10 Sep 2021

Stakeholders at the government, institution and investor level are increasingly looking at ESG in a more granular way – seeking information on many other criteria considered fundamental to improving the planet, business practices and wider society. It’s becoming increasingly apparent that reporting is not keeping pace. In an industry that’s no stranger to numbers, what’s going wrong and what steps can be taken to resolve these issues?

The investment industry is of course no stranger to numbers. Performance and success in this realm have been solely dictated by numeric gains and losses, which are easy to quantify or report on, and that make it more straightforward for investors to make comparisons.

Where is ESG reporting going wrong?

This isn’t really the case for ESG factors. There’s a wealth of qualitative data but it is much more difficult to compare. But as ethics and impact become more and more prominent (hence the emergence of ESG), so too will the means to measure success.

Most stakeholders would agree that there’s a distinct lack of standardisation in measuring and reporting ESG implementation – both at a corporate level and at a retail level. The number of differing approaches makes it difficult for investors to make decisions that align with their objectives.

ESG rating agencies

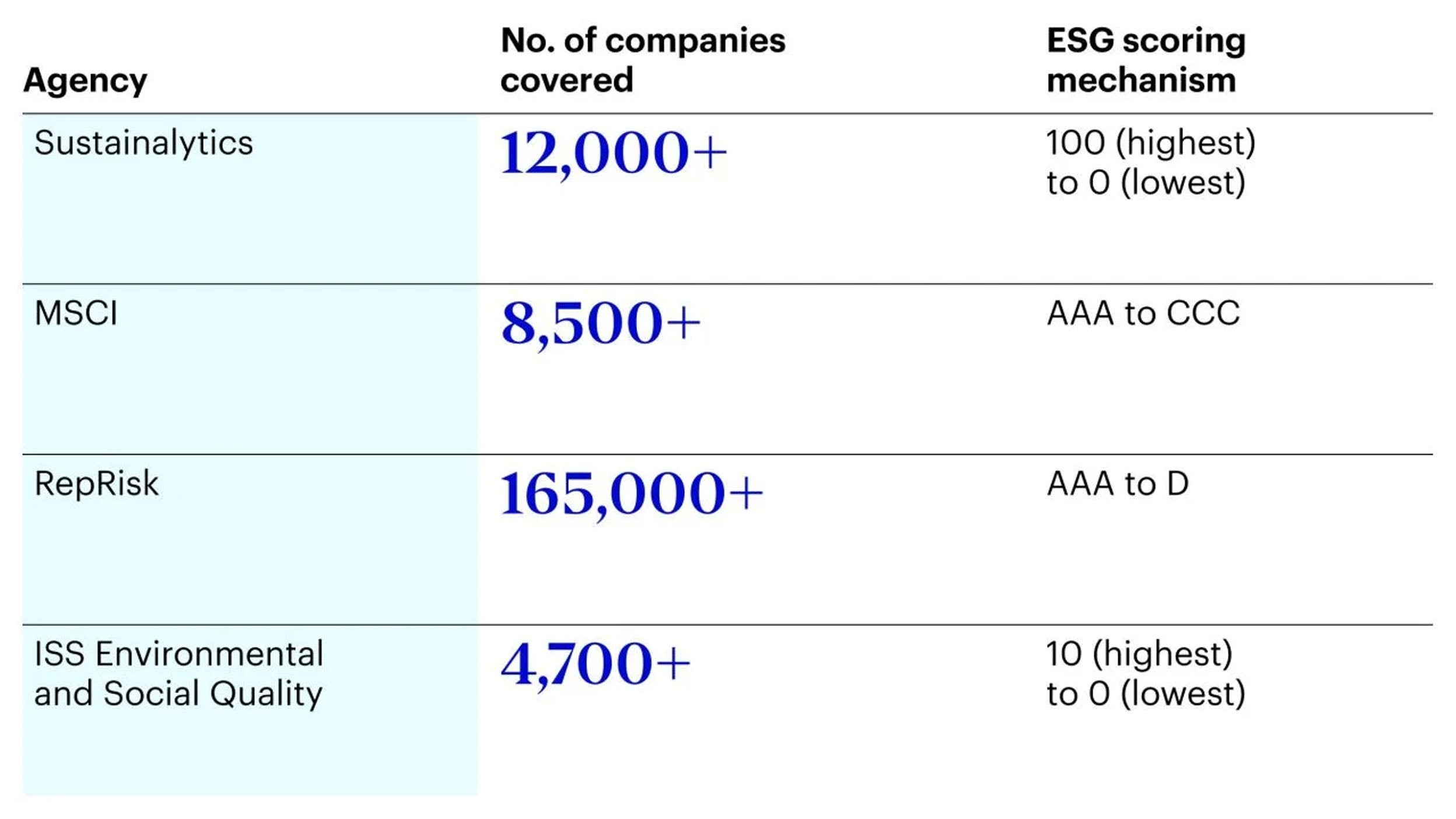

The ESG ratings sector emerged as a result of the call for standardisation. Four major organisations (with varying scope and coverage) are widely used by investment managers.

Despite their qualities, these off-the-shelf solutions haven’t necessarily achieved the desired outcome and have suffered from two key limitations. First, they operate on different methodologies and standards, so their ratings aren’t directly comparable. Also, their final scores tend to lack correlation – where one provider ranks a company highly on an ESG indicator, another provider may rank them poorly on the same indicator.

Source: Invesco analysis. Correct as at April 2021.

So, comparability is clearly a big issue. Such divergence can result from data discrepancies, benchmark choice, data imputation, information overload, or weighting schemes. But the vast amount of ESG metrics available is also a problem, and it’s difficult to see how providers will settle on a common set of data points.

Regulatory forces

Regulation is another area to influence ESG standardisation at a fund level and in March 2021, the EU introduced the Sustainable Finance Disclosure Regulation (SFDR). Its primary goal is to increase transparency and shift capital towards sustainable objectives.

SFDR introduced new reporting structures for asset managers and could have a significant impact on fund flows in the future.

One of the key structures is the introduction of new fund classifications – Articles 6, 8 and 9. Under the new framework, many funds are considered Article 6, which doesn’t carry many ESG requirements. Article 8 and 9 funds, on the other hand, have ESG incorporated into their structure.

While certainly a step in the right direction, many firms have struggled to successfully implement SFDR due to challenges with deadlines and inconsistencies between different initiatives. The consensus is that there’s a lack of clear roadmap and vision that outlines how all the various factors will fit together.

There’s also the fear that mandatory regulation could lead to some ‘window dressing’, with attempts to appear to be doing the right things, rather than actual positive efforts. Unless these are addressed, it’ll be difficult to enact real change.

Steps to help solve the problems

In our view, while there’s no one-size-fits-all approach when it comes to an absolute solution, it’s evident that there’s a real need to standardise non-financial reporting, despite the challenges.

The demand for doing while investing is here to stay, and investors need a reliable measure of what’s achievable in terms of ESG within their portfolios – aspirational ESG versus practical ESG.

Also, drawing a clear distinction between entity-level ESG and fund-level ESG is key. A good corporate ESG rating does not necessarily mean good ESG performance at an investment portfolio level and we often see elements of greenwashing come into play here.

First, it could be beneficial to categorise funds based on the area of ESG they primarily target. There will be certain funds that are specifically geared toward environmental factors, while others focus on social or governance factors, a step on from articles 6, 8 and 9.

Investors can then align their decisions with their non-financial investor objectives – in other words, their desire to ‘do good’. We set out three main components:

The two Rs - risk and return profiles are the fundamental factor in investors’ decision-making process. Integrating a third R, with a responsibility profile to every fund factsheet, with indicators for the area(s) of ESG it targets will mean it’s much easier to compare strategies within a peer group and for more bespoke portfolios. This could include strategies that focus specifically on diversity and inclusion, for example.

It’ll also reduce the amount of conflicting data or information that’s not relevant to the fund’s objective or to the investor’s ESG beliefs.

The Invesco view

At Invesco, we believe that getting this right is critical. As such, we have advanced a research effort aimed at addressing the topic from an investor’s perspective. Led by our internal practitioners and researchers Clive Emery and Kenneth Blay and in collaboration with associate professor at the University of North Carolina at Wilmington and a former Managing Director of the CFA Institute, Stephen Horan, and Professor Elroy Dimson of the Cambridge Judge Business School.

We will be assessing the current ESG landscape for investors and exploring potential and practical solutions to investor ESG challenges in much more detail.

On the analytics side specifically, we’ve already dedicated significant resource into creating our own purpose-built analytics and scoring tool, ESGintel.

Built by our Global ESG research team together with our Technology Strategy Innovation and Planning (SIP) team, ESGintel provides environmental, social and governance (ESG) insights, metrics, data points and direction of change.

Users see an internal rating, a rating trend, and a rank in sector using the Global Industry Classification Standard sectors. It provides a holistic view on the various ways a company’s value chain is affected by various ESG topics. It includes both fund and entity-level data, with around 20 ESG indicators for the former and 50 for the latter.

For some indicators, ESGintel includes the data for around 45,000 companies but in contrast, around 2,000-3,000 for others. This is reflective of the reporting disparities seen in the wider industry. Some data is simply not reported regularly and not every company has the same resource to dedicate to it. To plug the gap, we’re exploring alternative data sources – including mass-aggregated news data among others.

Enabling informed decisions

Reaching a consensus and taking steps to provide meaningful ESG measurements will require industry-wide collaboration. Ultimately, the goal of ESG is to have a positive impact on people and the planet, and tangible outcomes here are far more important than simply appearing to do the right thing for reputation purposes.

The combination of insightful qualitative data, and meaningful quantitative data as well as some clear reporting standards is what will help pave the way for practical metrics and methods that will allow investors to make informed decisions going forward.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.

Issued by Invesco Fund Managers Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.