03 Jan 2022

In 2022 we expect the market narrative to transition to the traditional expansionary phase of the business cycle. Here’s what it means for fixed income investors.

Throughout 2021 the invisible hand of easy global monetary policy supported financial markets. For 2022, however, the outlook is quite different. We have already seen central banks pare asset purchases, and we should expect a very different backdrop for short-term interest rates, pricing in rate hikes for most major central banks. This waning monetary support, coupled with expensive starting valuations, warrants a more selective approach to fixed income in 2022.

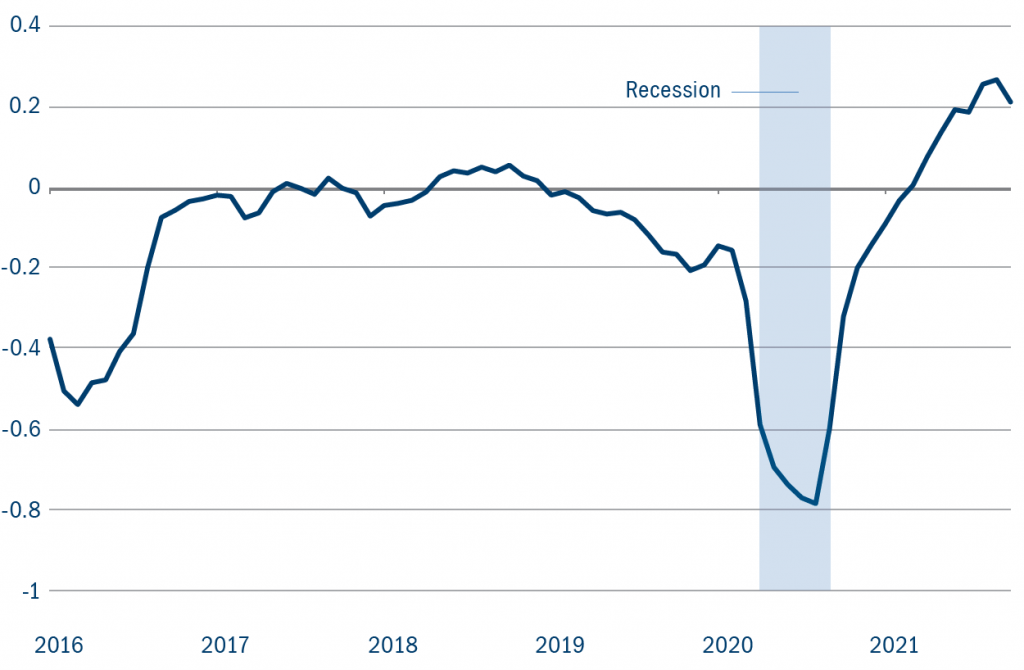

During recessions it is common for rating agencies to downgrade companies whose economic fortunes begin to dim. The volume of these “fallen angels” during the pandemic was historic – $184 billion of corporate debt lost its investment grade (IG) status.1 Aggressive management of costs, capital expenditures, dividends, share buybacks and capital structures all helped stabilise corporate cash balances. As demand steadily returned, profit margins and free cash flow grew rapidly allowing companies to pay down debt and improve credit quality. We believe 2022 will be a strong year for “rising stars” as many high yield companies achieve IG status (Figure 1). In an environment where price appreciation appears muted, rising star candidates could represent a rare opportunity for gains. Risk premiums between BB- and BBB-rated bonds still offer value and prices could rise as investors anticipate higher ratings. But it takes targeted fundamental credit research to identify these favorable credit stories ahead of ratings agency action.

Figure 1: Rising stars: credit upgrades for high yield companies are outpacing post-recession downgrades

Source: Bank of America/Macrobond, October 2021. High yield credit migration rates: trailing six-month net upgrades as a percentage of market value, 1 January 2016 – 31 October 2021

The Covid-induced liquidity wave pushed investors back into financial markets globally and drove valuations to historically expensive levels across most liquid bond markets. The notable exceptions are bonds that are less liquid, less followed or less benchmarked. This is particularly true in structured credit and municipal bonds. Nearly 40% of mortgage- and asset-backed securities are not included in any benchmark, including most of the higher yielding opportunities in that universe. The same dynamic occurs in the municipal bond space, where a high degree of fragmentation, small issue sizes and frequent absence of credit ratings mean that muni benchmarks don’t include a lot of the opportunity set. In each case, a research-driven active strategy can flesh out the risk-reward trade-off in these areas to generate higher income and return prospects than passive alternatives.

In 2022 we expect the market narrative to transition from the “shock and awe” of the pandemic to the traditional expansionary phase of the business cycle. In this stage bond investors benefit far less from owning generic market risk as central banks move toward the exits. A much more targeted approach, focused on improving corporate and consumer balance sheets, should lead to better outcomes in 2022.

2021 will be remembered as a year in which the word “transitory” was used more often than normal. Specific to the market it relates to the battle between rising inflation expectations and the idea that present outsized levels of price rises will rebalance in the coming year, once transitory factors such as the reopening of the economy, supply chain shortages (both labour and capital) and surging energy increases are behind us.

It was, as a result, a hard year for core government bonds. Yields and inflation expectations rose through much the year and returns were negative. All the while, central bank rhetoric erred on the side of dovishness – but frequently failed to win market confidence or support. Our own view of lower for longer growth, inflation and bond yields was challenged, making it a more difficult year for our funds at times.

What of the outlook? We feel this extraordinary type of inflationary pressure is unlikely to be repeatable and will not be met with sustainable pay rises. Thus, negative real wage growth, fiscal headwinds – particularly in the UK – and tighter monetary policy at the margin will weigh on economies after the strong rebound of this year.

Government bond markets should take comfort from this – and so an outcome of better returns in 2022 than 2021 is our central forecast.

For investment grade credit markets, 2021 will be best remembered as a year of low spread volatility – which was in stark contrast to the preceding 12 months. Global IG spreads traded in a range of around 20bps from January 2021 to mid-November 2021, while 2020 saw a much wider range in excess of 240bps.

This very low level of volatility and dispersion creates a more difficult environment for active management, and while most of our funds have outperformed this year, the extent of that outperformance is lower than last year.

What of the outlook for the coming year? We feel fairly neutral about the level of spreads. This reflects the balance between positive fundamentals and expensive valuations. Specifically, while policy conditions appear to be moving slowly in the “wrong direction”, the present low and/or negative rates of interest and assumed future levels will continue to provide a positive backdrop for the market.

Secondly, the global economy may be slowing a little – but for IG credit a “not too hot, not too cold” low but positive growth environment is ideal. It creates an atmosphere that helps rein in excessive animal spirits in the boardroom yet doesn’t produce a risk of significant downgrades or worse. Corporate credit quality is also heading in the right direction and we expect key metrics to revisit where they were at the end of 2019 by the end of this year.

Lastly, we still expect to see demand for income-generating asset classes with lower risk such as IG credit – this at a time of lower new issuance and ongoing central bank buying in Europe.

So why are we not more bullish? The trouble is valuations or spreads. The present level of credit spread is well through both shorter term (fiveyear) and longer term (20-year) averages and a little over 0.5 standard deviations expensive to the latter.

For European high yield credit markets, 2021 will be remembered as the year of improving credit quality seen through both the return of rising stars as well as the fall of default expectations to sub 1% levels. This was in sharp contrast to 2020 where the market size and credit quality grew due to the number and type of issuers who joined the EHY universe as falling angels and default expectations almost reached double-digit levels.

EHY spreads have done a 100bps round trip in the past 12 months with the lows reached in mid-September. Credit spreads fell back to pre-Covid levels, helped by improving corporate fundamentals and positive credit rating progress. This led to lower default expectations as central banks continued to stick with lower for longer – providing good support for the asset class.

What of the coming year? The EHY outlook continues to be supported by a positive growth outlook and improved corporate fundamentals. Rising numbers of Covid cases, as well as recent developments around the Omicron variant, are a reminder of the risk. But efforts to avoid lockdowns to support an improving economic picture remain a key aim of most governments. Market technicals appear balanced: inflation worries linked to supply and labour shortages, as well as logistics disruptions, put pressure on government yield curves, and central banks appear to move away from loose monetary policy.

But appetite for income and higher yielding assets remains good and new issuers coming to markets offer opportunities. With spreads now almost 100bps higher than the 2021 lows and back to the levels seen 12 months ago, valuations look fair despite recent increased uncertainty. Expectations of an ongoing post-pandemic economic recovery appear priced in, while default concerns have fallen to historical lows. With risk premia near historically low levels, there is some concern that compensation for unanticipated volatility is limited. Still, with a yield pick-up and moderate duration, the EHY market offers opportunities.

1 ICE BofA US High Yield Cash Pay Constrained Index, January-December 2020

Important Information

For use by professional clients and/or equivalent investor types in your jurisdiction (not to be used with or passed on to retail clients). This is an advertising document.

This document is intended for informational purposes only and should not be considered representative of any particular investment. This should not be considered an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Investing involves risk including the risk of loss of principal. Your capital is at risk. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The value of investments is not guaranteed, and therefore an investor may not get back the amount invested. International investing involves certain risks and volatility due to potential political, economic or currency fluctuations and different financial and accounting standards. The securities included herein are for illustrative purposes only, subject to change and should not be construed as a recommendation to buy or sell. Securities discussed may or may not prove profitable. The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Threadneedle Investments (Columbia Threadneedle) associates or affiliates. Actual investments or investment decisions made by Columbia Threadneedle and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors.

Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Information and opinions provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This document and its contents have not been reviewed by any regulatory authority.

In Australia: Issued by Threadneedle Investments Singapore (Pte.) Limited [“TIS”], ARBN 600 027 414. TIS is exempt from the requirement to hold an Australian financial services licence under the Corporations Act and relies on Class Order 03/1102 in marketing and providing financial

services to Australian wholesale clients as defined in Section 761G of the Corporations Act 2001. TIS is regulated in Singapore (Registration number: 201101559W) by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289), which differ from Australian laws.

In Singapore: Issued by Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapore 239519, which is regulated in Singapore by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289). Registration number:

201101559W. This document has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong: Issued by Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司. Unit 3004, Two Exchange Square, 8 Connaught Place, Hong Kong, which is licensed by the Securities and Futures Commission (“SFC”) to conduct Type 1 regulated activities

(CE:AQA779). Registered in Hong Kong under the ce (Chapter 622), No. 1173058.

In the UK: issued by Threadneedle Asset Management Limited, registered in England and Wales, No. 573204. Registered Office: Cannon Place, 78 Cannon Street, London EC4N 6AG. Authorised and regulated in the UK by the Financial Conduct Authority.

In the EEA: Issued by Threadneedle Management Luxembourg S.A. Registered with the Registre de Commerce et des Sociétés (Luxembourg), Registered No. B 110242 44, rue de la Vallée, L-2661 Luxembourg, Grand Duchy of Luxembourg.

In the Middle East: this document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA). This document is intended to provide distributors with information about Group products and services and is not for further

distribution. The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparty and no other Person should act upon it.

In Switzerland: Threadneedle Asset Management Limited. Registered in England and Wales, Registered No. 573204, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority. Issued by Threadneedle Portfolio Services AG, Registered address: Claridenstrasse 41, 8002 Zurich, Switzerland.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.