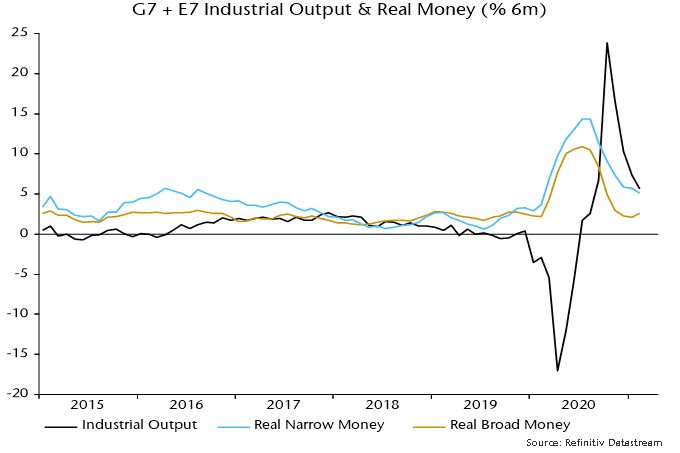

Global six-month real narrow money growth is estimated to have fallen further in February, based on monetary data covering 70% of the G7 plus E7 aggregate calculated here. The decline from a July 2020 peak suggests a slowdown in industrial momentum extending through Q3 2021.

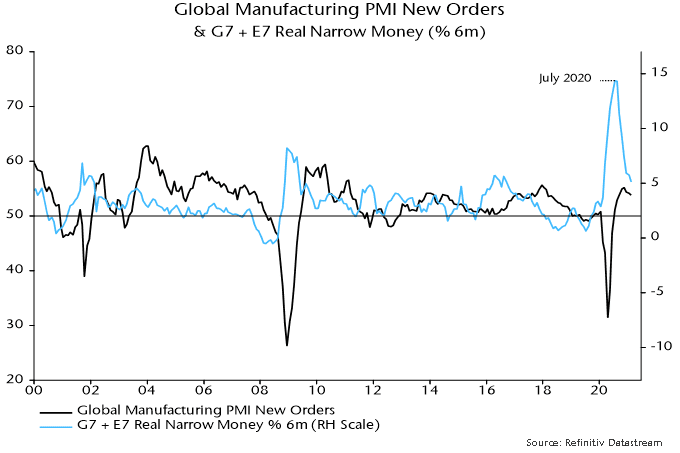

Turning points in six-month real narrow money growth have led turning points in the global manufacturing PMI new orders index by 6-7 months on average historically. The July money growth peak, therefore, suggested a new orders peak in January-February. The current high point of the orders index is November 2020 but this may have been surpassed in March. These are details: the key point is that the index appears to be reaching a peak on schedule, with money trends suggesting a significant relapse by end-Q3.

Chart 1

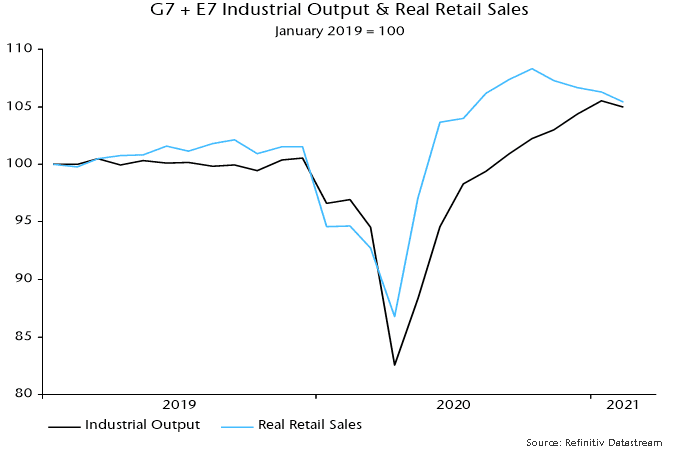

Cooler consumer goods demand is consistent with a coming industrial slowdown. Global retail sales fell between October and January, with early data suggesting another decline in February – chart 2.

Chart 2

Industrial output growth appears to have been sustained by a continued recovery in investment goods demand and – probably more importantly – a rebuilding of depleted inventories. Restocking, however, will have been accelerated by softer consumer goods demand and the associated output boost may be peaking.

A key point, often neglected, is that the level of industrial output is related to the rate of change of inventories. These are probably still lower than desired and restocking should continue. A slowdown in the rate of increase, however, is sufficient to exert a negative impact on the level of output.

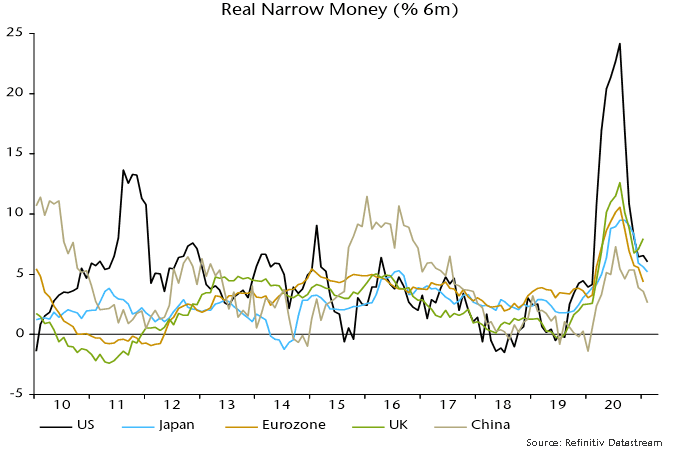

A normalisation of US six-month real narrow money growth has been a key driver of the slowdown in the global measure, although smaller declines have occurred elsewhere – chart 3. US money growth should rebound strongly in March / April as the Treasury transfers cash to households from its account at the Fed (i.e. helicopter money).

Chart 3

A US rebound could drive a pick-up in global six-month real narrow money growth, signalling industrial reacceleration in late 2021 / H1 2022. This isn’t guaranteed, however: a further inflation rise will drag on real money growth near term, while nominal money trends elsewhere may continue to cool.

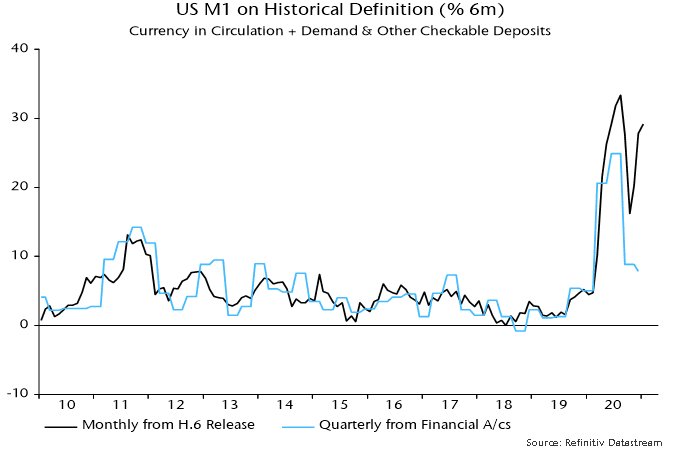

Analysis of US narrow money trends has been complicated by banks reclassifying some savings accounts as transactions accounts following a Fed decision to lift restrictions on the former. This artificially boosted the old M1 measure in 2020, particularly later in the year, when its six-month growth rate rebounded strongly – chart 4. The numbers used here attempt to correct for this distortion but the suggestion of a significant slowdown was disputed by some readers.

The debate has now been resolved by the recently released Q4 financial accounts – these contain M1 flow data adjusted for reclassifications and other discontinuities. The fall in six-month growth of the break-adjusted M1 series during H2 2020 was similar to that of the corrected measure calculated here.

Chart 4

A global industrial slowdown in Q2 / Q3 may not be reflected in GDP data because of services reopening. The latter, indeed, could contribute to industrial softening as consumer demand switches back from goods to services. The judgement here is that industrial trends are a better guide to underlying economic momentum and a more important driver of markets, partly reflecting a stronger correlation with equity market earnings.

A simple rule for switching between global equities and US dollar cash discussed in previous posts holds cash when six-month growth of global real narrow money is below that of industrial output. A negative cross-over occurred in October 2020 and – allowing for data publication lags – resulted in the switching rule recommending a move to cash at end-2020.

Real money growth was below industrial output growth in January and early indications are that this remained the case in February – chart 5. The rule, therefore, will continue to recommend cash in April and, probably, May. The rule is currently about 4% offside since the end-December switch. Such a drawdown is not unusual and compares with a 32% gain when the rule was in equities between end-April and end-December 2020.

Chart 5