05 Mar 2021

February 2021 | Simon Ward, Economic Adviser

An article in November presented a “monetarist” forecast of a rise in UK annual CPI inflation to 3.2% in Q4 2021, far above the Bank of England’s central projection of 2.1% (reduced to 1.9% in February). News since then has been consistent with the assumptions underlying the forecast, which is maintained.

January inflation of 0.7% was slightly above the forecast for the month made in November.

Economists share the Bank’s relaxed view of prospects. The median Q4 projection in the Treasury’s latest survey of independent forecasters is 2.0%. Only one contributor expects an outturn above 3%*.

The assumptions underlying the forecast are set out below but the key differences from the Bank / consensus are 1) a larger rise in global commodity prices and associated stronger paths for energy / food inflation, 2) a more pessimistic assessment of current core trends, and 3) an expected increase in core inflation in response to last year’s broad money surge.

The commodity price view is on track, with the Brent oil price up by 40% since November and Ofgem hiking the energy price cap by 9% from April – above a 5% assumption in the November forecast. The FAO world food price index, meanwhile, rose by 7% between November and January, pushing annual growth up to 11%.

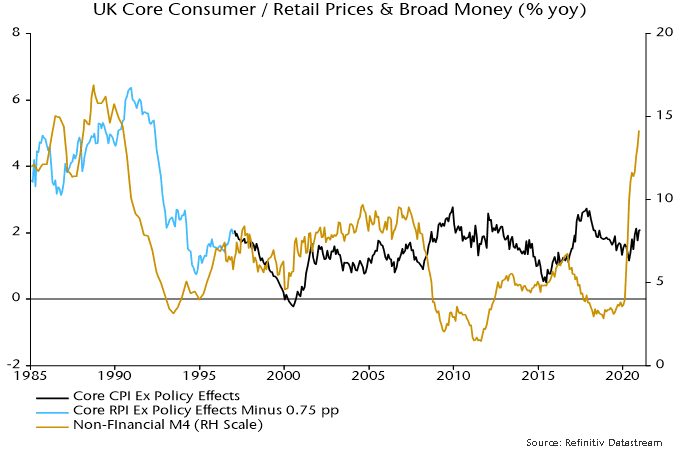

The preferred broad money measure here (i.e. non-financial M4, comprising money holdings of households and private non-financial corporations) continued to rise strongly in November / December, with annual growth now at a 31-year high of 14.2% – see chart 1.

Chart 1

Previous research documented a leading relationship between broad money growth and core CPI / RPI inflation in post-WW2 data, with an average lead time at turning points of 26-27 months. The lead, however, varied widely and was affected particularly by exchange rate developments. A fall in money growth in the late 1990s, for example, was swiftly reflected in core inflation because of prior sterling strength. The lead was much longer after the GFC, when a large fall in the currency placed extended upward pressure on import prices.

Sterling’s effective rate has firmed 3% since November but is little changed from a year ago. A reasonable assumption, therefore, is that the lead time from money growth to core inflation will conform to historical average experience, implying a rising core rate through end-2022, at least.

An assessment of current core trends is complicated by the temporary VAT cut for hospitality and tourism. The assumption here is that one-third of this cut was reflected in prices, in which case core inflation (i.e. ex. energy, food, alcohol and tobacco) of 1.4% in January is understated by 0.7 percentage points (pp). The Bank of England and consensus assume that pass-through was much lower.

The forecast, accordingly, assumes a 0.6 pp boost to published core inflation when VAT for these industries is normalised – currently scheduled for April but possibly to be delayed**. The Bank / consensus view, by contrast, implies little impact. The VAT reversion is likely to coincide with excess demand for these services as the economy reopens, suggesting scope for providers to hike prices to protect current margins – the assumption of one-third pass-through could be too conservative.

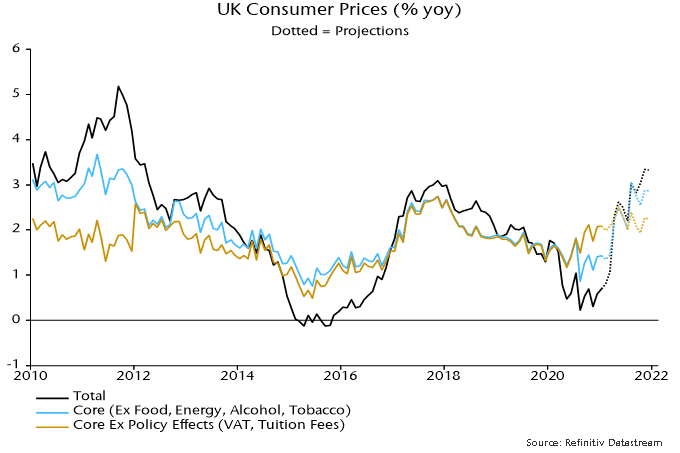

Chart 2 shows projections for headline inflation, the published core measure and the policy-adjusted core series calculated here. These incorporate the same assumptions as in November, except for a small change in the Ofgem energy price cap.

A rise in inflation for food, alcohol and tobacco to 2.0% in December 2021 (2010-19 average = 2.5%, January = 0.4%).

A return of vehicle fuel prices to their pre-covid level (unleaded petrol = £1.28 per litre).

A further 3% increase in the Ofgem energy price cap in October.

Monthly growth in core prices excluding tax effects of 2.25% at an annualised rate.

Chart 2

Note that the headline and published core rates will be artificially high in Q4 because of a reversal of the VAT effect. This distortion will end in April 2022, assuming that VAT is normalised in April 2021. Adjusted core inflation, however, is likely to have risen further by then, suggesting limited decline in headline / published core rates.

What could derail this forecast? A significant further rise in the exchange rate could push back an inflation pick-up but bullish positioning in sterling may already be extreme, judging from Consensus Inc. sentiment and US CFTC futures data – risks may now be skewed to the downside.

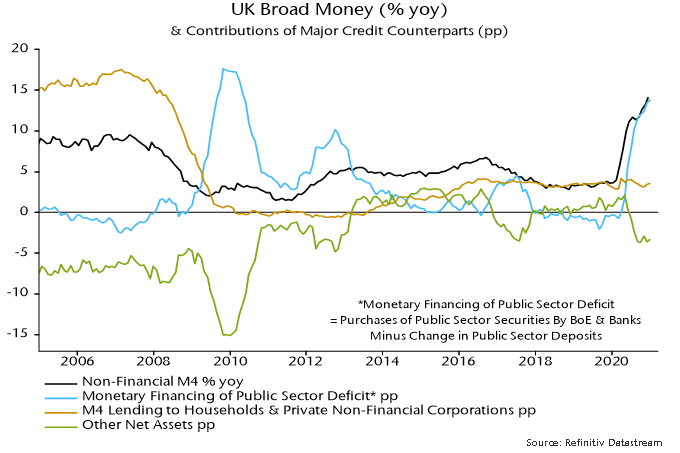

Inflation prospects beyond 2021-22 will depend on broad money developments this year. Monetary deficit financing has given as large a boost to broad money growth in the UK as in the US – chart 3. With little appetite for fiscal restraint***, and the Bank of England restored to its historical role of government financing arm, it is likely to remain a significant driver this year, suggesting low probability of money growth returning to its post-GFC average (i.e. over 2010-19) of 4.2%.

Chart 3

*Economic Perspectives (Peter Warburton).

**The impact is asymmetric because of changes in weights.

***The claim that low bond yields “make it a good time for governments to borrow” is misleading, because deficits are being financed by monetary expansion (and an implicit future inflation tax) rather than borrowing from savers: low yields would be unlikely to survive a switch to non-monetary financing.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.