14 Jun 2021

Our Multi Asset team's views on which asset classes and markets are presenting the greatest opportunities and risks.

Global Asset Allocation Insights - May 2021 (PDF)

![]()

Inflation burns up: transitory or persistent?

Global reopening coming in hot

The rapid roll-out of vaccinations across the US and the UK, with Europe catching up, pushed developed market PMIs once again to record highs in May. Business activity and new orders have accelerated across both manufacturing and services sectors, business confidence continues to rise and employment gains remain in positive territory. Global activity momentum has remained at very elevated levels as a result. However, the recovery has encountered some turbulence, with significant supply-side disruptions emerging. This has led to shortages across a wide swathe of inputs, ranging from food products, to base metals, to semiconductors. This widening gap between supply and demand, combined with base effects, meant the April core CPI print in the US came in at a year-on-year rate of 2.96% – a year-on-year rate unseen since the mid-1990s.

In China, growth momentum continued to moderate as the government maintains its focus on controlled deleveraging and rebalancing of the economy. The Politburo reaffirmed that there would be ‘no sharp policy turn’, which has been borne out by gentle reductions in fiscal deficit spending and credit growth. While the potentially disruptive default of the Huarong SOE was carefully managed by policymakers, we remain vigilant of the high and growing levels of leverage in the wider system.

Finally, emerging markets remain a pocket of risk to the global economy, with countries that avoided the worst of the pandemic in 2020 now succumbing to rising caseloads due in part to low vaccination rates. India continues to grapple with a tragic wave of Covid fatalities, stemming from the inability of the health care system to serve the population. An additional concern is the fact that inflationary pressures are beginning to mount in a number of EMs, limiting the ability of policymakers to keep financial conditions accommodative.

Inflation: likely transitory for now…

Taking a step back, the key question for markets is whether the incipient inflation we are seeing in the US today is transitory or persistent. On balance, we believe the inflation we are seeing now is of the transitory kind. First, our bottom-up analysts are telling us that the vast majority of the supply chain disruptions that we have seen are already beginning to resolve themselves. Second, while enhanced unemployment insurance (UI) appears to have induced some labour market distortions and tightness, given the expiration of this enhanced UI on the 6 September, we expect the labour market to start finding a more normal equilibrium in Q3/Q4.

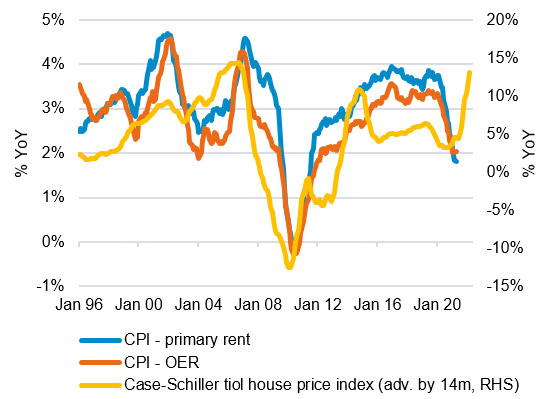

Third and finally, it is important to note the compositional differences in US inflation metrics when it comes to primary and owners’ equivalent rents (OER) inflation. In core CPI, primary rents and OER make up 40% of the basket. In contrast, rents inflation only comprises 18% of the core PCE basket. As a result, given the significant strength we have seen in the US housing market, we are likely to continue to see strong core CPI prints (see Chart 1). However, given the difference in composition, this will not flow through to the same extent to core PCE inflation, the Fed’s preferred inflation metric. Overall then, it does appear that the inflation we are seeing today is transitory in nature, however, this doesn’t exclude the possibility that it becomes persistent later down the track.

Chart 1: CPI housing costs versus Case-Shiller index

Source: Fidelity International, Refinitiv Datastream, May 2021.

Inflation: …with the risk of persistency

Ultimately, inflation persistence will be driven by expectations. Shifts in supply and demand can change price levels, but expectations are key for inflation to become embedded. As we have argued before, for the monetary and fiscal authorities in the US, inflation is a policy choice that is intrinsically related to very high debt burdens. As a result, the potential exists for the Fed to capitalise on transitorily high inflation to re-set expectations higher, thus giving it more policy space in future downturns. Additionally, in collaboration with our bottom-up research analysts, we have identified some potential longer-term sources of persistent inflation:

As a result of all of this, we continue to expect policy credibility to remain front and centre for markets through 2021. On the fundamental side, reflation will continue to play out, as a result of the significant US fiscal pump and drawdowns on excess savings. With the combination of these forces taking GDP growth significantly into positive territory. However, as we have highlighted, the potential for full-loop inflation will figure prominently as a risk for investors and may require the Fed to take tangible action to prove that it will not renege on its low-rates-for-very-long policy stance.

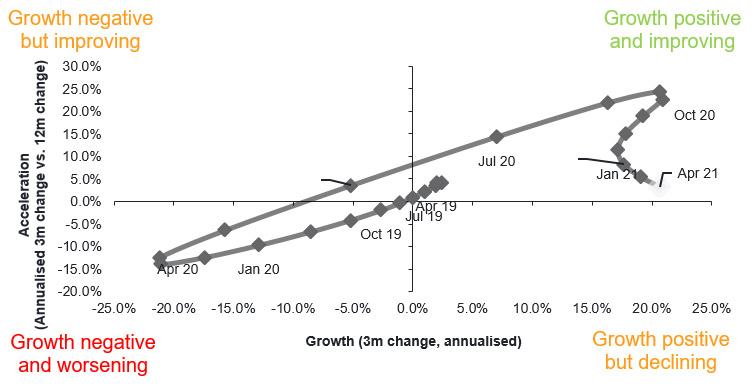

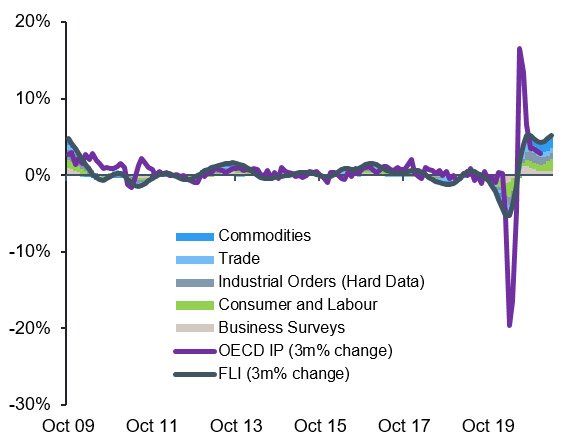

The FLI Cycle Tracker remains in the ‘top-right’ quadrant (growth above-trend and improving), with a modest ‘second wind’ after a few softer months, driven by consumer and commodity components. The peak of the recovery is nevertheless well behind, with two sectors now in outright deceleration. The FLI quantitative ‘bet’ ticked back up to neutral, indicating a mixed outlook for risk and duration as markets digest a fading global recovery impulse. Sector developments broadly indicate weaker momentum, but consumer and commodities have helped support growth after a few softer months. More concerning is Industrial Orders, which is getting very near to the bottom-right quadrant.

FLI Cycle Tracker

Source: Fidelity International, May 2021.

FLI: 3-month % change versus OECD

Source: Fidelity International, May 2021.

The Commodities sector is well into the top-right quadrant, with growth positive and improving as supply has struggled to keep up with rising demand and survey components continue to move higher. The Consumer and Labour sector remains in the ‘top-right’ quadrant, with the consumer demonstrating significant strength thanks to policy support. Globally, as vaccines are rolled out, consumer confidence has improved, and this has been most significant in the US. Business surveys have stabilised in the bottom-right quadrant, with sentiment stalling across new orders and manufacturing. Interestingly the outperformance of manufacturing over services that the world has experienced over the past year seems to have reversed this month, with the global services PMI stronger than manufacturing - perhaps a sign of a genuine ‘vaccine recovery’ in the West. Europe continues to hold up well, with German new foreign orders showing growth. The picture is less rosy in Japan and the US, where restocking looks to have stalled.

US

As highlighted previously in this edition, inflation remains a key area of interest when thinking about equity exposure, with the US no exception. Overall, the team believes current inflation effects should be broadly transitory in nature, as opposed to structural. In our assessment of US equities, key to watch will be the market’s reaction (and possible over-reaction) to evolving inflation expectations.

Alongside these broader economic trends, Q1’s earning season was very strong, with both earnings and sales data generating positive surprises in addition to the strong Q4 season. This season saw margin expansions and little sign of these being impacted by cost pressures. From a US sector perspective, IT and consumer discretionary are very strong in beats, but price reaction has been negative. The US has moved above other regions in terms of earnings revisions this season, particularly in the financials sector, with cyclicals leading the way. Feedback from Fidelity’s bottom-up research platform suggests the US has seen the highest upgrade in rating actions, particularly in financials (whereas consumer discretionary companies saw the most downgrades). Consumer-related companies will be important to watch, potentially helping to gauge the unfolding re-opening outlook and consumers’ response to potential cost pressures. Vaccination roll-out also remains a focus here, where the US has made strong progress to date.

Asia

One focus of the team’s debate this month was whether EM Asia countries might be impacted by the same dynamics as other emerging markets as the pandemic continues. With cases rising across the region, governments continue to find a trade-off between economic openness and viral containment. While economic resilience has been stronger so far across the region, this may come under pressure with the rise of new variants. Indeed, EM Asia may appear to have more ammunition in its toolkit to deal with the fall-out of another Covid wave, including fiscal and monetary policy levers given better current account dynamics), but China could be an important factor and act as a stronger headwind in this region. While Covid-19 developments are dominating headlines in the region, what may matter more for EM Asia versus broader EM is China’s tightening stance versus US expansionary policy. The former is acting as a headwind for EM Asia at a time when the rest of EM (and especially LatAm) would be more directly benefiting from US fiscal and monetary policy.

Europe

This month’s discussions continued to centre on Europe’s progression through Covid-19, where it is likely too soon to chart the longer-term impact for the region. The team is watching closely for evolving sentiment, with consumer confidence picking up against a backdrop of weak economic data. European equities saw a good earnings season in Q1, with 69% of companies beating expectations. However, like in the US, the price response was generally negative, suggesting these improvements have been broadly priced in. Another strong earnings season in Q2 could potentially prompt a more positive reaction. The team will also be watching the political picture in Europe over the coming months, including the upcoming German elections.

Global perspective

Overall, from a regional perspective the team remains focused on those with greatest exposure to the global economic recovery. From a regional equity perspective, the team is focused on regions with cheaper valuations, given mean-reversion is a key risk in more extended and highly valued markets. The pandemic’s progression through summer remains a driver of risk across asset classes. In developed markets, consumer strength, fiscal stimulus and accommodative monetary policy remain key pillars of support. However, the divergence between developed and emerging markets will continue in terms of economic growth, especially as China’s growth plateaus. We see ongoing tensions on trade and geopolitics as potential sources of risk.

See the Global Asset Allocation Insights as a PDF

Global Asset Allocation Insights - May 2021 (PDF)

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. The Fidelity Multi Asset funds use financial derivative instruments for investment purposes, which may expose the fund to a higher degree of risk and can cause investments to experience larger than average price fluctuations. Investments in overseas markets, changes in currency exchange rates may affect the value of an investment. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuer's ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between different government issuers as well as between different corporate issuers. Sub-investment grade bonds are considered riskier bonds. They have an increased risk of default which could affect both income and the capital value of the fund investing in them. Changes in currency exchange rates may affect the value of investments in overseas markets. Investments in small and emerging markets can be more volatile than other more developed markets. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only.