Simon Ward, Economic Adviser

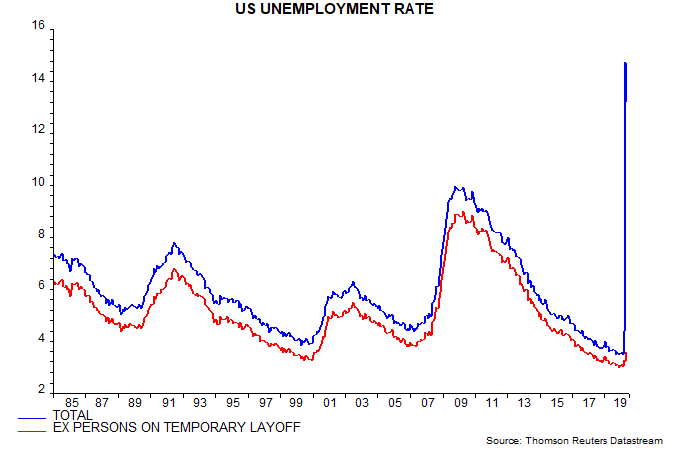

The view here is that much of the current unemployment surge is temporary and will reverse swiftly as the global economy stages a V-shaped recovery. Of the 21.0 million US unemployed in May, 15.3 million or 73% were classified as temporarily laid off – rehiring of such workers accounted for the surprise drop in the aggregate jobless rate. “Permanent” unemployment rose but only to 3.6% of the labour force versus a recent low of 3.0% – see first chart.

Permanent unemployment is certain to increase further but is likely to peak well below levels reached after prior recessions. “Structural” unemployment, meanwhile, may rise because of demand shifts caused by the health crisis and deglobalisation. Labour market pressures, therefore, could emerge at an early stage of the coming economic upswing, wrong-footing analysts expecting a repeat of post-GFC experience.

A near-term inflation rise would probably be driven by a rebound in commodity prices as the global economy recovers strongly. Firms in industries suffering supply shortages would be able raise prices and profit margins, at least temporarily. Higher headline inflation coupled with rapidly falling unemployment could drive an early pick-up in wage demands – wage pressures depend on the rate of change as well as the level of labour market slack.

The forecast of a medium-term inflation upswing is predicated on continued monetary strength – plausible given monetary financing of fiscal deficits and official pressure on banks to boost lending to support economic growth. A reasonable judgement is that G7 broad money needs to – and will – expand at a high single digit pace, at least, through end-2021; for comparison, growth averaged only 3.7% pa over 2010-19.