24 May 2024

Newton1 global income portfolio manager Jon Bell assesses the potential fate of income stocks in a world no longer characterised by ‘free money’. Are equity markets about to see a switch in leadership?

Looking ahead, Newton global income portfolio manager Jon Bell thinks inflationary pressures are likely to outweigh disinflationary pressures. As such, he expects a change in global equity markets, to one that sees leadership shift away from growth stocks towards income-oriented stocks that pay dividends.

According to Bell, some disinflationary forces remain. These include challenging demographics, high levels of global debt and significant technological disruption. But he thinks these will be overshadowed by inflationary pressures, including rising wages, deglobalisation, increased defence spending and the energy transition.

“The inflation genie has been released from its lamp,” says Bell. “In this environment of higher inflation, it is hard to believe central banks can aggressively pivot and cut interest rates. In our view this means the era of ‘free money’ is over.”

The end of ‘free money’?

Bell describes the post global financial crisis era characterised by low interest rates, quantitative easing (QE) and low inflation as an “abnormal” period in history. This, he adds, was a good environment for growth stocks because their future cashflows could be discounted back at virtually zero bond yields.

But Bell views the current regime of higher inflation and interest rate as a more “normal” environment in the context of market and economic history. In this environment, Bell thinks dividends will be key to long-term total returns. For one thing, he says when interest rates are higher, dividends tend to become more significant to long-term equity returns. This is because dividend returns tend to be less volatile than capital returns. What’s more, Bell says the compounding of dividends is key to returns.

Is history about to repeat?

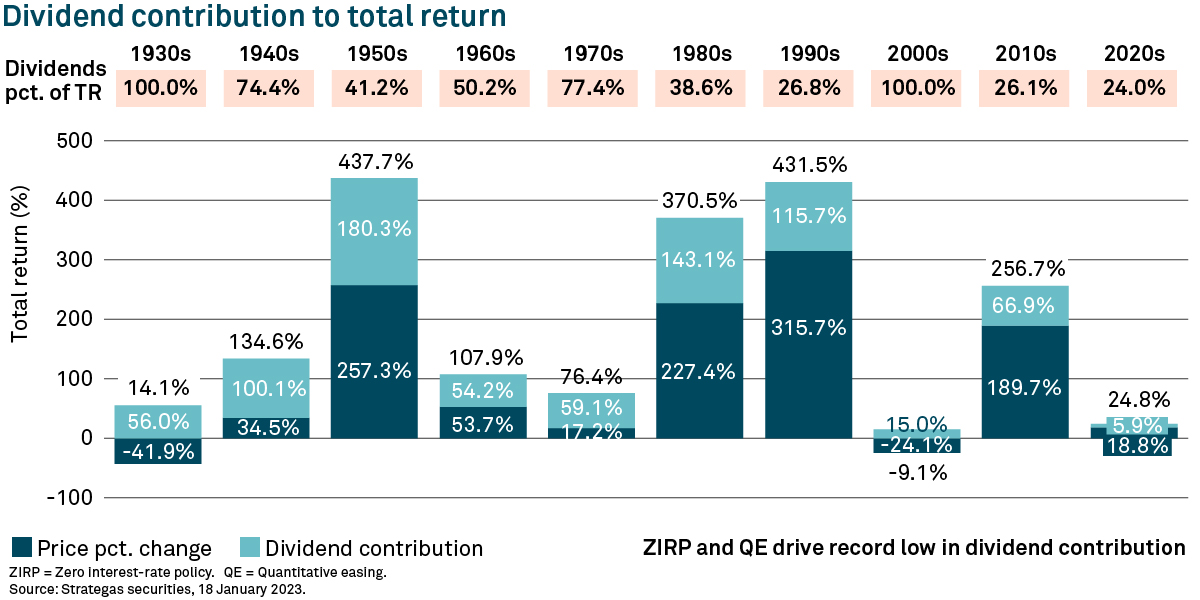

Looking at history, Bell notes the importance of dividends in decades following the bursting of growth equity bubbles. Examples include during the 1930s and the 2000s, both of which saw a 100% contribution from dividends to total return.

Source: Strategas securities, 18 January 2023. Refence index: S&P 500

Bell observes that the current decade (2020s) has started with dividends making a low contribution to total return of just 24%. This, he posits, is because QE and zero interest rate policy (ZIRP) encouraged greater speculation on growth.

But he adds: “Given this pivot in the environment and the end of ‘free money’, we believe that when we get to 2030, we will look back on a decade where dividends have once again been critical to your return.”

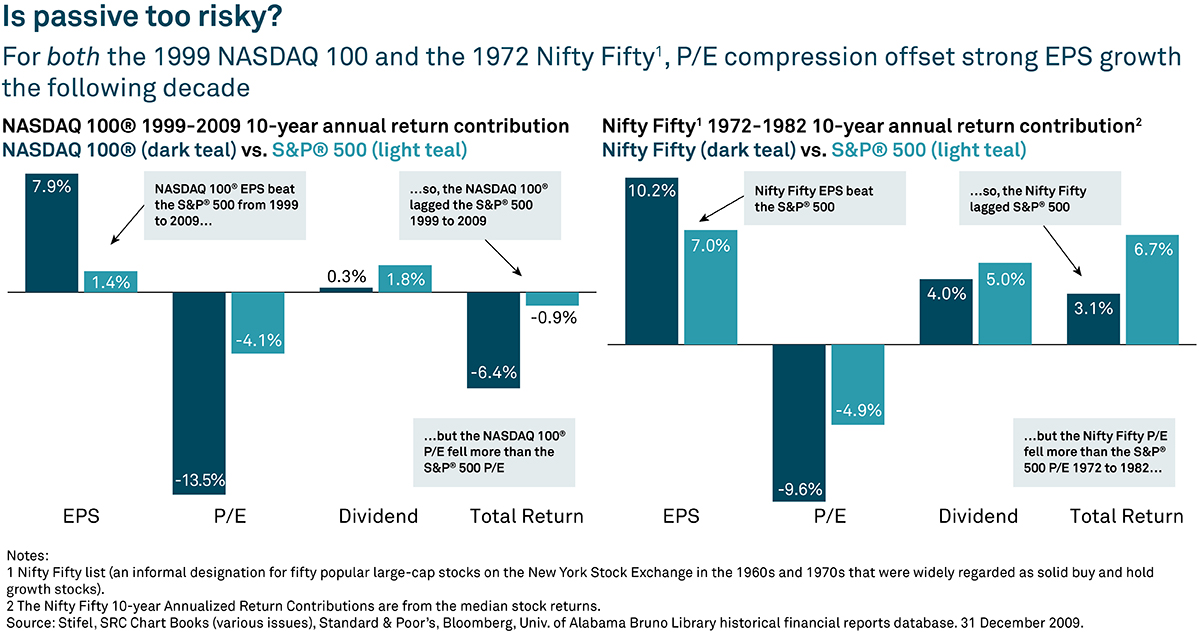

What’s more, Bell also flags what happened to valuations in the decade following the bursting of the Nasdaq bubble (see chart below). Over the next 10 years (1999-2009), the Nasdaq 100 index grew its earnings at just shy of 8% while the rest of the market grew at about 1.4%. However, he notes the price to earnings (P/E) ratio that the market was prepared to pay for those companies fell by 13.5%, compared with a 4% fall for the rest of the market. As a result, the Nasdaq 100 underperformed by 5.5% over the next 10 years. “Despite the fact the companies were doing better, they derated which led to underperformance,” notes Bell.

Source: Stifel, SRC Chart Books (various issues), Standard & Poor’s, Bloomberg, Univ, of Alabama Bruno Library historical financial reports database. 31 December 2009.

A similar thing happened with the Nifty 50 index between 1972 and 1982 (see chart above). Operationally, the companies outperformed over that decade, but their valuation fell by more, leading to 3% underperformance over that period, Bell observes.

“Is history going to repeat itself with the magnificent seven? We don’t have a crystal ball, so we don’t know. But what we do know is the world has changed, the conditions that tend to be favourable for growth stocks are behind us and valuations are high. So, there is a very good chance [equity market] leadership can change from here,” Bell concludes.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

1Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.