10 Jan 2025

A new regime calls for a new approach to multi-asset, says Newton multi-asset chief investment officer Mitesh Sheth – one, he argues, that could see liquid alternatives play a bigger role in portfolios.

Key points

Newton’s Mitesh Sheth believes liquid and flexible alternative strategies could play a larger role in investors’ asset allocation plans, providing the potential for uncorrelated returns and downside risk management, without the high fees and additional risks typically associated with alternative vehicles.

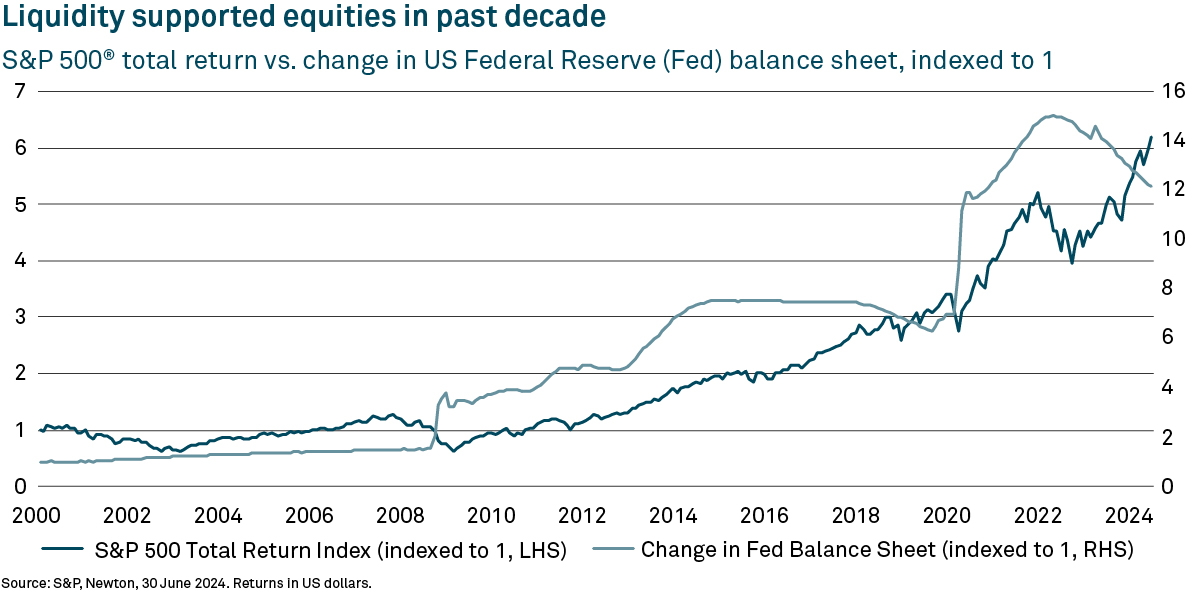

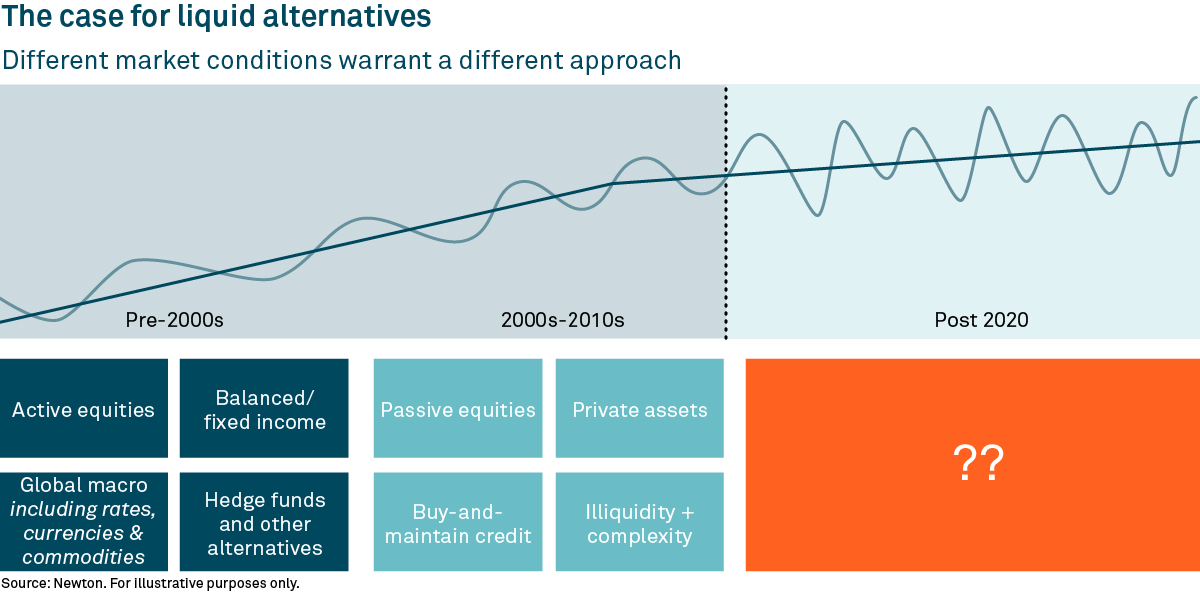

Sheth suggests some asset owners may need to review their investment approaches, many of which were devised in the past macroeconomic and market regime. This regime refers to the period between the global financial crisis and the Covid pandemic, characterised by quantitative easing (QE). This, Sheth notes, was a period in which financial markets were buoyed by ultra-low nominal interest rates and central bank asset purchases.

The QE era is over

During this time, many asset owners chose passive equities, as well as buy-and-maintain credit strategies, notes Sheth. Some boosted their allocation to illiquid assets such as infrastructure, real estate and private equity, seeking diversification benefits and the potential for higher returns than those delivered by traditional markets.

On the whole, this strategic asset allocation (SAA) approach worked well over this period, says Sheth. However, he adds: “As QE came to an end the combination of unprecedented fiscal and monetary stimulus in response to the pandemic led to high and persistent inflation, and central banks then aggressively raised interest rates as they sought to contain it.”

Inflation has declined from its 2022 peak, adds Sheth, but he thinks structural factors such as high fiscal deficits, ageing workforces and geopolitical fragmentation threaten to keep it high relative to the QE era, potentially limiting the flexibility of central banks.

In addition, he says the growing realisation that the planet is facing some significant biophysical constraints means that whatever growth is experienced over the next few decades is likely to be shaped in part by those limits.

“The QE era has ended and, with it, the ‘long any risky asset’ strategy may have ended too. Given high cash rates, we do not expect the current regime to reward equity market beta in the same way as occurred during the QE era,” says Sheth.

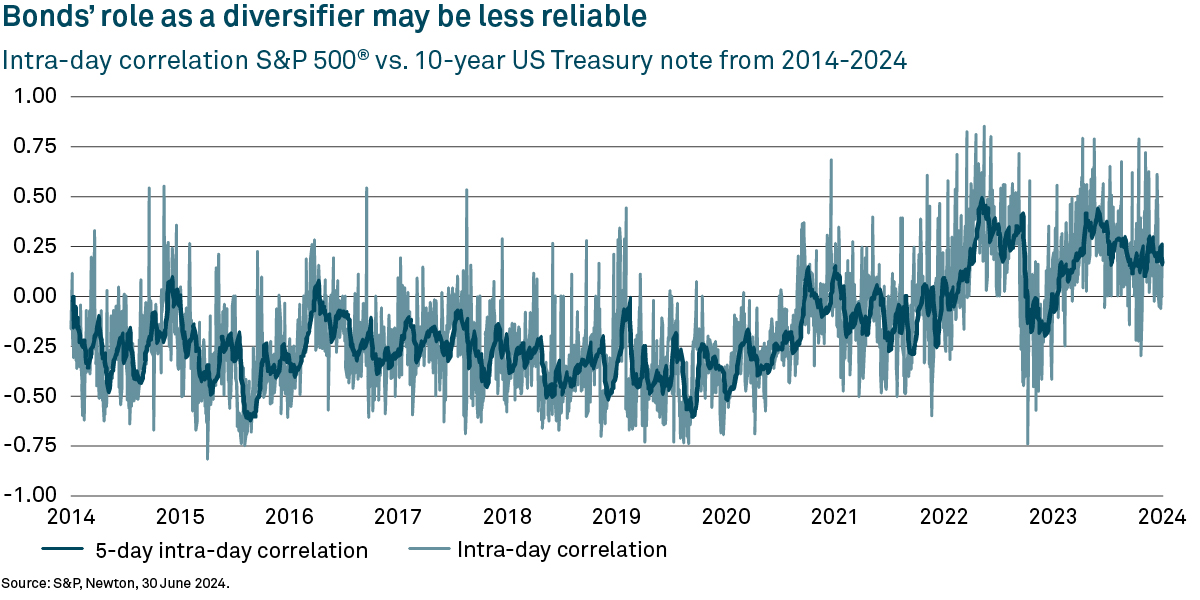

“Similarly, we expect bonds to offer a lower premium, and perhaps more significantly, we already expect bonds to provide a less reliable diversification benefit versus equities (see chart below). Clients may also be contending with a significant portion of their assets being tied up in private markets that lack liquidity and may face markdowns.”

A new approach for a new era

Sheth says all things considered, the new regime could see financial-market participants face higher volatility and shorter business cycles than they have become accustomed to. Against a background of high cash rates and lower premiums, an investment approach founded on ever-rising markets and lower interest rates may no longer reliably deliver the returns clients are seeking, he adds.

In anticipation of this outcome, Sheth observes that many asset owners have been moving away from an SAA approach in favour of a ‘total portfolio approach’. This, he explains, is where investment goals are focused less on measuring the performance of individual components versus index-based benchmarks and more on seeking solutions that can contribute to a total portfolio outcome.

Sheth believes so-called liquid alternatives could play a key role in a total portfolio approach. He says relevant components of liquid alternatives could include:

“In a world that is less connected and less stable geopolitically, and delivering greater dispersion of financial market returns across and within asset classes, we believe that liquid, long/short global approaches should start to perform well,” explains Sheth. “They take idiosyncratic risks and offer the prospect of diversification benefits that may be underrepresented in clients’ portfolios today. In fact, many clients had more money allocated to these types of strategies prior to the global financial crisis.

“As asset owners have expanded their target allocation to diversifiers and alternative investments, investing in market-neutral, multi-strategy solutions can allow them to gain efficient access to these varied and liquid approaches in a way that we think will be valuable in the new market regime.”

Systematic and fundamental

Sheth argues in the new environment there is a place for both systematic and fundamental multi-asset strategies. At Newton, fundamental and systematic investors have been working together since Newton’s integration of Mellon Investment Corporation’s multi-asset business in 2021.

“Our fundamental portfolio managers have been able to improve their own models by harnessing the insights from their systematic colleagues. This has allowed greater efficiency to filter through and has given our fundamental portfolio managers more time to focus on new ideas.

“For our systematic team, having fundamental colleagues highlighting when trends are about to change can help them de-emphasise certain signals, structure portfolios better, and respond more quickly to a change in direction,” Sheth concludes.

The value of investments can fall. Investors may not get back the amount invested.