09 Aug 2023

Martin Currie: Tightening US credit lending conditions could pose a growing risk to US economic growth. Read the latest market update from Zehrid Osmani.

Tightening US credit lending conditions could pose a growing risk to US economic growth

With the banking failures in the US regional banks in March and April, we highlighted at the time that credit lending conditions tightening could be a risk to watch out for, given that it would be the transmission mechanism that could lead to higher risk for the US economic activity. In this month’s insights, we zoom in on the latest credit lending conditions, with the latest datapoint coming through in early May.

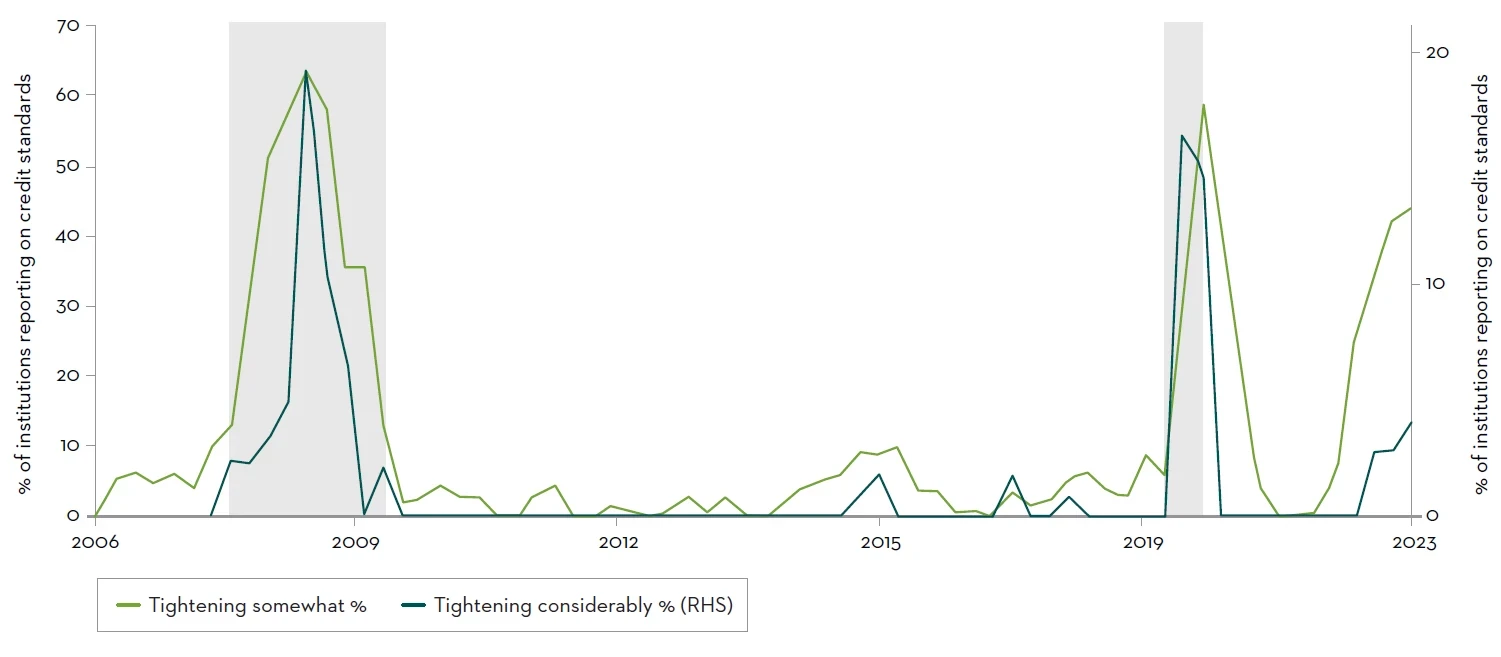

The chart below shows the tightening credit lending standards in the US, through the Senior Loans Officers' Survey. The market bears will focus on the spiking curve related to the “tightening somewhat” responses, shown in light green. Bringing in the black curve, the “tightening considerably” responses is important to do, as it shows a somewhat more measured picture of credit conditions, as it puts things into perspective, compared to previous significant tightening in lending conditions that have occurred around recessions, both in 2008-09 and in 2020.

Senior Loan Officers Survey

Credit lending conditions for large, middle market & small firms

Source: State Street Global Markets, Bloomberg. Past performance is not an indicator or a guarantee of future results.

The conclusion so far is that whilst credit conditions are tightening, the proportion of responses showing significant tightening is nowhere near the levels of previous recent recessions. The trend does however need ongoing careful monitoring, as it could imply that tighter credit conditions will impact economic activity negatively, which could in turn increase the risk of a recession in the US.

The reason that the market has been particularly focused on credit lending conditions is the close relationship between those, and the ISM Manufacturing* new orders data, as can be seen in the chart below, this is the US purchasing manager index. There is a strong correlation between tightening credit conditions and deteriorating ISM manufacturing new orders. This is shown by the increasing number Commercial and Industrial (C&L) survey respondents reporting tightening lending conditions (light green line).

C&L Loans Survey – banks tightening credit

Source: Refinitiv Datastream, Credit Suisse Research as at May 2023. Past performance is not an indicator or a guarantee of future results. *Institute for Supply Management. Also known as ISM Manufacturing Purchasing Managers Index (ISM PMI), is a monthly gauge of the level of economic activity in the manufacturing sector in the United States versus the previous month.

Whilst we keep our probability of a recession in the US in 2023 at 30-35%, there is a risk that such probability could be increasing if credit conditions continue to tighten from here. Our core scenario remains one of a sharp slowdown, which we continue to assess at 60-65% probability, but we will be reviewing this in light of additional datapoints.

WHAT ARE THE RISKS?

Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Equity securities are subject to price fluctuation and possible loss of principal. Fixed-income securities involve interest rate, credit, inflation and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed income securities falls. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Commodities and currencies contain heightened risk that include market, political, regulatory, and natural conditions and may not be suitable for all investors.

US Treasuries are direct debt obligations issued and backed by the “full faith and credit” of the US government. The US government guarantees the principal and interest payments on US Treasuries when the securities are held to maturity. Unlike US Treasuries, debt securities issued by the federal agencies and instrumentalities and related investments may or may not be backed by the full faith and credit of the US government. Even when the US government guarantees principal and interest payments on securities, this guarantee does not apply to losses resulting from declines in the market value of these securities.

CONTRIBUTORS

Zehrid Osmani

Zehrid Osmani

Head of Global Long Term Unconstrained,

Senior Portfolio Manager

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton ("FT") has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued by Franklin Templeton Investment Management Limited (FTIML). Registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. FTIML is authorised and regulated by the Financial Conduct Authority.

Investments entail risks, the value of investments can go down as well as up and investors should be aware they might not get back the full value invested.