03 May 2021

15 April 2021 | Sunil Krishnan, Head of Multi-asset Funds

While inflation is expected to rise after last year’s lows, it will likely be transitory. Sunil Krishnan explores what this means for the economy, yield curves and equity markets.

Multi-asset allocation views: Loose policy doesn’t rule out a steeper curve

Although there have been some difficulties in Europe, our view that vaccine rollouts will enable most developed economies to reopen in the medium term hasn’t changed. As a result, we expect to see higher US inflation in the near term due to base effects when comparing with 2020.

Looking at year-on-year inflation, we will shortly be comparing current inflation to the low point in 2020 when the world economy was experiencing a deep recession. That will automatically make year-on-year inflation look high, not just for headline measures that include energy prices, but also for core measures.

We expect to see higher US inflation in the near term due to base effects when comparing with 2020

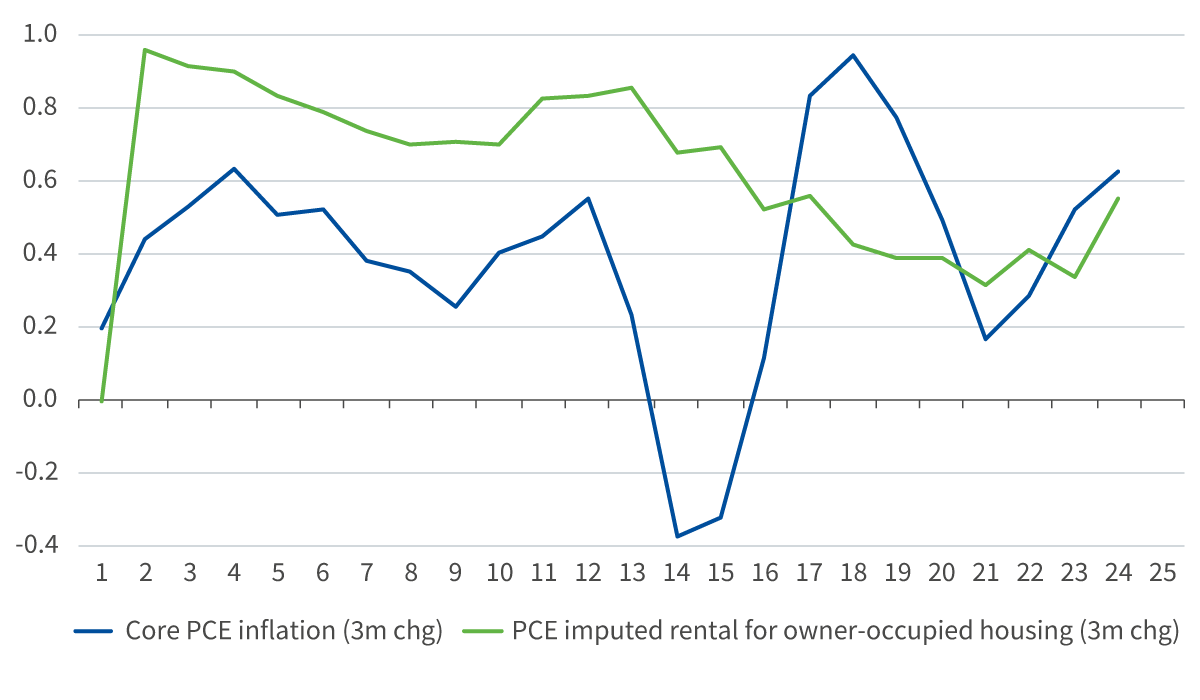

For instance, in the United States, the Federal Reserve (Fed) has a long-term two per cent target for the core Personal Consumption Expenditures index (core PCE), one of its preferred measures of inflation. Core PCE will likely run well ahead of its target for at least a month or two. However, we don’t expect inflation measures to continue coming in at those levels in the second half of 2021, and that by itself should dissipate some of the recent market concerns about a significant spike in inflation.

One indicator that could point to inflation becoming more entrenched is the housing market, as it has an important weight in US inflation measures, which try to capture home-ownership costs. We watch this closely, but resilience in the US housing market has not led to a meaningful rise in inflation so far.

Figure 1: Inflation could receive a short-term boost (per cent)

Source: Bloomberg, Aviva Investors, as of April 8, 2021

Any spike is therefore likely to be temporary; something the Fed supported in its most recent statement when it said it would not consider transitory inflation pressures sufficient reason to raise interest rates, particularly as the central bank aims to achieve inflation moderately in excess of two per cent for some time.1

From time to time, investors will doubt the Fed’s commitment to keep policy easy

Given this significant change in the Fed’s policy, which followed its framework review in 2020, it is trying to offer clarity that it will not move quickly to a tightening cycle. For instance, the dots showing various members of the Fed’s opinion about when they think interest rates will next rise indicated only a small minority expect rates to rise in 2022, and slightly more in 2023.2

From time to time, investors will continue to doubt the Fed’s commitment to keep policy, easy even as the economy seems on a solid footing. However, the Fed is clearly communicating its intention to keep rates low for a long time yet. Ultimately, that will provide support for the Treasury market, as well as for the real economy by keeping financing conditions loose, which will benefit listed companies.

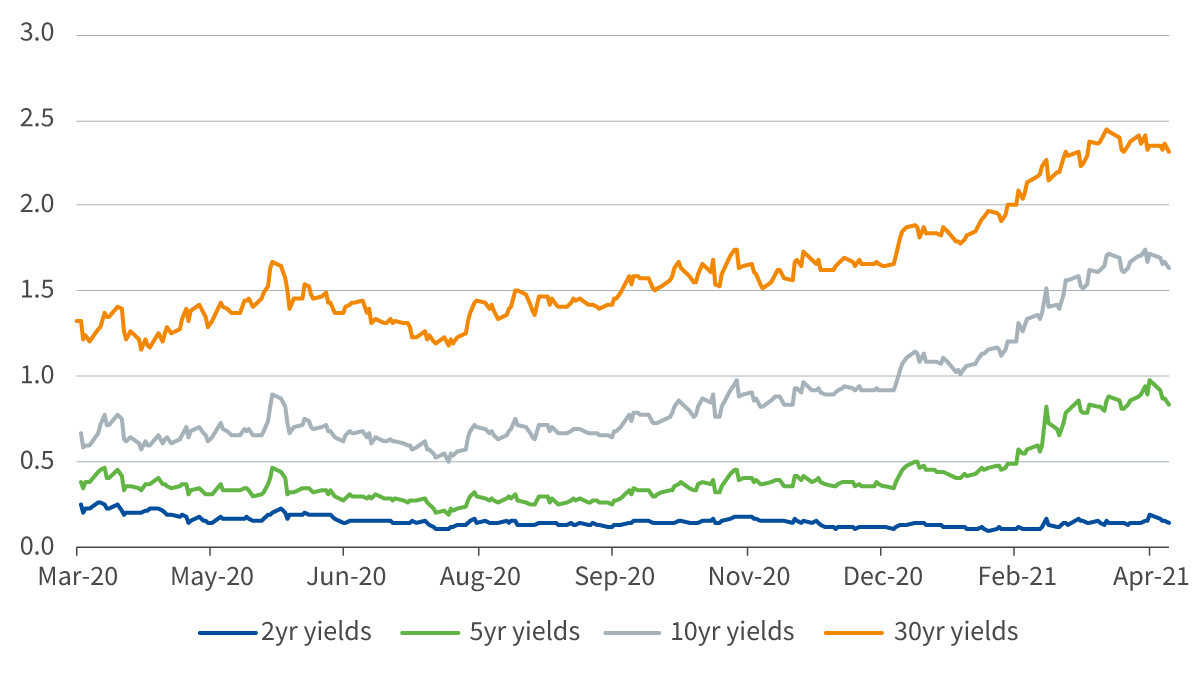

However, it doesn’t rule out the possibility of a continued rise in longer-dated US Treasury yields. The immediate reaction to the March Federal Open Market Committee (FOMC) statement was a significant steepening of the US Treasury curve; while yields up to five years barely rose, there were much bigger rises at ten and 30 years.

Figure 2: The US Treasury curve has steepened

Source: Bloomberg, Aviva Investors, as of April 8, 2021

This is consistent with the Fed’s plan, which considers an upward-sloping yield curve a sign of more normal risk appetite and financing conditions as it (in theory) reflects an improving economy. A continued rise in yields in long-dated Treasuries therefore cannot be ruled out. Five-year yields could even rise if the economy recovers enough for doubts to re-emerge on the Fed’s commitment to keep interest rates down.

While this possibility poses some near-term risks to Treasuries, it isn’t indicative of a breakdown in the bond market. The Treasury market is also becoming more attractive to non-US investors from a carry perspective compared to their home markets, which should limit downside risks.

While Treasuries should gradually regain some attractiveness, we remain neutral on government bonds

As a result, while Treasuries should gradually regain some attractiveness and reach a point where they will offer both value and diversification potential for our portfolios, until then we remain neutral on government bonds.

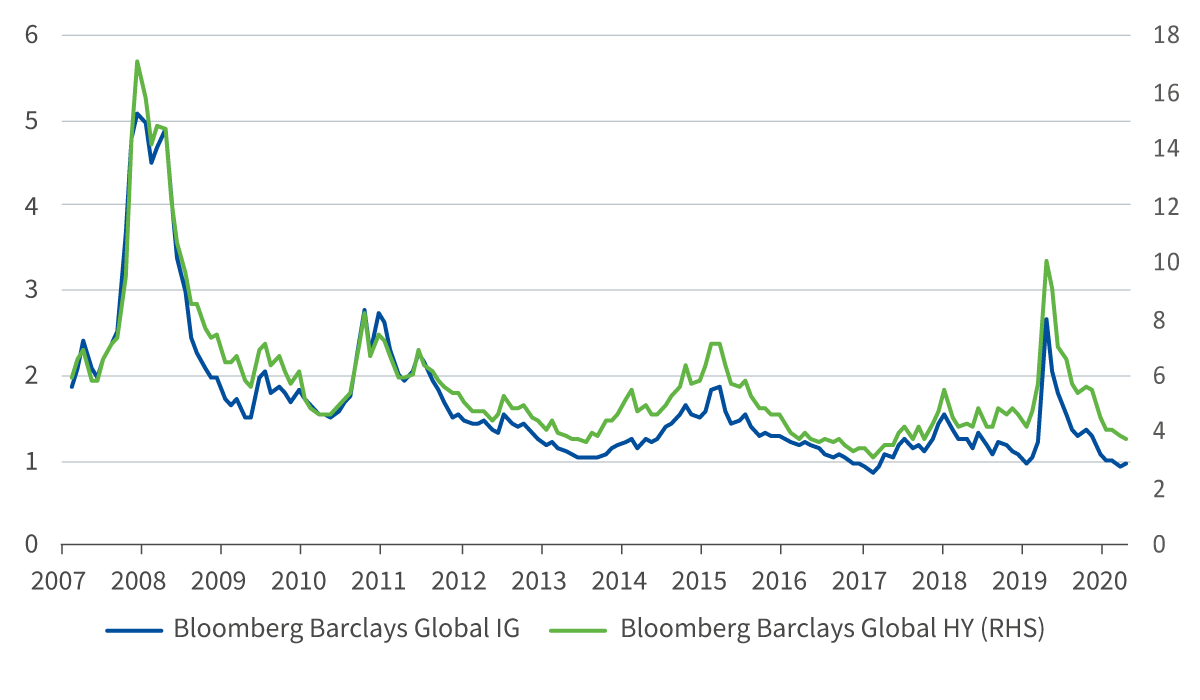

In contrast, increased volatility in interest-rate duration makes the risk-reward less attractive for credit, particularly given credit spreads remain near to historically tight levels. As well as there being a risk of widening credit spreads if economic activity disappoints, higher volatility reflects the risk of a continued sell-off in duration. Therefore, having relied on credit significantly through the summer and second half of 2020, we are now slightly underweight, as the potential upside looks limited.

Figure 3: Credit spreads are historically tight

Source: Bloomberg, Aviva Investors, as of April 8, 2021

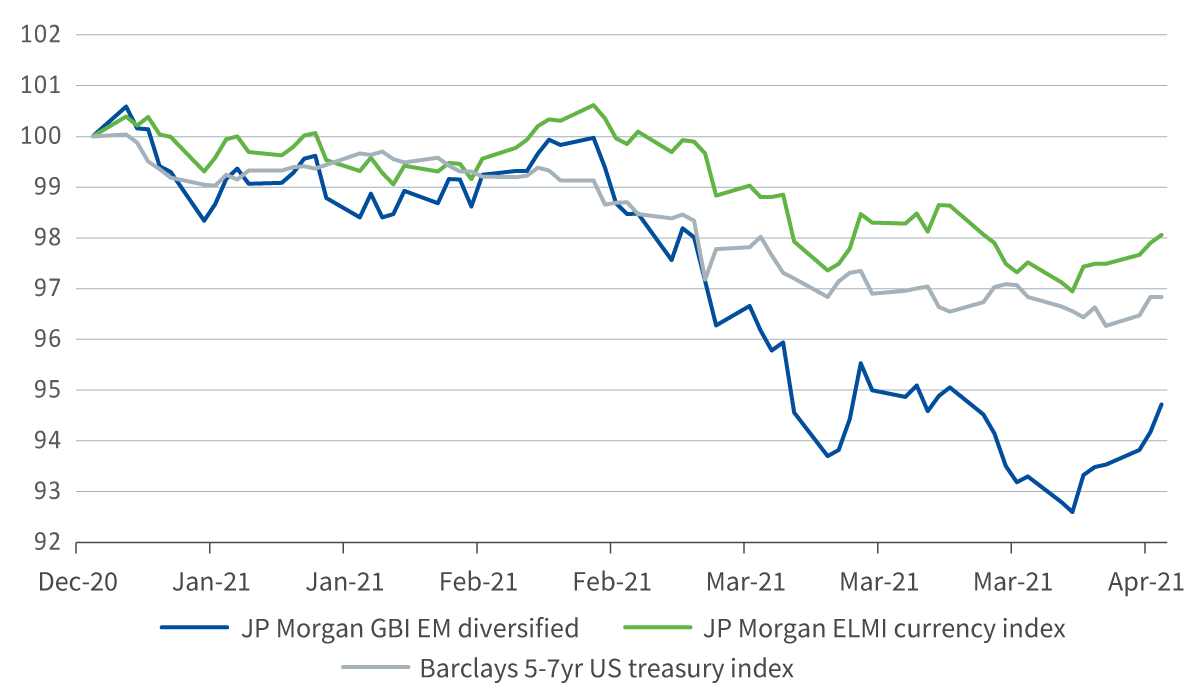

Volatility is also affecting the attractiveness of local-currency emerging-market debt (EMD) on two fronts.

Firstly, it has meant that duration has played an unusually large part in driving total returns in the asset class in the year to date. As local-currency EMD is relatively short duration – generally four or five years – movements in local currencies tend to be the biggest driver of total returns. But given how volatile duration has been, it has become the bigger driver. This is not an attractive property for the asset class, and although a rate-hiking cycle has begun in some emerging markets like Brazil, Turkey and Russia, it has some way to run before the carry picture becomes compelling.

Figure 4: Bond declines have been a headwind for Emerging markets

Source: Bloomberg, Aviva Investors, as of April 8, 2021

Secondly, the rise in longer-dated interest rates in the Treasury market is marginally supportive of the US dollar. This also makes it less attractive to take significant risk exposure on emerging-market currencies, whose performance is often negatively correlated to the US dollar.

In equities, this possibility of rising yields may threaten some high-valuation pockets, but we don’t expect it to impact the broader global market and retain our medium-term overweight. In contrast to the years following the global financial crisis, policy is being run very differently, with more fiscal support. This puts equities in a more privileged position, both generally and for specific sectors.

Infrastructure has been the focal point of the latest stimulus package

For example, the industrial sector typically benefits most from a combination of strong private-sector demand (supported by low interest rates) and fiscal demand, which is possible in 2021 and 2022. Although infrastructure spending was not included in the Biden Administration’s first round of stimulus, it has been the focal point of the latest package.3 There have also been moderate improvements in companies’ capex intentions, and the potential for growth is not yet reflected in valuations.

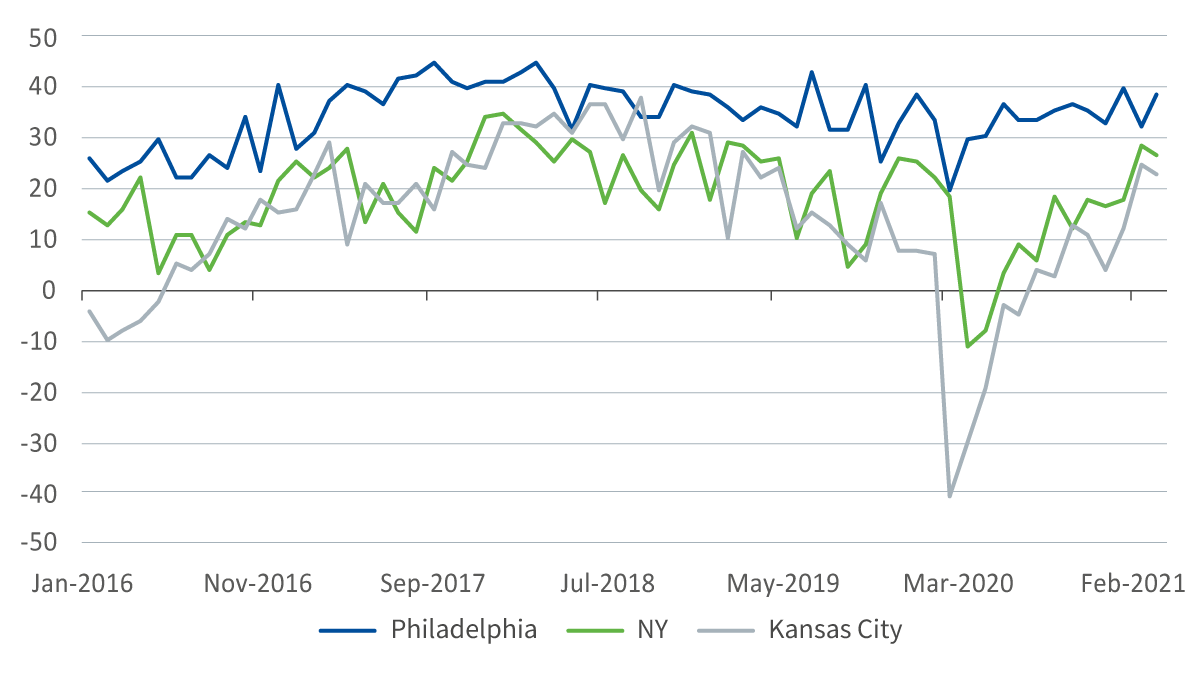

Figure 5: US regional Fed capital spending surveys

Source: Philadelphia, New York and Kansas City Federal Reserves, Bloomberg, Aviva Investors, as of April 8, 2021

In terms of equity regions, we maintain our preference for the US and UK and are concerned about the outlook for emerging markets. While emerging markets led in terms of earnings momentum in the second half of 2020, they are now back in the pack.4 This could reflect the fact China – and the economies that depend on it – began to recover from the pandemic fastest, a recovery which may now be plateauing, while other economies like the US and the UK are catching up.

Some large Chinese companies are caught in the political crossfire between Xi Jinping and Joe Biden

Some large Chinese companies are also caught in the political crossfire between Xi Jinping and Joe Biden. Minority shareholders are likely to be low on the priority list as these companies navigate the challenges, which reinforces our preference for a small underweight position in emerging market equities.

Current conditions offer more visibility in the equity market than in rates or credit. As a result, a significant amount of our portfolio risk is now in equities, both in our absolute and relative views. This is a significant change compared to 2020.

References

Important information

Except where stated as otherwise, the source of all information is Aviva Investors Global Services Limited (AIGSL). Unless stated otherwise any views and opinions are those of Aviva Investors. They should not be viewed as indicating any guarantee of return from an investment managed by Aviva Investors nor as advice of any nature. Information contained herein has been obtained from sources believed to be reliable but has not been independently verified by Aviva Investors and is not guaranteed to be accurate. Past performance is not a guide to the future. The value of an investment and any income from it may go down as well as up and the investor may not get back the original amount invested. Nothing in this material, including any references to specific securities, assets classes and financial markets is intended to or should be construed as advice or recommendations of any nature. This material is not a recommendation to sell or purchase any investment.

In Europe this document is issued by Aviva Investors Luxembourg S.A. Registered Office: 2 rue du Fort Bourbon, 1st Floor, 1249 Luxembourg. Supervised by Commission de Surveillance du Secteur Financier. An Aviva company. In the UK Issued by Aviva Investors Global Services Limited. Registered in England No. 1151805. Registered Office: St Helens, 1 Undershaft, London EC3P 3DQ. Authorised and regulated by the Financial Conduct Authority. Firm Reference No. 119178. In France, Aviva Investors France is a portfolio management company approved by the French Authority “Autorité des Marchés Financiers”, under n° GP 97-114, a limited liability company with Board of Directors and Supervisory Board, having a share capital of 17 793 700 euros, whose registered office is located at 14 rue Roquépine, 75008 Paris and registered in the Paris Company Register under n° 335 133 229. In Switzerland, this document is issued by Aviva Investors Schweiz GmbH.

In Singapore, this material is being circulated by way of an arrangement with Aviva Investors Asia Pte. Limited (AIAPL) for distribution to institutional investors only. Please note that AIAPL does not provide any independent research or analysis in the substance or preparation of this material. Recipients of this material are to contact AIAPL in respect of any matters arising from, or in connection with, this material. AIAPL, a company incorporated under the laws of Singapore with registration number 200813519W, holds a valid Capital Markets Services Licence to carry out fund management activities issued under the Securities and Futures Act (Singapore Statute Cap. 289) and Asian Exempt Financial Adviser for the purposes of the Financial Advisers Act (Singapore Statute Cap.110). Registered Office: 1 Raffles Quay, #27-13 South Tower, Singapore 048583. In Australia, this material is being circulated by way of an arrangement with Aviva Investors Pacific Pty Ltd (AIPPL) for distribution to wholesale investors only. Please note that AIPPL does not provide any independent research or analysis in the substance or preparation of this material. Recipients of this material are to contact AIPPL in respect of any matters arising from, or in connection with, this material. AIPPL, a company incorporated under the laws of Australia with Australian Business No. 87 153 200 278 and Australian Company No. 153 200 278, holds an Australian Financial Services License (AFSL 411458) issued by the Australian Securities and Investments Commission. Business Address: Level 30, Collins Place, 35 Collins Street, Melbourne, Vic 3000, Australia.

The name “Aviva Investors” as used in this material refers to the global organization of affiliated asset management businesses operating under the Aviva Investors name. Each Aviva investors’ affiliate is a subsidiary of Aviva plc, a publicly- traded multi-national financial services company headquartered in the United Kingdom. Aviva Investors Canada, Inc. (“AIC”) is located in Toronto and is registered with the Ontario Securities Commission (“OSC”) as a Portfolio Manager, an Exempt Market Dealer, and a Commodity Trading Manager. Aviva Investors Americas LLC is a federally registered investment advisor with the U.S. Securities and Exchange Commission. Aviva Investors Americas is also a commodity trading advisor (“CTA”) registered with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National Futures Association (“NFA”). AIA’s Form ADV Part 2A, which provides background information about the firm and its business practices, is available upon written request to: Compliance Department, 225 West Wacker Drive, Suite 2250, Chicago, IL 60606.