29 Mar 2022

David Elms and Natasha Sibley from the Diversified Alternatives team consider the value of a multi-strategy approach to using liquid alternatives to help improve diversification and complement traditional asset class allocations.

Key takeaways:

The start of 2022 marked a significant shift in global markets. Inflation, already at elevated levels, moved even higher and became entrenched longer term. The shift from the highly accommodative monetary policy we have become used to from central banks gathered momentum. And more recently, the level of uncertainty gripping the world deepened as the crisis in Ukraine unfolded. It is no surprise then that diversification and downside risk protection, and the potential role that alternatives can play within a wider portfolio, became a key consideration for many investors.

People often think of alternatives as private equity or credit vehicles, more illiquid exposures, early-stage venture equity, or something similar. But the more liquid end of the diversified alternatives spectrum offers investors the opportunity to diversify away from traditional fixed income and equity exposures more naturally. Unlike traditional equities and bonds investments, there is no single predominant source of return across alternatives. Instead of equity or credit risk premia, we see a more varied and often more ephemeral range of potentially important tools in the toolset.

The multi strategy approach

The liquid alternative end of the diversified alternatives space is really dominated by the multi strategy universe. And as the name implies, it is a combination of different ways of trying to generate returns for investors.

There are a wide range of ways to potentially do this. For example, if you think about what investment banks used to do in the 1980s, 1990s and early part of the 2000s, much of the profit generated by the banking industry came from the provision of short-term liquidity to markets. Government bond auctions require a great deal of short-term liquidity, so small discounts appear to encourage investors to provide that liquidity. By taking a systematic approach to the opportunity, it is possible to find interesting sources of return for investors. Similarly, when companies come to market to raise funds, providing the liquidity needed to help a large block of stock find a home can often earn a healthy risk premia.

Another classic strategy is convertible bond arbitrage. Convertible bonds have an implicit embedded volatility exposure. By hedging out the equity risk, credit risk and interest rate risk, it is possible to isolate that volatility exposure, which may be cheap or expensive. That type of exposure can be extremely profitable at the right moment in time

The rise of price-insensitive products

One of the big themes we have seen in markets in recent times has been the rise of price-insensitive products – the obvious example of which is passive funds. But there has also been a significant increase in bank structured products, ranging all the way from quant investment strategies (QIS) to autocallable notes, typically sold to retail investors.

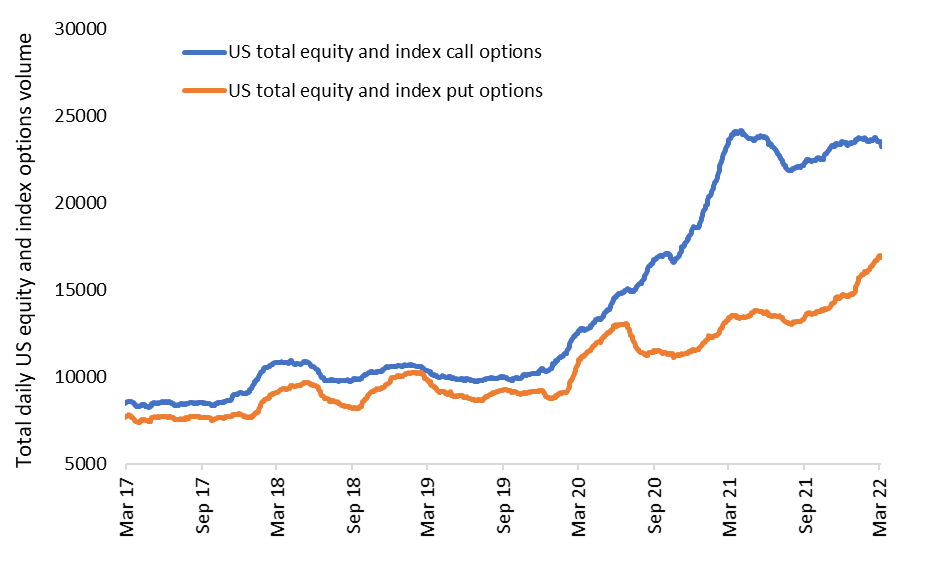

A more controversial example of price insensitivity activity stems from options trading, where we have seen a sharp increase over the past couple of years, particularly from the US (Exhibit 1). While options trading is not in itself price insensitive, it creates a price insensitive flow as market makers hedge their positions.

Exhibit 1: US options trading volume has seen a sharp increase

Source: Bloomberg. 18 March 2017 to 17 March 2022. The chart shows the total equity/index call and put option volumes traded on all US Options Price Reporting Authority (OPRA) exchanges. Shown here as monthly averages.

When you combine the increase in price insensitive strategies with a shrinking market share for active asset managers, you end up with price moves that can exhibit more noise (information that confuses or misdirects) and less signal. That can be a good thing for alternative investors as it increases the opportunity set, although it can come with additional volatility.

Flexible, multi-strategy investing

The best way, in our view, to respond to that set of very inflexible trading strategies is to be as flexible as possible, and this is where a multi-strategy approach to alternatives can potentially help. Gaining exposure to a broad range of different strategies, and adjusting that exposure to match the opportunity set, is a real strength, reflected, we think, in the inflows that multi-strategy vehicles have seen in recent years.

Within that multi-strategy concept, there are two ways to proceed, either through the frequency of trading, or by using a lot of different strategies. Ideally, you want strategies that have low correlation, not just to each other but to the market as well. It is important to be cognisant of factor exposure and sector exposure, to ensure that diversification does what it says.

There are a healthy range of liquid alternative options that can be combined or selected for use in a multi-strategy allocation – see Exhibit 2 for examples.

Exhibit 2: A multi-strategy toolkit

|

Equity market neutral:

|

Seeks to deliver alpha by investing long and short across equities. |

|

Event driven:

|

Looks to exploit pricing inefficiencies around corporate events or capital structures. |

|

Risk transfer:

|

Looks to capitalise on supply/demand-driven imbalances in the derivatives market. |

|

Portfolio protection:

|

Seeks to mitigate tail risk through a multi-faceted protection strategy. |

|

Price pressure:

|

Aims to generate returns through the provision of capital to liquidity opportunities. |

|

Convertible arbitrage: |

Aims to capitalise on mispricings for convertible bonds.

|

When markets are stressed, correlations can often go to ‘one’

Correlations are not stable at the best of times and in stress scenarios correlations tend to rise in an unfavourable way, sometimes even moving to ‘one’, with all diversification benefits lost. This can be managed is by adding hedges; trades that you would expect to be negatively correlated to the market. This means you can create a relatively neutral portfolio, even if market conditions suddenly change, as we saw at the start of 2022.

While hedging comes with a cost, there are two tangible benefits to using it. First is the direct benefit of a lower drawdown when markets are stressed, as we saw in January 2022 when stocks and bonds were both down. The second benefit is they can leave you well placed for what comes after. By smoothing returns through diversification and hedging, investors have an opportunity to add new trades, particularly when other market participants might be unable or unwilling to do the same. The key quality that we believe investors need at times of uncertainty is patience, but also the right tools to provide diversification while other parts of the investment world are failing to deliver as intended.

The views presented are as of the date published. They are for information purposes only and should not be used or construed as investment, legal or tax advice or as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. Nothing in this material shall be deemed to be a direct or indirect provision of investment management services specific to any client requirements. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, are subject to change and may not reflect the views of others in the organization. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its use. Janus Henderson Investors is the source of data unless otherwise indicated, and has reasonable belief to rely on information and data sourced from third parties. Past performance does not predict future returns. Investing involves risk, including the possible loss of principal and fluctuation of value.

Not all products or services are available in all jurisdictions. This material or information contained in it may be restricted by law, may not be reproduced or referred to without express written permission or used in any jurisdiction or circumstance in which its use would be unlawful. Janus Henderson is not responsible for any unlawful distribution of this material to any third parties, in whole or in part. The contents of this material have not been approved or endorsed by any regulatory agency.

Janus Henderson Investors is the name under which investment products and services are provided by the entities identified in the following jurisdictions: (a) Europe by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Henderson Management S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier);

Janus Henderson, Janus, Henderson, Intech, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.