Key points

- Oil has experienced its worst quarter in history, with Brent crude falling over 65% to $22.73 per barrel at the end of March - the lowest price since April 2003.

- The primary driver of the hit to oil has largely been from the demand side as global governments impose economic ‘shut downs’ to prevent the virus’ spread.

- With such a steep contango in the market, and storage capacity dwindling quickly, we maintain a negative outlook in the near-term

For many investors, it will be very tempting to build positions in oil given the current price relative to history. We think that caution and an acute focus on the investment time horizon is required. In the near-term, the balance of risks is negative, but over a six to 12-month time horizon we are more constructive. If we see demand stabilise, and the adage “the cure for low prices is low prices” holds true on the supply side, the price rally could be significant.

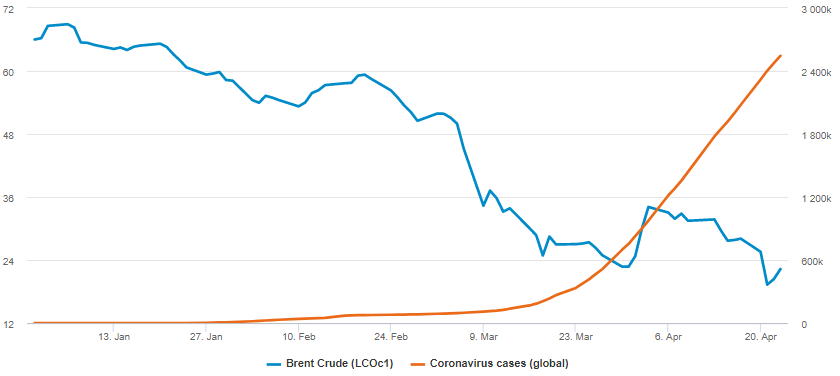

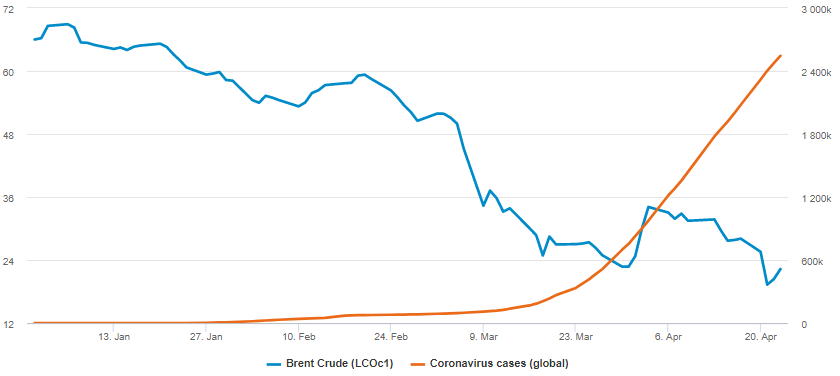

Oil demand shock as Coronavius cases grow

Source: Fidelity International, Refinitiv Datastream as at 23 April 2020. LHS: ICE Europe Brent Crude Electronic Energy Future (USD), RHS: Global coronavirus cases, cumulative (World Health Organisation)

What caused the oil price crisis?

The primary driver of the hit to oil has largely been from the demand side as the most common response to coronavirus has been to impose economic ‘shut downs’ to prevent the virus’ spread. In more normal times when demand suffers, this is rarely seen with our own eyes. In this case, it is hard to avoid. Across the globe vehicles are parked, aircraft - representing 8% of global demand - are grounded, and industrial production is weak.

The coronavirus’ global spread - including to the United States which accounts for 20% of global demand - has clearly hit the oil price. While there are tentative signs of Chinese demand picking up there are risks of a second-wave of infections that can’t be ignored, and of course the rest of the world remains in ‘lock down’. For as long as the virus is setting the timeline, we remain negative on demand.

To make matters worse, the supply picture has also turned negative for prices. While industry consensus was for OPEC+ to agree on a large supply cut at the meeting in March, this was derailed as Saudi Arabia and Russia’s 3-year agreement to prop up prices collapsed. Russia announced an end to the OPEC agreement on supply restrictions and Saudi Arabia followed suit.

In terms of who can sustain this price war longer, Russia is relatively better placed given its lower fiscal breakeven of $42 compared to Saudi Arabia’s $84 level. While there is a fine balance to be struck by OPEC producers to maintain market share and earn enough revenues to support spending, clear victims include US shale and other high-cost producers.

Despite the recent agreement on the supply side, there are early signs are that markets are seeing the agreed supply cut as not meaningful enough to outweigh the still weak demand picture. In addition, cuts do not happen overnight, and will take some time to be implemented.

What’s the outlook for oil?

Our approach when building views on oil is to assess demand, supply, inventories, and technicals, and we would need to see meaningful signs from not just one, but a majority of these factors in order to shift to a positive view.

While quite a lot of negativity on the demand picture is already priced in, this is unlikely to turn around until signs of coronavirus spread slows or halts. While supply gluts can be mitigated by curbs on production, this cut was relatively modest given the scale of the problem. April has seen tremendous inventory builds due to these twin supply and demand shocks, and the market is struggling to find a home for surplus barrels which is seeing prices extend ever lower and forcing production down further. This has even seen prices in negative territory in some markets, as producers are forced to either close wells or pay to have their oil removed. Technical factors are also negative, with markets in super-contango territory, whereby it is cost effective to hoard oil - even chartering ships for the purpose - selling it on the futures market for later delivery.

With such a steep contango in the market, and storage capacity dwindling quickly, we maintain a negative outlook in the near-term, and would need to see a turnaround in these factors to become more bullish. Demand stabilisation is at the mercy of the virus, and supply cuts are unlikely to tip the balance towards higher prices in the near term. But we are more optimistic on a positive turn in prices over the medium-term and would look to add some oil beta in the near future given the attractive entry point.

This piece was originally featured in FT Adviser