06 Nov 2024

Claire Shaw – Portfolio Director

As with any investment, your capital is at risk.

What are the implications of eliminating the dead zones that prevent a quarter of the US from getting mobile phone signals? And what if we could solve problems in seconds that would take today’s supercomputers decades?

Perhaps we’ll soon find out, thanks to private companies in Scottish Mortgage’s portfolio.

Speaking at the Trust’s inaugural digital conference, manager Tom Slater and deputy Lawrence Burns shared why holding companies across the private-public divide gives shareholders exposure to a differentiated and diversified returns.

With companies staying private longer, Scottish Mortgage gives its clients a low-cost way to tap into the value accruing in unlisted companies without locking them in.

Scottish Mortgage can invest up to 30 per cent of its value in private companies, as measured at the time of investment. It currently backs 40 private companies, the 10 largest of which account for two-thirds of the 23 per cent exposure.

Since 2012, , the Trust has deployed £4.6bn of capital to 46 companies. Of those, 14 – including Spotify, Wise and Tempus AI – have successfully floated and remain in the portfolio. Others, including ByteDance, SpaceX and Epic Games have thrived while remaining outside public markets.

“We’re looking for private growth companies, those with the potential to be multiples of their size over our investment horizon,” said Burns.

“Our role is to provide capital that’s a catalyst to that growth, to help continue and accelerate it.”

That means that most private capital is deployed when companies’ business models have established a path to profitability and are beginning to scale.

Occasionally, the Trust will take smaller holdings in earlier-stage companies, such as UPSIDE Foods. Conversations with their founders help the managers understand emerging industries and spot further opportunities.

SpaceX is Scottish Mortgage’s largest private holding, accounting for just over 4 per cent of the portfolio.

With close to 100 launches last year, SpaceX has more than doubled the number of launches in 18 months. Its new skyscraper-sized vehicle, Starship, can take 150 tonnes into orbit, allowing its clients to deploy larger, more complex and capable satellite systems.

Slater also highlighted the potential of SpaceX’s satellite internet business, Starlink. With over three million subscribers in 100 countries, its ability to provide high-speed data connectivity to remote and rural areas worldwide is a substantial competitive advantage.

In addition, Spotify illustrates why bridging the private-public divide can create long-term compounding returns. Scottish Mortgage first invested in 2015 at about $56 a share, then in a subsequent funding round in 2017 and again when it listed in 2018 at about $130 a share. Earlier this year, the Trust sold some shares at about $300.

Those early years allowed the managers to know the company better and build close relationships with its leaders. Today, they are among a select group who are invited to meet founder Daniel Ek one-on-one.

Companies developing innovative energy transition solutions could have enormous societal impact.

Redwood Materials, for example, is recycling lithium-ion battery components to help others provide lower-cost energy storage for electric vehicles and renewables.

The primary capital that Scottish Mortgage and other provided helped the firm fund facilities in Nevada and South Carolina. Last year, these could process about 40,000 tonnes of material, enough to build batteries for approximately 100,000 electric cars.

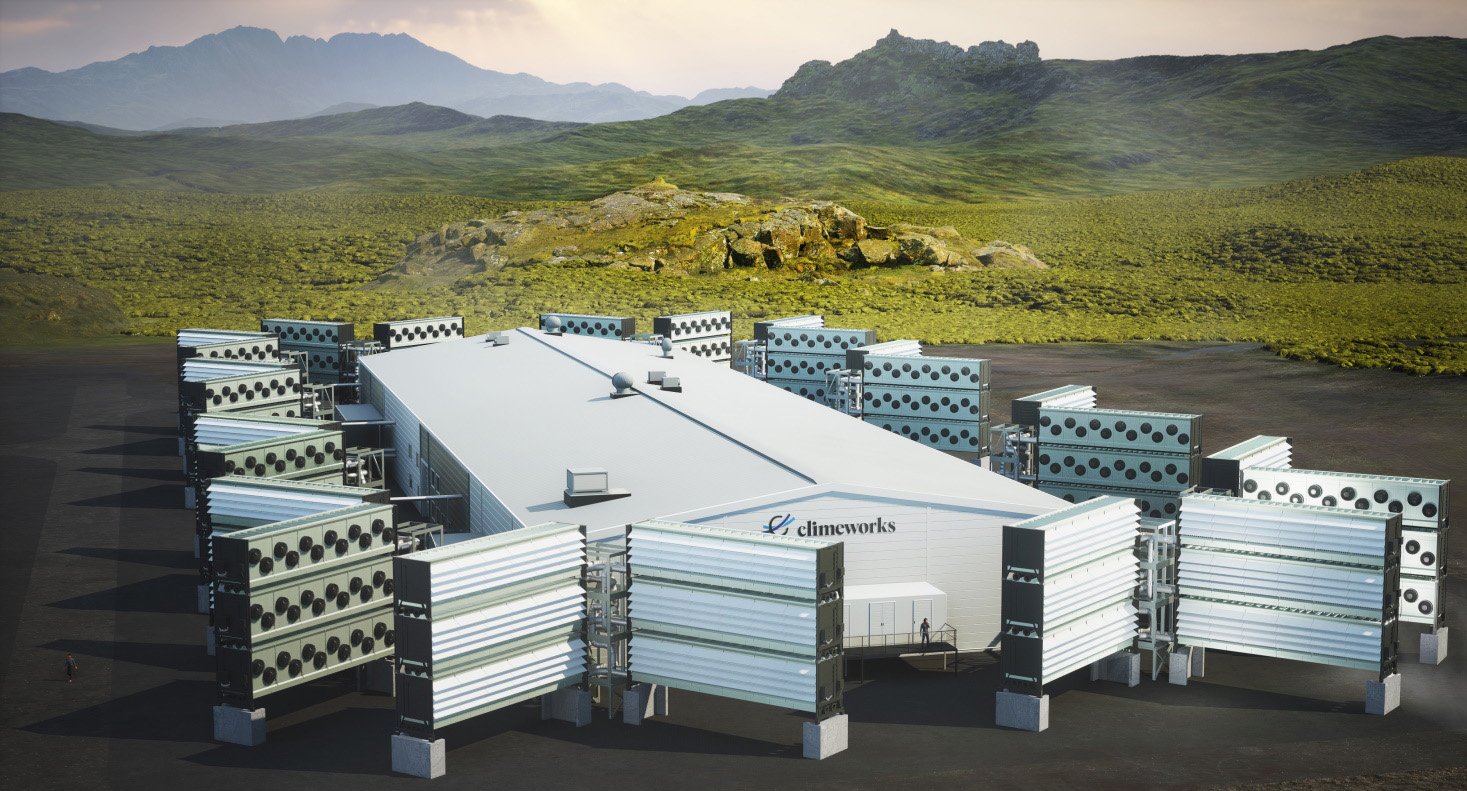

© Climeworks. Illustrative purposes only

Climeworks is also building what could become a multi-billion-dollar industry: carbon removal. Scottish Mortgage contributed to the funding of two Icelandic facilities, which are sucking carbon dioxide out of the atmosphere for underground storage.

“[Achieving scale] could have a material and financial impact on shareholders, but it is also possible that if they succeed, they will change the world,” said Burns.

Slater referred to Northvolt, the European champion in battery technology, which has seen intense Asian competition and a slightly cooling demand in Europe for electric vehicles. These factors have led to a challenging period which the managers are monitoring closely.

Slater explained that various macro variables, including confidence and interest rates, determine the pace of IPOs (initial public offerings).

There was “a huge appetite for companies growing very quickly but not profitable three or five years ago. As a company, being profitable or having a clear path to profitability has become an important variable.”

He is optimistic about the outlook, partly due to the “huge pipeline of companies that have effectively been trapped for the past three years, where pressure is building to move and transition to a public company.”

A recent positive was Tempus AI listing at a valuation of circa $6bn. It helps healthcare professionals better diagnose and treat cancer and other diseases.

Purpose takes many forms. Sometimes, emerging technology makes a difference in unexpected ways.

Having survived the downturn in crypto markets over the past three or four years, Blockchain.com benefits from an enhanced competitive position.

Slater recounted how its technology, used alongside Starlink’s internet connectivity, makes it possible for Sub-Saharan African villages to install a solar facility to provide their energy needs while running a crypto-mining machine that pays for the installation.

Elsewhere, PsiQuantum is developing quantum computers that would make today’s supercomputers positively slow. Faster drug development, better fertilisers and superior battery chemistries are just a few of the end possibilities.

Holding companies with such world-changing potential across the private-public divide extends the window for long-term compounding returns. But there’s more.

Capital becomes truly purposeful when it goes directly to companies to accelerate progress. It is one reason why private companies addressing change can meaningfully drive growth and contribute to shareholder returns over the long term.

Risk Factors

Unlisted investments such as private companies, in which the Trust has a significant

investment, can increase risk. These assets may be more difficult to sell, so changes in

their prices may be greater.

The trust invests in overseas securities. Changes in the rates of exchange may also cause

the value of your investment (and any income it may pay) to go down or up.

About the author - Claire Shaw, Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Important information

This communication was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

A Key Information Document is available by visiting our Documents page.

Any images used in this content are for illustrative purposes only.