Despite experiencing its deepest and longest drawdown on record, the biotechnology sector looks stronger than ever, says Portfolio Manager Andy Acker, thanks to accelerating innovation and valuations that have reset.

Key takeaways:

- Over the past year, biotechnology has been caught up in a historic sell-off, sending the sector’s stocks down by more than 50%, on average.

- But in our view, biotech’s long-term growth drivers have not been impaired. On the contrary, a combination of scientific breakthroughs and robust funding are expected to lift sales by an average of 9% annually through 2026.

- At the same time, the S&P Biotech Sector trades at half its long-term average, which could set up the sector for a strong recovery.

While global equity markets have been in retreat since the beginning of 2022, for the biotechnology sector, the selling has been going on for much longer. Since hitting a peak on 8 February 2021, the SPDR® S&P® Biotech ETF (XBI), a widely used industry benchmark, has declined by more than 50% and underperformed the S&P 500® Index by over 60% – representing the XBI’s longest contraction on record (270+ trading days), as well as its deepest on both an absolute and relative basis.1

It’s easy to be discouraged by this performance, but we don’t believe the long-term outlook for biotech has become impaired. On the contrary, with valuations compressed and innovation in the sector accelerating, we’d argue the case for biotech has only grown stronger.

Short-Term Setbacks, Long-Term Value

A number of reasons have been cited for biotech’s recent rout. For one, it followed a frothy initial public offering (IPO) market, fueled by monetary stimulus and enthusiasm for the industry’s historic COVID-19 response, lifting valuations of early-stage companies. It was impacted by a renewed push for drug-pricing reform in the U.S. and the absence of a permanent commissioner at the Food and Drug Administration (FDA), which may have contributed to unexpected regulatory decisions. Finally, the prospect of rising interest rates drove a rotation out of longer-duration assets, including biotech.

We believe many of the sector’s headwinds are showing signs of abating. Proposals that would allow the U.S. government to “negotiate” drug prices have been scaled back and, in their current form, would affect only a small subset of medicines near the end of exclusivity periods.2 The passing of legislation could also remove an overhang of uncertainty for the sector. The FDA has kept up a rapid pace of approvals – 50 new drugs in 2021, on par with the elevated rate of recent years – even before a permanent commissioner was confirmed in early 2022.3 And studies show little correlation between biotech returns and interest rates. In fact, from 2000 to 2021, biotech stocks saw gains in six out of the nine years when 10-year U.S. Treasury yields rose.4

The IPO boom that occurred in biotech in 2020 and 2021 has stalled amid market volatility and a shift to tighter monetary policy. Some reckoning was likely due: Over the past two years, private companies were often completing IPOs just months after the last private transaction, compared with a more typical one-year time frame, all while fetching premiums of 50% to 100% or more. Further, a growing percentage of firms were going public in the early stages of their pipeline development, raising risks in development and the timeline to profitability for investors.5

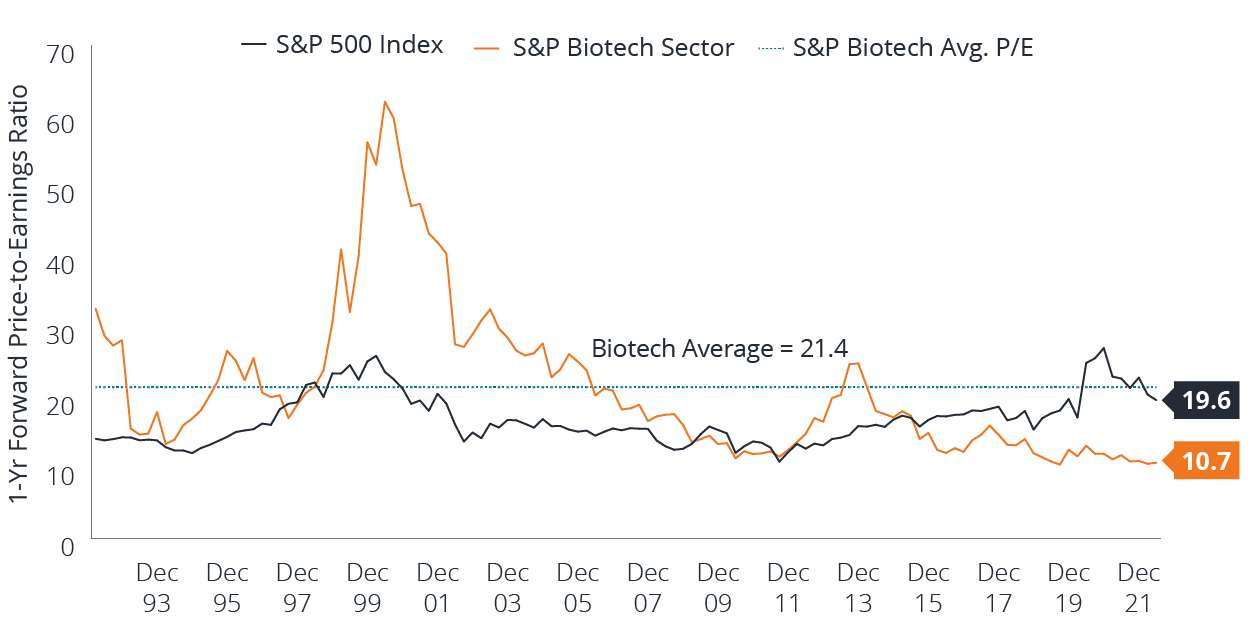

The IPO freeze could thaw when market volatility subsides and the path of rate hikes becomes clearer. In the meantime, there’s reason to believe many areas of the sector have become oversold. As of early 2022, a remarkable 16% of U.S.-listed biotechs traded below the level of cash on their balance sheets, more than during the 2002 and 2008 equity bear markets (8% and 11%, respectively).6 And by the end of February, valuations for large-cap biotechs sat well under their long-term average, as well as the average for the broader equity market (Exhibit 1).

Exhibit 1: Biotech Valuations Fall

Source: Bloomberg, from 30 September 1992 to 28 February 2022. The S&P Biotech Sector is composed of the large-cap biotechs in the S&P 500 Index. Forward Price-to-Earnings (P/E) Ratio measures share price compared to estimated future earnings per share for a stock or stocks in a portfolio.

Innovation Drives Growth

Even as biotech stocks have sold off, the sector’s innovation has continued to advance. Last year, more than half of drugs approved by the FDA were considered first-in-class, meaning the medicines had mechanisms of action different from those of existing therapies. Nearly three-quarters (74%) used one or more expedited development and review methods, available for drugs that have the potential to significantly advance the standard of medical care.7

Importantly, the drug pipeline is expanding. Globally, more than 6,000 medicines are actively under development, up 68% from 2016, according to the IQVIA Institute.8 Funding has been ample: In 2020, biotech and pharma saw US$27 billion in venture capital deal activity, followed by US$38 billion in 2021.9 For its part, large-cap biopharma spent a record US$133 billion on research and development last year, up 44% from 2016.10 Still, small- and mid-cap biotechs are responsible for the majority of molecules in the pipeline today, while large-cap companies face a looming patent cliff for many top-selling drugs. Consequently, it’s likely that over the coming years these industry giants, sitting on large cash reserves, will seek to replenish product portfolios through mergers and acquisitions (M&A) or strategic partnerships. Indeed, in 2022, a cohort of 18 pharma companies are estimated to have roughly US$1.7 trillion of total funding available for deal-making, including more than US$500 billion in cash.11

Positioning for Recovery

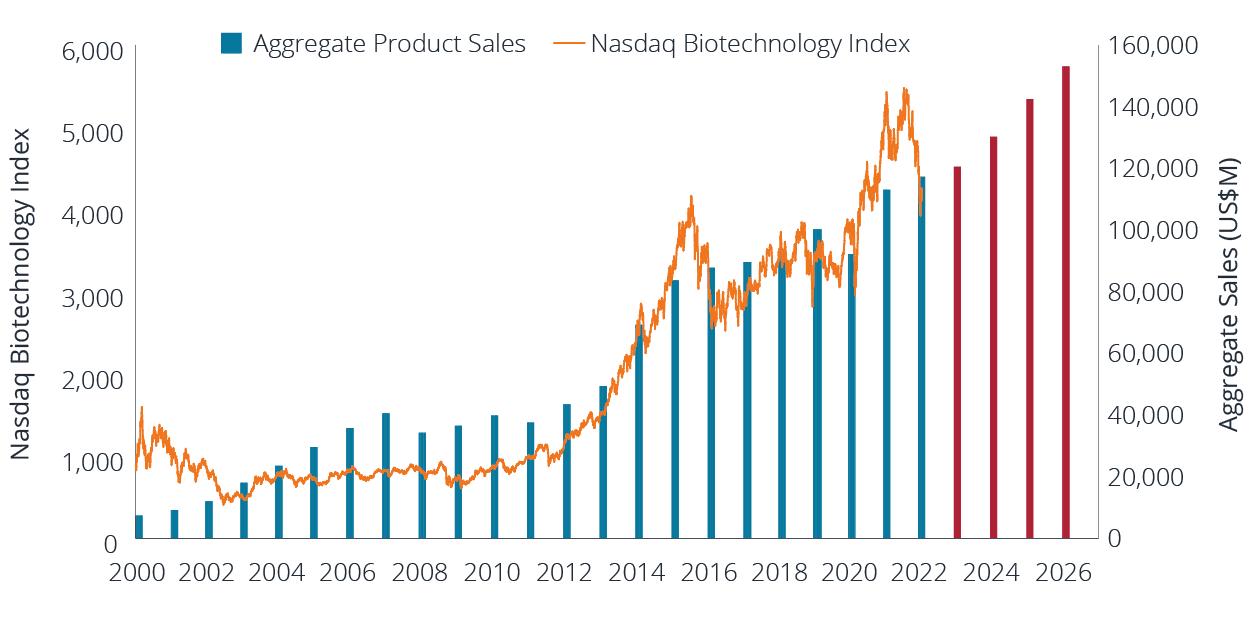

It’s anyone’s guess what will spark a rebound in biotech, whether it’s a pickup in M&A or clarity on drug-pricing reform or something else. But we do know that after the bottom of the last 11 drawdowns of at least 20%, the XBI has delivered a median return of 50% over the following 12 months.12 In addition, over the long term, returns for large-cap biotechs have historically been correlated with drug revenues. With health care demand growing and pharma pricing remaining steady – particularly as more medicines revolutionize the standard of care – revenues are projected to rise by a compound annual growth rate of 9% from 2020 to 2026 (Exhibit 2).

Exhibit 2: Nasdaq Biotechnology Index vs. Aggregate Product Revenue, 2000-2026E

Source: Cowen and Company, as of 25 February 2022. Data from 31 December 1999 through 31 December 2026.

Note: Revenue is an aggregate of actual and estimated figures for 65 companies representative of the biotech sector. The Nasdaq Biotechnology Index is a stock market index made up of securities of Nasdaq-listed companies classified according to the Industry Classification Benchmark as either the biotechnology or the pharmaceutical industry. Red bars = estimated.

As we navigate this challenging period for biotech, we recognize that some companies may have an easier time coming through the current market environment than others. Firms with meaningful revenues/earnings, lower multiples and/or near-term pipeline catalysts could be better positioned than earlier-stage, less-liquid companies. Strong balance sheets can also help support valuations. Still, over the long term, we remain as positive as ever about the sector’s growth potential and believe the current drawdown – like the many that have come before it – will one day give way to a recovery.

Glossary

Monetary policy is a set of actions available to a nation's central bank to achieve sustainable economic growth by adjusting the money supply.

Disclosures

FN 2072:

The opinions and views expressed are as of the date published and are subject to change. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent and may not reflect the views of others in the organization. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

FN 3211:

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

FN 3002:

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

FN 3213:

Growth stocks are subject to increased risk of loss and price volatility and may not realize their perceived growth potential.

FN 3040:

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.

FN 3017:

Initial Public Offerings (IPOs) are highly speculative investments and may be subject to lower liquidity and greater volatility. Special risks associated with IPOs include limited operating history, unseasoned trading, high turnover and non-repeatable performance.

FN 3516:

Health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

FN 3007:

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

FN 8068:

Volatility measures risk using the dispersion of returns for a given investment.

FN 8055:

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

FN 7036:

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

FN 2049:

Janus Henderson Distributors US LLC

FN 2481:

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.

C-0322-42409 03-30-23 TL

1 Bloomberg, Janus Henderson Investors. Current drawdown data from 8 February 2021 to 14 March 2022. Data for other periods are from 27 February 2006 to 16 March 2020 and reflect declines of 20% or more in the SPDR S&P Biotech ETF (XBI). XBI is designed to correspond to the performance of a modified equal weighting of the S&P Biotechnology Select IndustryTM Index, with an inception date of 31 January 2006.

2 Kaiser Family Foundation, Simulating the Impact of the Drug Price Negotiation Proposal in the Build Back Better Act, 27 January 2022.

3 Food and Drug Administration, as of 31 December 2021.

4 Cowen and Company, This Biotech Bear Market Too Shall Pass, 25 February 2022.

5 Janus Henderson Investors, as of 31 December 2021.

6 BioCentury, Weathering one of biotech’s worst bear markets, 4 February 2022.

7 Food and Drug Administration, Advancing Health Through Innovation: New Drug Therapy Approvals 2021, January 2022.

8 IQVIA, Global Trends in R&D: Overview through 2021, February 2022.

9 Q4 2021 PitchBook-NVCA Venture Monitor, as of 31 December 2021.

10 IQVIA, Global Trends in R&D: Overview through 2021, February 2022. Data based on 15 largest pharmaceutical companies.

11 SVB Leerink, Big Biopharma Will Have $500Bn in Gross Cash to Deploy YE22 - Get Set for M&A, December 2021.

12 Bloomberg, Janus Henderson Investors. Data from 27 February 2006 to 16 March 2020 and reflect periods where the SPDR S&P Biotech ETF (XBI) experienced a price decline of 20% or more.

The views presented are as of the date published. They are for information purposes only and should not be used or construed as investment, legal or tax advice or as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. Nothing in this material shall be deemed to be a direct or indirect provision of investment management services specific to any client requirements. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, are subject to change and may not reflect the views of others in the organization. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its use. Janus Henderson Investors is the source of data unless otherwise indicated, and has reasonable belief to rely on information and data sourced from third parties. Past performance does not predict future returns. Investing involves risk, including the possible loss of principal and fluctuation of value.

Not all products or services are available in all jurisdictions. This material or information contained in it may be restricted by law, may not be reproduced or referred to without express written permission or used in any jurisdiction or circumstance in which its use would be unlawful. Janus Henderson is not responsible for any unlawful distribution of this material to any third parties, in whole or in part. The contents of this material have not been approved or endorsed by any regulatory agency.

Janus Henderson Investors is the name under which investment products and services are provided by the entities identified in the following jurisdictions: (a) Europe by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Henderson Management S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier);

Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.