25 May 2021

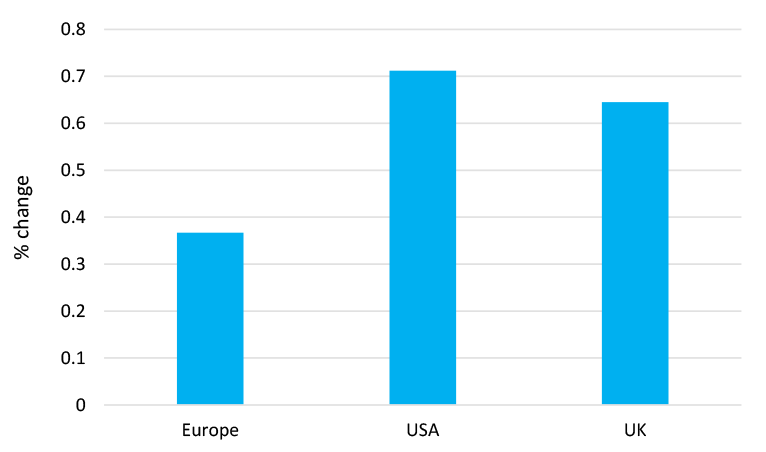

As we reach the mid-point of Q2 2021 it seems a good time to sum up fixed income markets year-to-date. As you can see in Figure 1, government bond yields are higher – with the US and, to an extent, the UK underperforming and up by more than 60 basis points. European yields, represented by German bunds, are much more stable. The chief reason for this is rising inflation expectations, especially in the US, where 10-year yields are up from 0.5% to 2.4% in around 14 months.

Other factors having an impact include: supply shortfalls as the US economy reopens – labour and microchips etc; rising commodity prices – for example the BCOM index is up nearly 50% year-on-year driven by rising demand expectations and dry weather; and President Biden’s fiscal plan and the expected spend of accrued high savings, especially on services. However, the US Federal Reserve is telling us this is likely to be temporary, so there’s no need to change policy conditions.

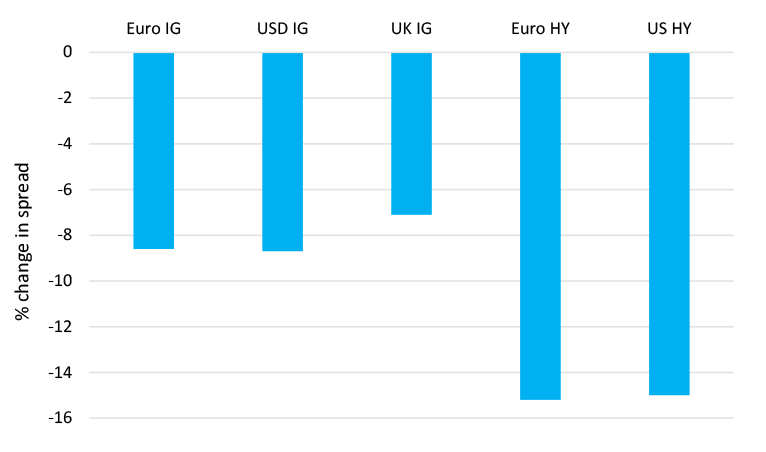

Meanwhile, for credit markets, based on BofA Merrill Lynch Bond Indices, it has been a better year (Figure 2). Spreads have moved tighter in all the represented markets with high yield outperforming on a risk-adjusted percentage basis. Within this, Europe is outperforming so European investment grade has done better than US and GBP credit, and it’s the same story in HY, with spreads tighter in Europe than USD.

Markets remain supported by numerous things: policy conditions, both present and expected; likely improving credit quality and decent results; better economic data, with the expectation of more to come; low and falling market volatility; and ongoing demand for income.

The issue here is one of valuations, where spreads in all markets are below averages in the short-term (five-year) and longer-term (20-year). For example, Global IG spreads are more than one standard deviation rich to the short-term average and around 0.6 standard deviations expensive to the long-term measure.

Important Information

For use by professional clients and/or equivalent investor types in your jurisdiction (not to be used with or passed on to retail clients)

This is an advertising document.

Past performance is not a guide to future performance. The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. Your capital is at risk.

The analysis included in this document has been produced by Columbia Threadneedle Investments for its own investment management activities, may have been acted upon prior to publication and is made available here incidentally. Any opinions expressed are made as at the date of publication but are subject to change without notice and should not be seen as investment advice. Information obtained from external sources is believed to be reliable but its accuracy or completeness cannot be guaranteed. This document includes forward looking statements, including projections of future economic and financial conditions. None of Columbia Threadneedle Investments, its directors, officers or employees make any representation, warranty, guaranty, or other assurance that any of these forward-looking statements will prove to be accurate.

The mention of any specific shares or bonds should not be taken as a recommendation to deal. This material is for information only and does not constitute an offer or solicitation of an order to buy or sell any securities or other financial instruments, or to provide investment advice or services. This document is not investment, legal, tax, or accounting advice. Investors should consult with their own professional advisors for advice on any investment, legal, tax, or accounting issues relating an investment with Columbia Threadneedle Investments.

In the UK issued by Threadneedle Asset Management Limited, registered in England and Wales, No. 573204. Registered Office: Cannon Place, 78 Cannon Street, London EC4N 6AG. Authorised and regulated in the UK by the Financial Conduct Authority.

In the EEA: Issued by Threadneedle Management Luxembourg S.A. Registered with the Registre de Commerce et des Sociétés (Luxembourg), Registered No. B 110242 44, rue de la Vallée, L-2661 Luxembourg, Grand Duchy of Luxembourg.

In the Middle East: this document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA). For Distributors: This document is intended to provide distributors with information about Group products and services and is not for further distribution. For Institutional Clients: The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparty and no other Person should act upon it.

In Switzerland: Threadneedle Asset Management Limited. Registered in England and Wales, Registered No. 573204, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority. Issued by Threadneedle Portfolio Services AG, Registered address: Claridenstrasse 41, 8002 Zurich, Switzerland.

In Australia: Issued by Threadneedle Investments Singapore (Pte.) Limited [“TIS”], ARBN 600 027 414. TIS is exempt from the requirement to hold an Australian financial services licence under the Corporations Act and relies on Class Order 03/1102 in marketing and providing financial services to Australian wholesale clients as defined in Section 761G of the Corporations Act 2001. TIS is regulated in Singapore (Registration number: 201101559W) by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289), which differ from Australian laws.

In Singapore: Issued by Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapore 239519, which is regulated in Singapore by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289). Registration number: 201101559W. This advertisement has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong: Issued by Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司. Unit 3004, Two Exchange Square, 8 Connaught Place, Hong Kong, which is licensed by the Securities and Futures Commission (“SFC”) to conduct Type 1 regulated activities (CE:AQA779). Registered in Hong Kong under the Companies Ordinance (Chapter 622), No. 1173058.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.