08 Jan 2025

Newton’s Janice Kim assesses four macroeconomic themes influencing the mixed asset team’s decision making. Meanwhile, Paul Flood gives his view on bonds, equities and alternatives.

Key points:

For a long time, investors were used to an environment led by monetary policy, globalisation and free trade, low to zero interest rates and disinflation. But that landscape has shifted dramatically, says Newton’s Janice Kim. The world is now dominated by fiscal measures, increased protectionism, deglobalisation and reshoring, higher debt costs, and potentially higher inflation.

“We ask ourselves whether this paradigm shift will drive a return to cyclicality and increased volatility,” says Kim. “But as multi-asset investors, we view volatility as our friend. It allows us to take advantage of market dislocations across asset classes and find attractive entry points for areas of long-term opportunity.”

Big government

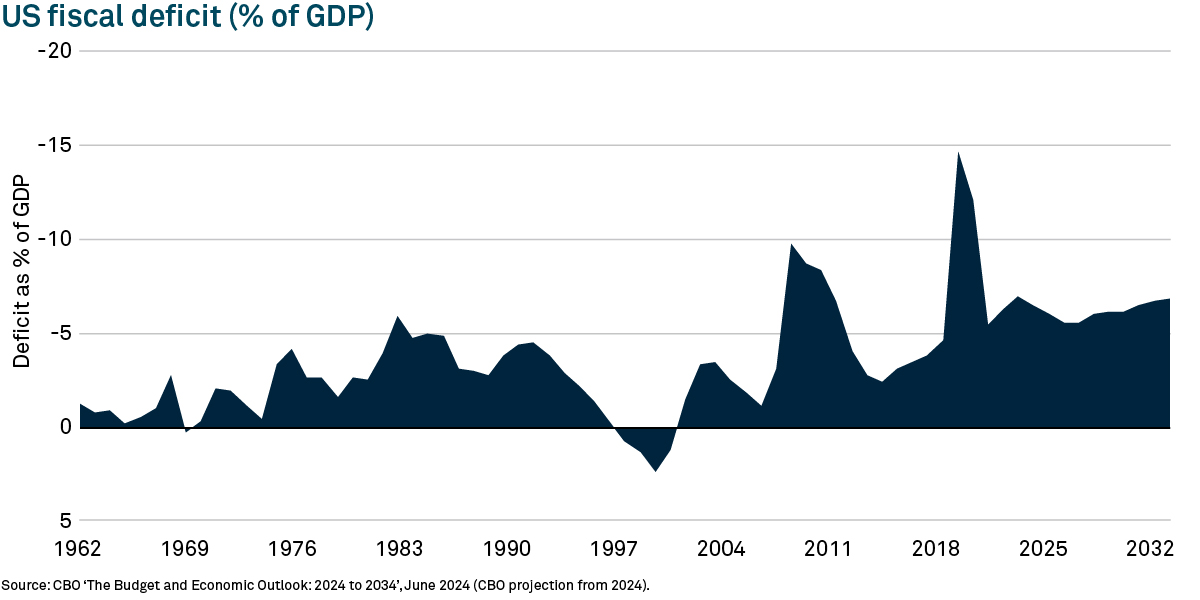

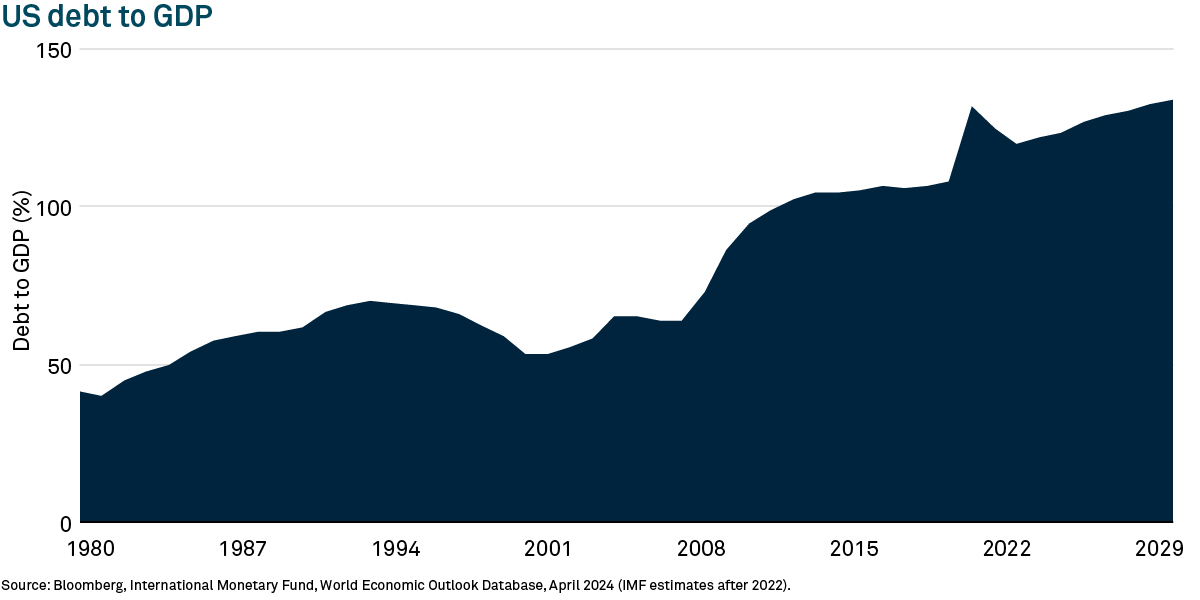

One theme emerging in this new regime is the rise of big government – in particular, increasing state involvement in economies. Kim says this is evident in the US and other developed and developing nations through larger fiscal deficits and rising government debt to GDP levels.

“We believe this is likely to continue given some of the structural shifts underway like deglobalisation and reshoring. Combined with other dynamics like ageing demographics and the rising costs of healthcare and higher debt, investors have called into question whether government spending is sustainable.”

Kim says a key question is whether economies can grow their way out of the debt situation without inflation spiralling. She observes that in the US, prices have cooled and, despite higher interest rates, the economy and labour market have been reasonably resilient.

But she notes new US job additions have been declining. “With a slowing of the jobs market, there has emerged a more robust debate around growth versus inflation and where interest rates are likely to go from here,” she adds.

Interest rate ‘tug of war’

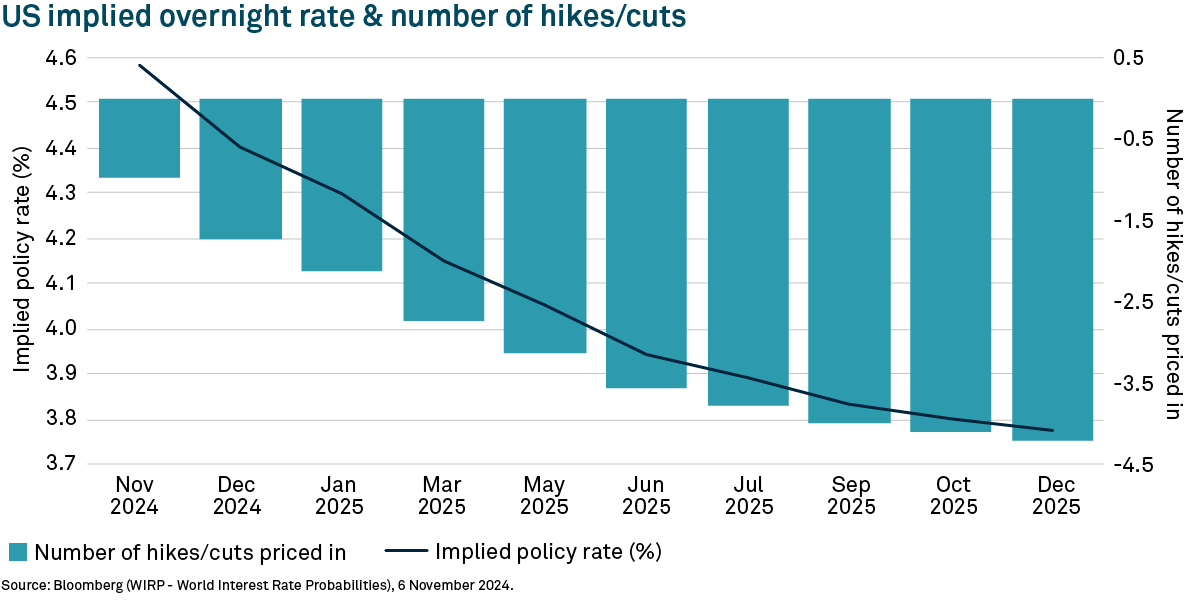

On interest rates, Kim notes rate cut expectations have lowered. In the summer nearly seven cuts were being priced in. Today the market is pricing in four cuts over the next five quarters, which would leave the policy rate at about 3.8% by the end of 2025, says Kim.

There is a debate around the path for interest rates, she adds. “One side argues growth has been resilient in a higher rate environment. Therefore, slow moderate cuts would ensure the inflation genie is securely put back in its bottle. On the other side, however, people expect more aggressive rate cuts to pre-empt any sort of severe recession now that we've seen evidence of a slowing labour market in the US. We expect this tug of war to continue with the markets remaining focused on employment data.”

Political moves

With Donald Trump as US president-elect, Kim says the market's focus has shifted “from political uncertainty to policy uncertainty”. Key themes for Trump's second term, she notes, appear to be tariffs, immigration, deregulation, and lower taxes and fiscal spending. “The Republicans may be able to advance Trump's agenda more easily from the get-go with the House and the Senate both under Republican control,” she adds.

In the UK, the Labour Party’s budget in October delivered an increase of around £40bn in taxes1. Businesses are set to do the heavy lifting on this, with higher National Insurance (NI) contributions expected to bring in the bulk of that total2.

“How employers absorb this additional NI burden remains a big question,” says Kim. “It may end up being a drag on economic growth if businesses look to cap wage growth and limit hiring and investment, especially employers of lower paid workers.”

The UK government also announced current (day-to-day) spending is projected to rise by £47bn (1.4% of GDP) by 2029/303. “The discrepancy between expected tax revenues and spending has meant higher borrowing, all at a point when borrowing costs are high,” adds Kim.

According to Kim, the UK faces similar issues around fiscal deficits and government debt levels as the US. “However, you are seeing divergent policies emerge between the UK and US economies, with the Trump administration laying plans to reduce public spending and maintain lower taxes, and the UK effectively doing the opposite,” she adds.

“If the Reeves’ budget isn't able to raise productivity and growth, these divergent policies could potentially lead to very different longer-term outcomes in growth and inflation for the UK and the US.”

China

Growth has been a challenge for China, the world’s second-largest economy. While the Chinese government’s economic stimulus measures have revived hopes of a consumption recovery, the question remains as to whether the government can, in fact, jumpstart the economy back into growth mode, according to Kim.

She notes that the China market trades at around 10 times earnings4, with valuations for certain quality Chinese companies looking compelling, even in the absence of any government stimulus.

With this backdrop in mind, Newton head of mixed assets investment Paul Flood outlines the multi-asset team’s thoughts on bonds, equities and alternatives…

Key points:

Bonds

Paul Flood notes the multi-asset team has been adding to bonds across portfolios on the belief they provide diversification in portfolios.

He says: “At the beginning of 2024 we felt a lot of rate cuts were being priced into the market, so we reduced the allocation to bonds. During the growth scares we saw in August 2024, when equity markets sold off, we saw good returns from the bond market.”

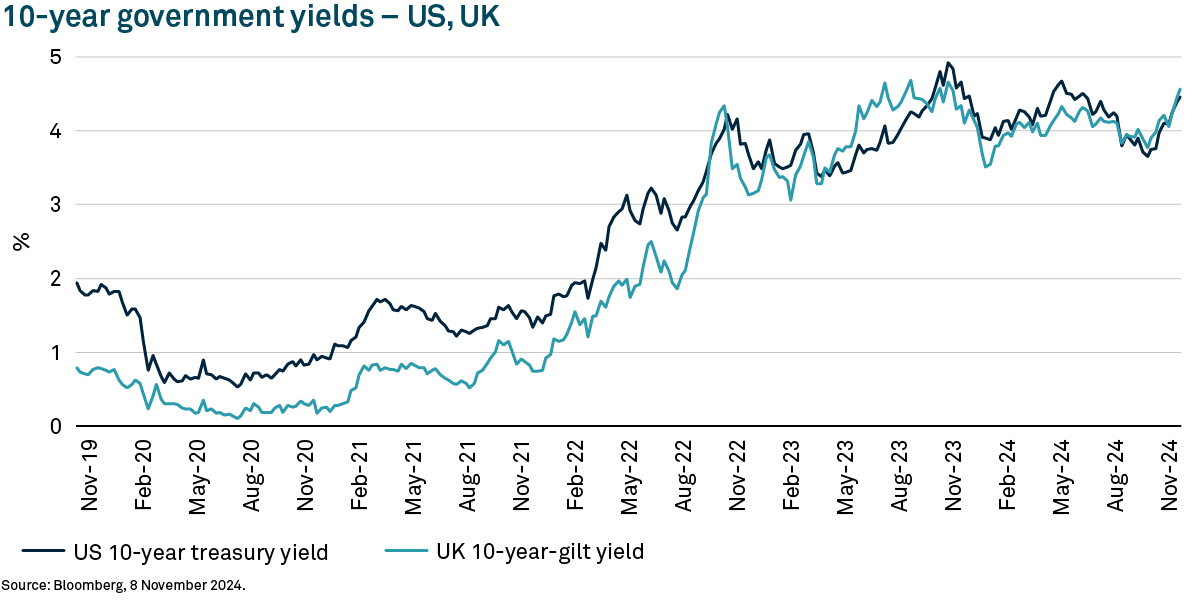

In terms of market observations, Flood notes since the US presidential election, yields on the 10-year US Treasury and 10-year gilt have been moving towards 5%. Flood thinks this shows the market pricing in inflationary concerns arising from both government fiscal spending and some Trump policies.

“More recently, since the end of the Q3, we have been adding back into the bond market at the longer end where we're getting up to 5% particularly in the UK gilt market,” he adds. “We think 5% sounds reasonable, given where inflation is. If the central banks are successful at keeping inflation at target, that could lead to a 3% real return which we believe is attractive.”

Equities

According to Flood, equity market valuations are elevated. In fact, he thinks, valuations are in similar territory to early 2022, driven by growth stocks, particularly the magnificent seven.

“We reduced equities going into 2022 and increased that going into 2023,” he adds. “More recently, however, we've been conscious of valuations. So, while equity weightings haven't changed dramatically, we have made reductions within technology given how strong this sector has been.”

Increased concentration within indices and equity portfolios is something the team is concerned about, says Flood, but he observes earnings numbers are starting to grow across the broader market.

According to Flood, one area of opportunity is stemming from the manufacturing renaissance, particularly in the US. The boom in artificial intelligence and the related increase in data centres and areas like cloud computing are likely to create significant demand for electricity.

Alternatives

Flood says the alternatives space has seen weakness. He thinks this can be explained, in part, because higher interest rates have resulted in greater demand for bonds, so competition for investors’ capital has been fierce.

Other contributors to weakness, Flood thinks, have included the debate around cost disclosure for investment trusts, as well as pension funds selling risk assets as they offload balance sheet risk to match liabilities.

“We reallocated some of the alternatives’ exposure through 2022 and 2023 into the bond allocations within portfolios,” says Flood.

But he is now more optimistic on alternatives. One reason for this is financial services retail disclosure requirements are being reformed[1]. Flood thinks this could entice multi-asset investors back into the investment trust space.

Another reason is the inflation-linked nature of some renewables. “With concern around inflation remaining higher, the inflation-linked cash flows characteristic of the renewables space could be positive for investors, providing portfolio diversification against bonds and equities.”

1Guardian. Budget 2024: Reeves reveals £40bn in tax rises as she promises to rebuild public services. 30 October 2024.

2Financial Times. Businesses and wealthy bear brunt of £40bn tax increases in UK Budget. 30 October 2024.

3Capital Economics. Despite large rise in taxes, Budget still boosts economy. 30 October 2024

4Bloomberg data, as at 29 November 2024. On a forward-looking price-to-earnings (P/E) basis, based on the MSCI China Index.

The value of investments can fall. Investors may not get back the amount invested