02 Oct 2024

Recent spikes in market volatility, slowing macro signals and stretched valuations are among the many signs that are pointing to a global slowdown. In this environment, portfolio managers Kris Atkinson and Shamil Gohil outline why they are de-risking portfolios and shoring up liquidity as they focus on high quality alpha opportunities and lock in still attractive all-in-yields in investment grade credit markets.

Key points

Our overriding conviction remains that the global economy is slowing and the US economy, if not already in a recession, is likely to face one just around the corner. As demonstrated by U.S. payrolls revisions in mid-August (where almost one million jobs were rubbed off), revisions to data are overwhelmingly negative so by the time we get confirmation from official data, it will no doubt be too late to position for it.

Various datapoints are pointing in that direction, for example, the vaunted ‘Sahm rule’ - which identifies signals related to the start of a recession - has been triggered, nearly all US states are seeing rising unemployment, expected changes in household income have plunged and economic surprise indices are negative.

Macro indicators suggest slowing economy

US unemployment is rising

.png)

Surprise indices are worsening

.png)

Source: Fidelity International, Bloomberg, 27 August 2024. RHS shows Citi Economic Suprise Index - Global.

Recent volatility in risk assets highlights fragility

Some suggest that the snap back in risk assets and the collapse in volatility is a sign of resilience in markets, but we would argue that the events of early August and subsequent behaviour points to underlying fragility. That this was soon forgotten is reflective of the narrative pendulum that prevails before the market gets the joke.

The question of how much of the yen carry trade has been unwound, has been met with a variety of finger-in-the-air-estimates. This is not the place to debate the exact quantum of unwinding seen but the overwhelming consensus of street analysts seems to be "not very much".

Stretched valuations

Fragile markets stem from poor liquidity, low volumes, and price-insensitive flows, all characteristics of 2024 so far. Indeed, our own experience these past few weeks has been of solid inflows and looking across Fidelity’s fixed income business this seems to be reflected in other high quality bond funds as well.

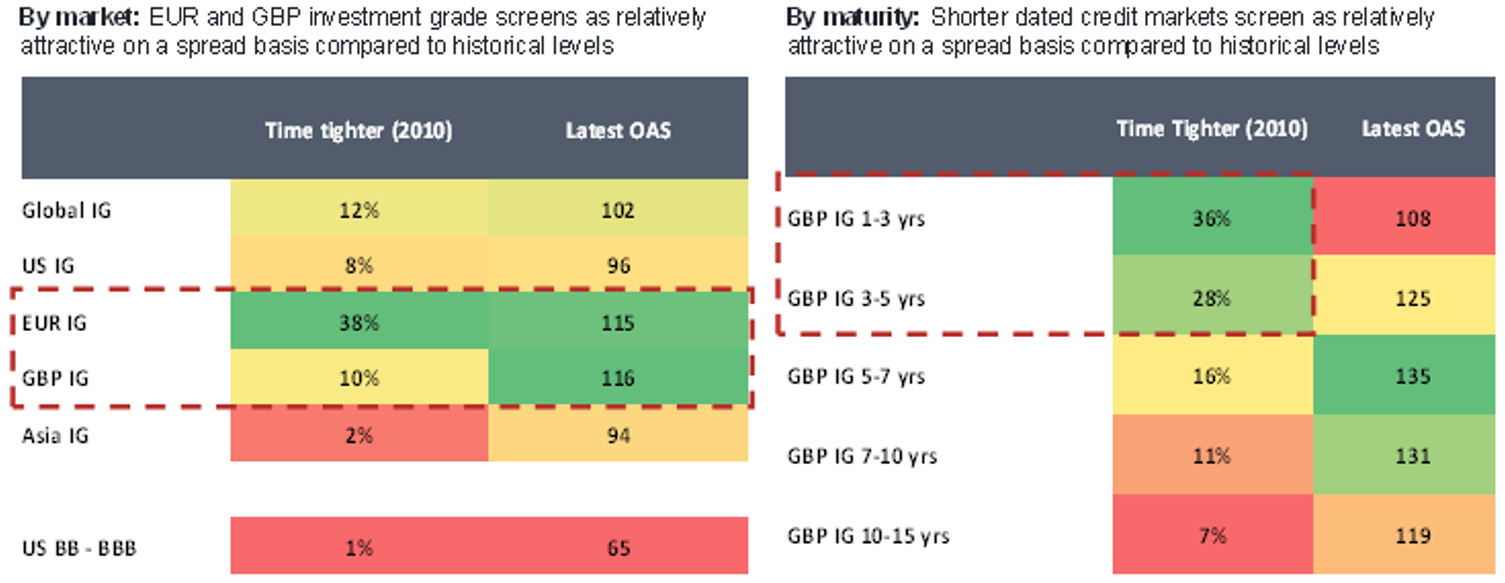

These inflows are likely indicative of a ‘duration-plus-carry’ argument, but it strikes us that there will be better opportunities to buy credit risk of all flavours in the not-so-distance future. It has taken a lot of truffle-hunting to unearth bonds that are not trading at their tights to spend these flows. To illustrate, our quant screens show that the proportion of time that global investment grade (IG) credit spreads have been tighter than today’s levels (since 2010) is just 14%. Using this same ‘time tighter’ metric, US IG looks even more expensive at just 8%, and Asia IG at just 2%. High yield too looks expensive relative to IG, with the spread between US double-B’s and triple-B’s tighter just 1% of the time since 2010. There are pockets of relative value, such as EUR IG and short dated GBP IG which have traded tighter 38% and 36% of the time respectively.

Credit valuations suggest relative value in EUR, GBP and front-end bonds

Source: Fidelity International, 27 August 2024.

Looking for hedges and ways to de-risk

With all this, it should come as no surprise that we are looking for ways to hedge and de-risk the credit side of the portfolios. That said, we are doing so in ways which do not lead to a loss in income, as doing so runs the risk of underperformance while we wait for another unwind in credit spreads. Cash balances are up, credit beta has fallen and remains just on the positive side of neutral, but we are overweight triple-B front-end bonds where spread ‘breakevens’ are at the highest and underweight the long-end giving us negative spread duration. Attractive breakevens (or ‘wipeout’ yields) at the front end of the curve are something we have commented on in the past (see here). In summary, low-duration bonds coupled with flat yield curves offer an attractive risk-adjusted option to cushion against yield volatility while harnessing yield.

Tactical positioning in interest rates with tight stop-losses in place

One area we are not currently positioned for a recession is in rates where we have moved to a small tactical short overall. This short positioning overall masks differing views across the major markets where we have; a small tactical short in US Treasuries and a short in Japanese government bonds, versus longs in gilts and bunds.

The rationale for the tactical short in US Treasuries is as follows;

In doing this, we are cautious and will have tight stop losses around 3.70% in the 10yr US Treasury yield and we will look to reload our long around 4%. There is a big move down to come and we don’t want to be on the wrong side of it when it happens. We say this as GDP-weighted global real rates are 1.8% which are still well above the post Global Financial Crisis (GFC) range (max 0.4%), indeed the only period when they were (slightly) higher was immediately before the GFC.

Our small long in gilts reflects our scepticism that the "bounce" in activity comes from the fading of lingering supply challenges and upside surprises from government spending. The latter fact was highlighted by Rachel Reeves (UK Chancellor) that borrowing was ahead of OBR expectations. If Labour are true to their word around fiscal prudence then this tailwind must fade and the business and consumer momentum still looks fragile.

Our highest conviction in rates is via a long in bunds. Above consensus European PMI’s do little to shake our conviction in slowing growth in the Euro Area. Absent the Olympic impact, the PMI print would have been flat and close to 50. The underlying trend thus looks weaker than the headline number and points to downside risks for Euro Area growth in the autumn, in particular, in Germany where PMIs were sub-50. Indeed, it seems not unreasonable to assume that after a splurge will come a period of retrenchment as profligate Olympics fans replenish their coffers.

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Due to the greater possibility of default, an investment in a corporate bond is generally less secure than an investment in government bonds. Fidelity’s range of fixed income funds can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations. Reference in this document to specific securities should not be interpreted as a recommendation to buy or sell these securities and is only included for illustration purposes.