20 Sep 2022

"Soaring gas prices have sent electricity prices skyrocketing, yet fiscal intervention will prevent households and corporates from bearing the full brunt of energy costs."

The energy crisis facing Europe is intensifying as winter approaches. The region’s dependency on gas flows from Russia has created substantial economic vulnerabilities, and prospects of supply disruptions are now looming large. In this piece we aim to provide a framework for understanding the implications of an energy-driven shock, including:

Country sensitivity to supply disruption

Options for diversifying supply and reducing demand

The potential response from policymakers, both fiscal and monetary

The implications for corporate earnings

Gauging vulnerabilities

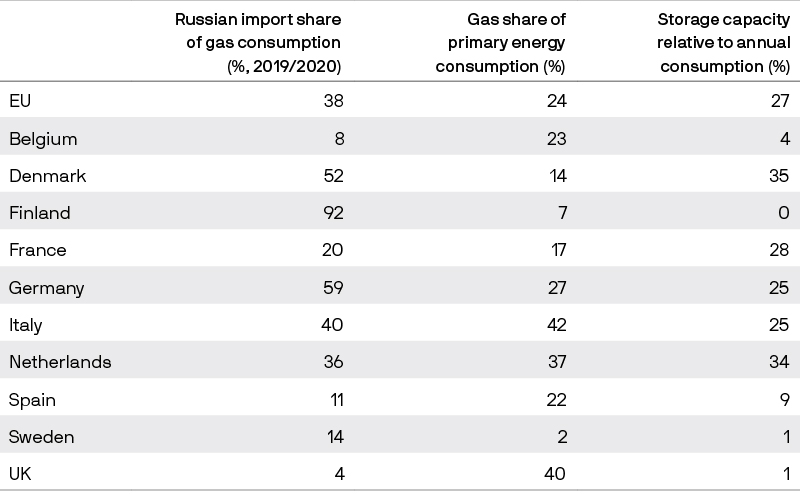

Three key metrics are crucial to understanding the gas-related risks facing European countries: reliance on Russian imports, share of gas in the energy mix and storage capacity. The European Union (EU) imported just under 40% of its natural gas from Russia prior to the invasion of Ukraine although this figure varies widely by country (Exhibit 1): Germany was the largest importer of Russian gas by volume last year, while liquid natural gas (LNG) terminals in Belgium and Spain help to reduce their Russian dependency. But the share of gas in a country’s energy mix can have a significant impact on risk; for example, over 90% of Finland’s gas imports historically originate in Russia, but gas is under 10% of the energy mix, vastly reducing Finland’s vulnerability. Lastly, while EU member states have made good progress stockpiling supply over the summer, storage capacity could be a limiting factor if it does not provide a meaningful proportion of annual consumption.

Exhibit 1: Dependence on Russian gas imports for selected European countries

Source: AGSI, European Council, Eurostat, J.P. Morgan Asset Management. Data for consumption is 2019 or 2020 (latest available), share of energy consumption is 2021 and storage capacity is 2022.

Supply sources

This year’s decline in gas imports from Russia is the result of several factors ranging from policy initiatives to supply disruption (Exhibit 2). The European Commission’s REPowerEU plan – first proposed in early March in response to the Russian invasion of Ukraine – included aims to reduce the bloc’s dependency on Russian gas by two-thirds this year, but stopped short of an outright ban. Supply disruptions began over the summer when several countries were cut off from Russian pipeline supply after refusing to make payments in Russian rubles. More recently, Russia has halted flows in the key Nord Stream 1 pipeline completely – previously considered a worst-case scenario – while stating that supplies will not resume in full until western sanctions linked to the Ukraine invasion are lifted.

Exhibit 2: EU natural gas imports from Russia

Million cubic metres

Source: Bruegel, J.P. Morgan Asset Management. Data as of 31 August 2022.

Above-average imports of LNG have helped to plug this supply gap over the summer, with flows from the US accelerating meaningfully: In the first seven months of the year, European imports from the US averaged 6.5 billion cubic metres (bcm), vs. a monthly average of 1.9 bcm over 2019 – 2020. One temporary factor helping to boost supply for Europe has been the lower demand for LNG from China, which will likely remain depressed until the Chinese economy reopens more meaningfully. However, imports have come at a hefty cost, made worse by the euro’s 12% slide against the US dollar between January and September. European efforts to expand LNG capacity, such as floating LNG terminals in Dutch and German ports, will begin to contribute later this year but are likely to make a much more significant contribution to supply towards the end of 2023.

Alternatives to natural gas have also ramped up with varying degrees of success. The International Energy Agency (IEA) estimates that EU coal consumption will rise by 7% in 2022 – even with coal prices hitting new all-time highs in May 2022 – due to increased demand for electricity generation. Nuclear energy currently accounts for about 25% of EU electricity generation but there are challenges to increasing that percentage, even after the European Commission’s decision in July to include the fuel source in the EU’s Environmental Taxonomy. While France remains the largest advocate, its power generation was disrupted over the summer as half of the country’s nuclear reactors were taken offline for maintenance that was delayed by the pandemic and low river water levels that impacted cooling systems. Opposition in Germany remains strong, although two of the three German nuclear power stations that were previously due to be switched off by year end will now be kept on standby until April.

Increased reliance on other fossil fuels is an unavoidable short-term consequence of the hurried move away from Russian natural gas, but an accelerated rollout of renewable energy is ultimately expected to provide the medium-term solution to the energy shortfall. The EU is now proposing a 45% target for renewables as a proportion of the overall energy mix by 2030, up from 40% under previous plans and versus around 20% today. In particular, recommendations within the REPowerEU plan that address the slow and complex permitting process for major renewables projects – which can currently take up to five years – could significantly accelerate the energy transition.

Dampening demand

The EU appears well on track to meet its target of filling 85% of the total underground gas storage capacity ahead of the coming winter (Exhibit 3). Yet despite this progress, scenario analysis from the IEA highlights that even with gas storage hitting 90% later this year, storage levels could become dangerously low by February 2023 if Russian gas flows are cut off, as non-Russian imports would be insufficient to cover the shortfall. The situation is further complicated by seasonality – despite the EU’s storage capacity providing roughly 27% of average annual consumption, over 55% of annual gas demand is consumed between November and March in a typical year – and limited infrastructure to transfer gas from west to east within the bloc. Looking forward, if storage capacity is run down to below average levels in order to survive the winter, restocking during the summer of 2023 could be particularly challenging, especially if Asian demand for LNG is rebounding. The risk of further demand reduction measures, including energy rationing for industry, is clear.

Exhibit 3: EU natural gas inventories

% of capacity

Source: Bloomberg, Gas Infrastructure Europe, J.P. Morgan Asset Management. Data as of 31 August 2022.

A closer look at gas demand by sector helps to anticipate the potential policy response ahead. Manufacturers and households are responsible for roughly 40% each of annual gas demand, with the services sector a large part of the remainder. Yet while high prices have crimped industrial demand over the summer, it will be much more difficult to keep total usage down over the winter when household demand for heating ramps up.

The EU has announced targets to cut consumption by 15% vs. a five-year average, although exemptions for some countries will likely take the effective demand cut closer to 10%. Member states are instructed to prioritise measures that do not affect the availability of gas to households or essential services. Germany is leading energy rationing efforts in Europe, while actions taken to date in other parts of Europe are more commonly voluntary.

Rising energy prices are proving the largest constraint on corporate demand so far, but absent a significant improvement in gas flows over the coming months, energy rationing is very feasible. The chemicals sector, which comprises over 35% of industrial demand, appears particularly vulnerable.

Policy response

With soaring gas prices having sent electricity prices skyrocketing, governments are under increasing pressure to ramp up support to both households and consumers (Exhibit 4). The link between gas and electricity prices is due to the “marginal pricing” system in place, whereby electricity prices are set by the most expensive (and often gas-fuelled) power plant called on to meet demand at any one time. The scale of the price rise is hard to comprehend, with 2023 baseload electricity prices in Germany hitting nearly EUR 1,000 per megawatt hour (MWh) at the peak in August, up over 700% YTD, and versus an average of EUR 71 per MWh in the first half of 2021. Absent policy intervention, households could see energy bills nearing 30% of disposable income based on current spot prices, three times above the typical definition of “fuel poverty”.

Exhibit 4: Household energy bills in Europe

Average annual household bill in EUR/GBP; labels show % increase since start of 2020

Source: Jefferies, J.P. Morgan Asset Management. For illustrative purposes only. Data as of 31 August 2022.

European consumers are in for a tough winter, although fiscal intervention will prevent the full passthrough of energy costs to households (Exhibit 5) which should somewhat dampen the hit to growth. For clarity, the spot numbers in the chart above are not what we expect customers to pay but rather a mechanical calculation that assumes no government intervention and no demand response. The size and shape of government support will vary by country as energy policy is typically set at a national level. (We note however that support for EU-wide price caps is gathering momentum at the time of writing.) The nature of intervention is also likely to create meaningful divergences in inflation across the region, as providing payments to consumers while allowing energy bills to rise could result in very different inflation figures compared to a cap on electricity costs.

Uncertainty around the policy response is likely a key factor behind the wide range of eye-catching inflation forecasts for the months ahead.

Measures to support industry have so far been less extensive, often focused on reducing energy bill levies that were designed to encourage energy efficiency at energy-intensive companies. France has put in place some of the most substantial measures to date. If more extensive rationing measures are required over the winter, we expect that support for the worst impacted industries would increase accordingly, providing some buffer to the growth hit.

Exhibit 5: Selected government measures to support households

Measures announced as of 8 September 2022

Source: J.P. Morgan Asset Management, as of 8 September 2022.

Contrary to the position of governments, the Bank of England and the European Central Bank (ECB) are less likely to be able to offer support to their economies given soaring inflation. With economic activity stronger than expected over the summer, our base case sees further rate hikes through the autumn in both the UK and the eurozone. Even faced with the high likelihood of recession in 2023, it will be difficult for either central bank to change course until they are much more confident that inflation is heading back towards target. For the ECB in particular, this determination will be complicated by the varied impact of government intervention across member states described above.

Earnings implications

European corporate earnings are currently expected to grow by more than 17% in 2022, up from just under 6% at the start of this year, with notable contributions from energy sector earnings upgrades and currency depreciation making overseas earnings more valuable (Exhibit 6). However, we expect to see some softening in earnings expectations ahead as analysts begin to reflect the deterioration in the macroeconomic outlook.

At a sector level, earnings for the European materials sector look particularly vulnerable to gas disruption, as chemicals companies make up roughly half of the sector. Earnings for some consumer companies may also weaken as higher energy prices weigh on consumption as well as increasing the cost of synthetic materials used in personal care products. Food and beverage is another industry which is heavily reliant on natural gas, with uses across the value chain.

Exhibit 6: Year-to-date change in MSCI Europe 2022 earnings growth expectations by sector

Percentage points

Source: MSCI, Refinitiv Datastream, J.P. Morgan Asset Management. Data as of 31 August 2022.

Energy companies are naturally the most leveraged to higher natural gas prices, while the impact on European utilities could vary significantly within the sector; those with high exposure to renewables should benefit over time from the strengthened tailwind behind the renewable rollout, while others will come under pressure from government price caps.

If earnings downgrades do materialise across European companies, relatively modest valuations could soften some of the hit to share prices. Valuations for the MSCI Europe ex-UK index still sit close to 20-year averages, but relative to the US they are now approaching levels last seen at the peak of the 2008-2009 financial crisis, suggesting that there is a significant amount of bad news already “in the price”. For both global industry leaders based in Europe but with limited economic sensitivity to the region, as well as companies critical to the green transition, investors should stay vigilant to medium-term opportunities that arise amid this winter’s woes.

Summary

European policymakers will need a combination of good luck and shrewd judgement to avoid a severe energy crisis in the coming months. Record gas prices are already leading to demand destruction across industry, yet further policy measures to stunt demand are likely required if Russian flows don’t increase. Strengthened demand for fossil fuels is inevitable to bolster short-term energy security, but we ultimately expect this crisis to turbocharge the rollout of renewables over the medium term. Policy support will seek to blunt the impact to growth, but this responsibility will fall to governments, as central banks grapple with surging inflation. Earnings downgrades are the likely consequence of the hit to growth, although multiples suggest that at least some of the gas-related risks are now reflected in equity prices.

The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programs are marketing communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy.

This communication is issued by the following entities:

In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be. In Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only.

For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright 2022 JPMorgan Chase & Co. All rights reserved.