21 Apr 2023

Since the Global Financial Crisis, regulators and policy makers have worked to avoid a repeat. Yet banks are in trouble again. Is this the same old story?

In light of recent events, we asked Ariel Bezalel and Harry Richards, investment managers for Jupiter’s global flexible bond strategy to comment on how turmoil in the banking sector has impacted the team’s thinking. Luca Evangelisti, Head of Credit Research, joined the discussion to provide specialist analysis: Luca is responsible for credit coverage on financials and is investment manager for our contingent capital strategy. This note was written on 16th March 2023.

In the 15 years since the Global Financial Crisis, regulators and policy makers have worked to establish macro-prudential and regulatory solutions to avoid a repeat. Yet banks are in trouble again. Is this the same old story?

There are many reasons behind recent issues with US banks and the contagion felt by Credit Suisse. The backdrop to all this is clearly the extremely sharp and rapid tightening in financial conditions over the last 12 months.

We have been highlighting for some time now that rapid tightening in policy would create a risk of accidents. The first example was the UK Gilt crisis last year. A strong policy response helped to dodge the bullet in that situation, but it was clearly a sign that the system was under acute stress. We believe that recent developments on Silicon Valley Bank (SVB) and Credit Suisse have a similar root cause.

There were very specific structural areas of weakness in SVB’s business, such as high client concentration, mostly uninsured deposits, and unhedged interest rate exposure. When rumours started and investors began to pull deposits, the bank had to realise huge losses on its bond holdings and a vicious cycle started which ultimately caused the bank to fail.

We believe that European banks simply do not have the same issues and are in a much healthier state, but the pressure from higher rates still has the power to expose weaknesses – such as at Credit Suisse. For a long time we had limited our exposure to Credit Suisse across our range of fixed income portfolios. This was driven by elevated governance concerns, historical underperformance of their core operations and the difficult restructuring plan that lay ahead.

Credit Suisse is systemically important, but nevertheless when trust erodes, liquidity problems can quickly arise. For the moment it’s difficult to predict how these short -term bank issues will play out. What we can say is that central banks have learned from 2008, have a powerful toolkit, and have already stepped up in the US and Switzerland.

Considering the bigger picture, it’s clear to us that what’s going on in banking is a warning signal. The Federal Reserve (Fed) has tightened financial conditions at the fastest rate in history over the last 12 months, and these efforts take 12-18 months to fully impact the economy. Ultimately this is what they want to happen – to kill inflation – but history suggests central banks tend to go too hard, too fast, and the risk of further ‘accidents’, whether in banking or elsewhere, is high. This remains a global economy with $300 trillion of debt that is incredibly sensitive to higher rates in the long run.

It is our view that these banking issues will tighten financial conditions, because the transmission of credit to the economy will be impacted. Regional banks will be concerned about deposit flight as the kneejerk reaction from customers will be to pull out their money and instead save with the large, systemic banks – why take the risk of being involved in the next bank to fail?

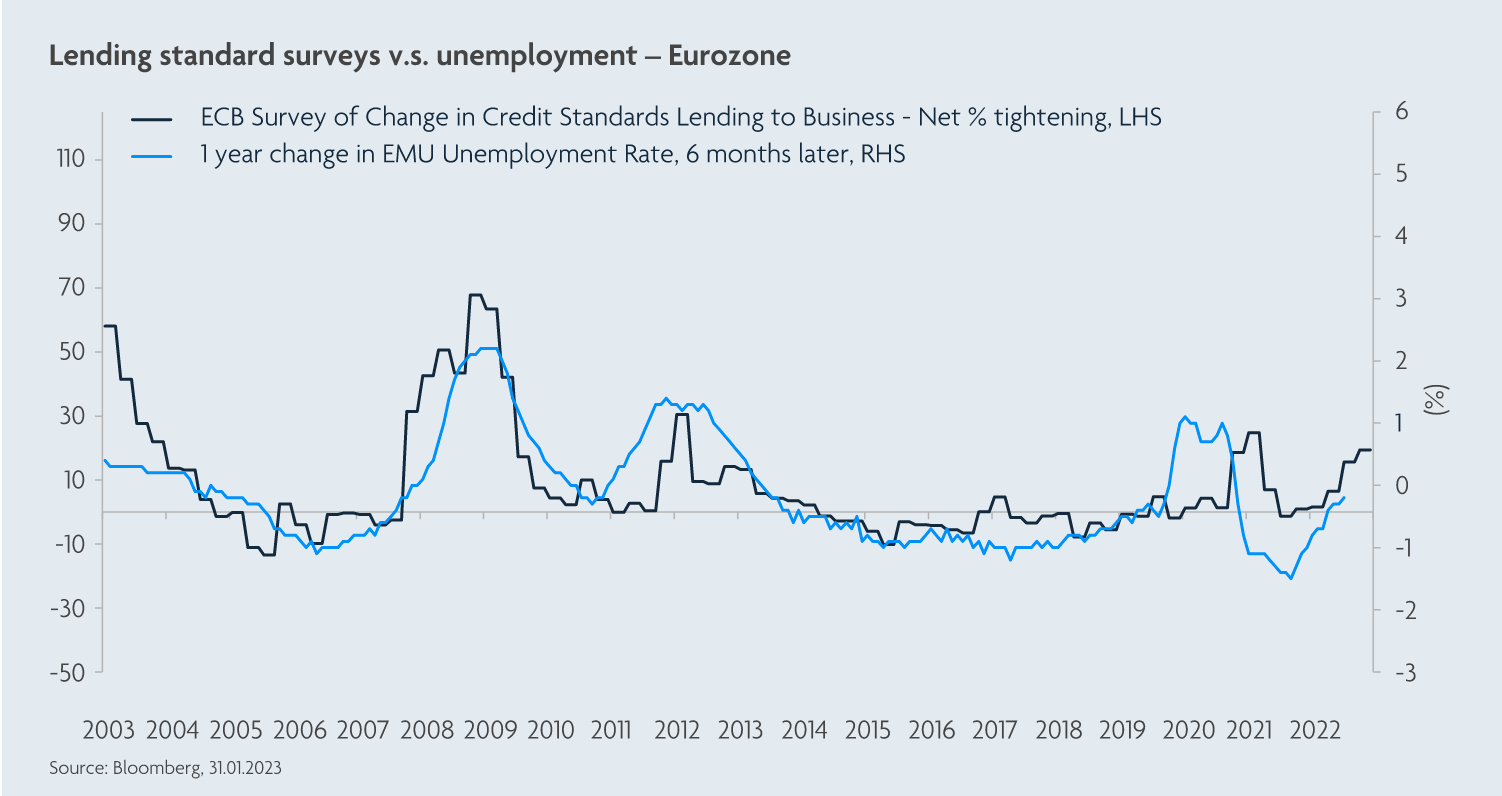

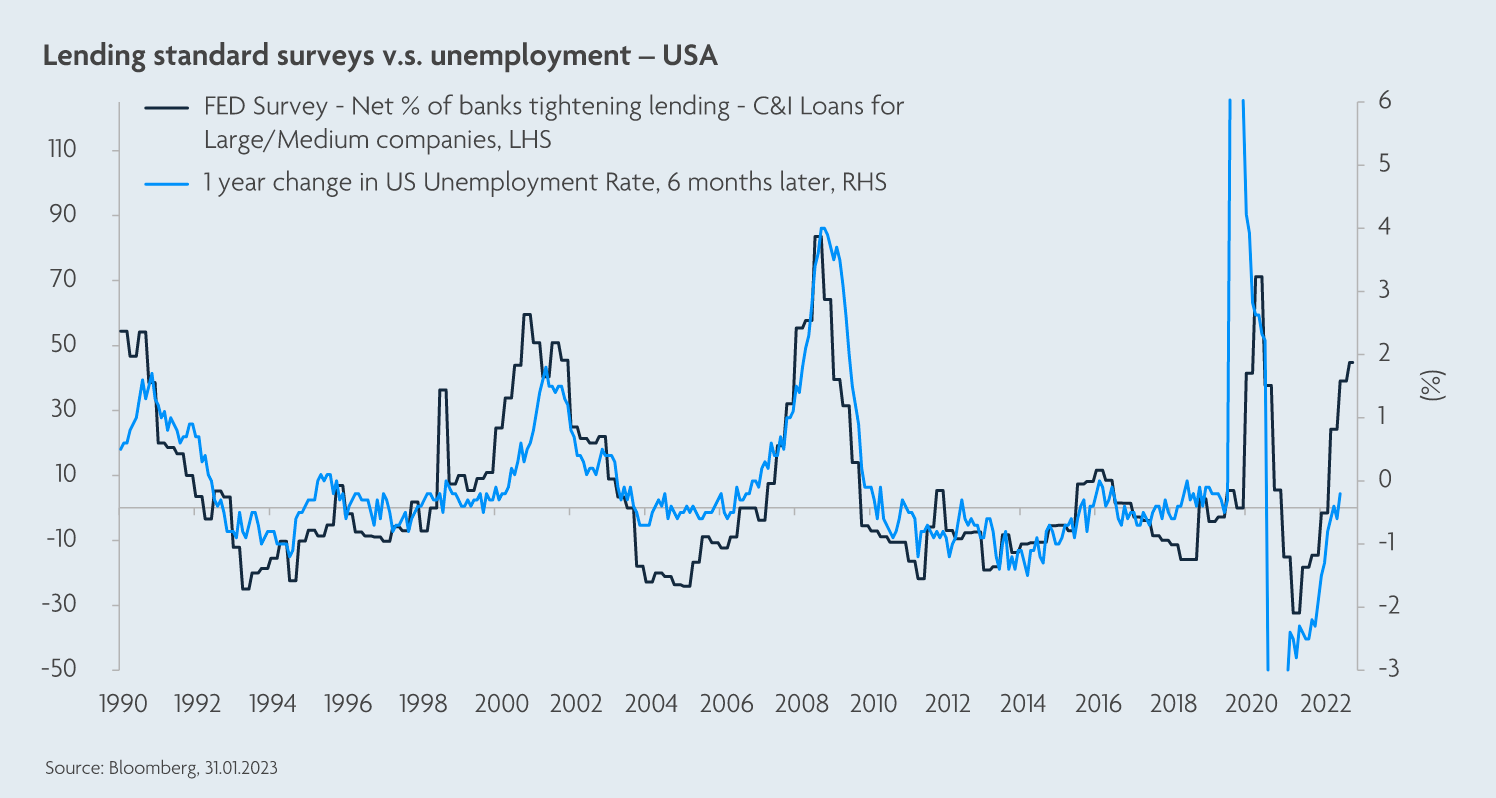

Uncertainty around potential deposit flight may push these smaller banks to offer higher savings rates, reducing profitability and leading to more expensive lending down the line. Banks may be less willing to expand their balance sheets given the stress visible in the financial sector. Lending standards have already meaningfully tightened in the US and Europe, and the relationship with unemployment is clear. We believe that these developments materially increase the risk of a credit crunch scenario taking hold, which would be in keeping with our ‘hard landing’ thesis that we have discussed in many previous notes.

Source: Bloomberg, as at 31.01.23.

Inflation is still running hot on a monthly basis in the US, but base effects in our opinion will lead to lower year-over-year figures in the coming months. This should allow the Fed breathing space to pause. Slower lending would help to tame inflation and will eventually come through in the employment data. The shelter component of CPI that has been supporting core numbers in recent months will gradually revert back to trend as seen in real-time rental markets.

The positive news for bond investors from the last week has been a strong reinstatement of the negative correlation between developed markets government bond yields and credit spreads. If the macro backdrop continues to weaken, government bonds can provide diversification versus credit. If on the other hand the situation were to stabilize, with markets effectively “muddling through”, it remains a decent environment for carry, given the wider spreads.

At these levels, the all-in yield available across fixed income remains extremely attractive, in our view. As the effects of tightening continue to hit the economy and central banks consider the long-awaited pivot, the direction of travel in yields is to the downside, and further stress in banking or the wider economy can see yields lurch far lower. Overall, we believe a diversified fixed income allocation with exposure to high quality government bonds and to carefully selected corporate credit is a powerful tool for investors to navigate these uncertain waters with a controlled level of volatility and the potential for strong returns at the end of the journey.

This document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with a financial adviser, particularly if you are unsure whether an investment is suitable. Jupiter is unable to provide investment advice. Market and exchange rate movements can cause the value of an investment to fall as well as rise, and you may get back less than originally invested. For definitions, please see the glossary at jupiteram.com. The views expressed are those of the individuals mentioned at the time of writing, are not necessarily those of Jupiter as a whole, and may be subject to change. This is particularly true during periods of rapidly changing market circumstances. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Holding examples are for illustrative purposes only and are not a recommendation to buy or sell. Issued in the UK by Jupiter Asset Management Limited (JAM), registered address: The Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ is authorised and regulated by the Financial Conduct Authority. Issued in the EU by Jupiter Asset Management International S.A. (JAMI), registered address: 5, Rue Heienhaff, Senningerberg L-1736, Luxembourg which is authorised and regulated by the Commission de Surveillance du Secteur Financier. For investors in Hong Kong: Issued by Jupiter Asset Management (Hong Kong) Limited (JAM HK) and has not been reviewed by the Securities and Futures Commission. No part of this document may be reproduced in any manner without the prior permission of JAM/JAMI/JAM HK. 325

The value of active minds: independent thinking

A key feature of Jupiter’s investment approach is that we eschew the adoption of a house view, instead preferring to allow our specialist fund managers to formulate their own opinions on their asset class. As a result, it should be noted that any views expressed – including on matters relating to environmental, social and governance considerations – are those of the author(s), and may differ from views held by other Jupiter investment professionals.

Important information

This communication is intended for investment professionals* and is not for the use or benefit of other persons, including retail investors. This communication is for informational purposes only and is not investment advice. Market and exchange rate movements can cause the value of an investment to fall as well as rise, and you may get back less than originally invested. The views expressed are those of the author(s) at the time of writing, are not necessarily those of Jupiter as a whole and may be subject to change. This is particularly true during periods of rapidly changing market circumstances. Every effort is made to ensure the accuracy of any information provided but no assurances or warranties are given. Issued in the UK by Jupiter Asset Management Limited, registered address: The Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ is authorised and regulated by the Financial Conduct Authority. Issued in the EU by Jupiter Asset Management International S.A. (JAMI), registered address: 5, Rue Heienhaff, Senningerberg L-1736, Luxembourg which is authorised and regulated by the Commission de Surveillance du Secteur Financier. Issued in Hong Kong by Jupiter Asset Management (Hong Kong) Limited (JAM HK) and has not been reviewed by the Securities and Futures Commission. No part of this [commentary] may be reproduced in any manner without the prior permission of JAM, JAMI or JAM HK.

*In Hong Kong, investment professionals refer to Professional Investors as defined under the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong) and in Singapore, Institutional Investors as defined under Section 304 of the Securities and Futures Act, Chapter 289 of Singapore.