respect of any matters arising from, or in connection with, this material. AIAPL, a company incorporated under the laws of Singapore with registration number 200813519W, holds a valid Capital Markets Services Licence to carry out fund management activities issued under the Securities and Futures Act (Singapore Statute Cap. 289) and Asian Exempt Financial Adviser for the purposes of the Financial Advisers Act (Singapore Statute Cap.110). Registered Office: 1 Raffles Quay, #27-13 South Tower, Singapore 048583.

In Australia, this material is being circulated by way of an arrangement with Aviva Investors Pacific Pty Ltd (AIPPL) for distribution to wholesale investors only. Please note that AIPPL does not provide any independent research or analysis in the substance or preparation of this material. Recipients of this material are to contact AIPPL in respect of any matters arising from, or in connection with, this material. AIPPL, a company incorporated under the laws of Australia with Australian Business No. 87 153 200 278 and Australian Company No. 153 200 278, holds an Australian Financial Services License (AFSL 411458) issued by the Australian Securities and Investments Commission. Business address: Level 27, 101 Collins Street, Melbourne, VIC 3000, Australia.

The name “Aviva Investors” as used in this material refers to the global organization of affiliated asset management businesses operating under the Aviva Investors name. Each Aviva investors’ affiliate is a subsidiary of Aviva plc, a publicly- traded multi-national financial services company headquartered in the United Kingdom.

Aviva Investors Canada, Inc. (“AIC”) is located in Toronto and is based within the North American region of the global organization of affiliated asset management businesses operating under the Aviva Investors name. AIC is registered with the Ontario Securities Commission as a commodity trading manager, exempt market dealer, portfolio manager and investment fund manager. AIC is also registered as an exempt market dealer and portfolio manager in each province of Canada and may also be registered as an investment fund manager in certain other applicable provinces.

Aviva Investors Americas LLC is a federally registered investment advisor with the U.S. Securities and Exchange Commission. Aviva Investors Americas is also a commodity trading advisor (“CTA”) registered with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National Futures Association (“NFA”). AIA’s Form ADV Part 2A, which provides background information about the firm and its business practices, is available upon written request to: Compliance Department, 225 West Wacker Drive, Suite 2250, Chicago, IL 60606.