19 Dec 2022

We expect much of the world to slip into recession, creating a challenging backdrop for equities. But there are also grounds for some optimism.

The overheating we worried about in last year’s outlook has combined with further negative supply shocks, most notably Russia’s invasion of Ukraine, to generate a major inflation overshoot in 2022. The dramatic monetary tightening undertaken in response has brought forward the potential timing of recession – and made a ‘soft landing’ even less likely in 2023.

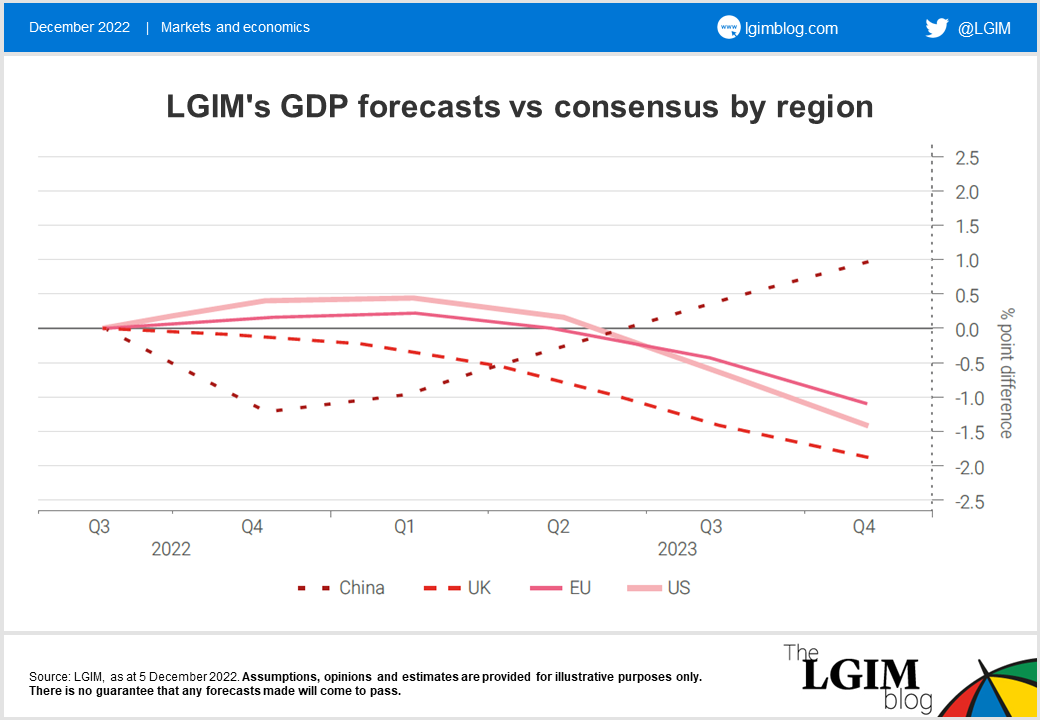

In the US, we expect recession to begin in the spring, with output falling through the rest of the year. In Europe and the UK, real incomes are being squeezed by a severe energy price shock. The recession in these regions has already begun, in our view, and is likely to prove deeper and longer-lasting than consensus expects. Furthermore, market pressure has forced the UK government to deliver a tighter fiscal policy than would otherwise have been necessary.

Japan is the potential growth outlier next year with activity likely to be supported by the easing of COVID restrictions and fiscal stimulus.

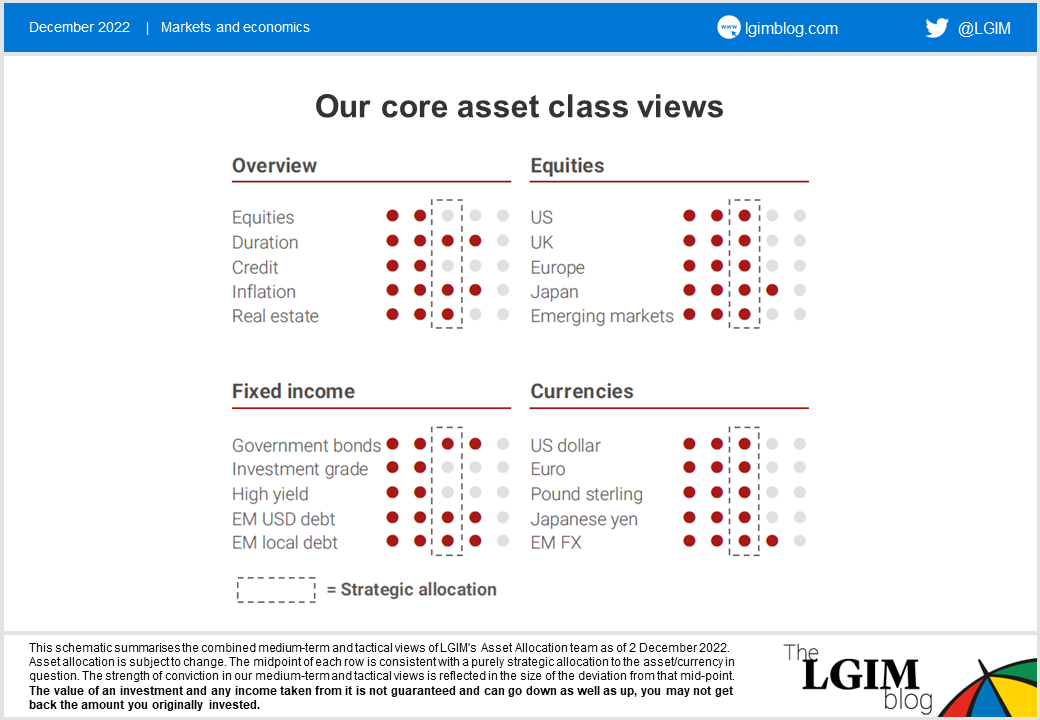

Against this backdrop, we fear that 2023 will be another difficult year for equity markets and harbour particular concerns about the most cyclically exposed sectors.

Regionally, Japan is our preferred market, given the desynchronised nature of its recovery. At the sectoral level, we think tech stocks are set to recover, with their earnings likely to prove more resilient in a global downturn. In terms of thematic plays, we believe decarbonisation will remain the most important secular theme.

Moreover, we expect equities to bottom before the recession ends. Late recession and early recovery phases of the cycle are typically the best time to invest.

In our view, that will only come when visibility on the economic trough improves, setting up a switch to a much healthier environment for risk assets – possibly towards the back end of the year.

The one positive economic development is that goods price inflation is set to fall rapidly in 2023, aided by cooling demand and improved supply chains. Service sector inflation will unfortunately likely prove much stickier, though.

There are considerable lags and uncertainty around exactly when the labour market will turn, but recession and rising unemployment should reduce wage pressures as the year unfolds. Unlike last year, we believe that there are more than enough additional hikes priced in for the US Federal Reserve (Fed) and Bank of England and we also see the prospect for rate cuts towards the end of the year.

We are, therefore, positive on duration going into 2023, looking for nominal and real government bond yields to drift lower after shooting higher in 2022. The repricing of real yields over the last 12 months is one of the most profound changes in the investment landscape. That should offer some respite to assets which have been punished as yields moved rapidly higher.

The fortunes of infrastructure and property assets should be dictated by the fundamentals, rather than discounting. We worry about near-term pressure on

credit spreads given the poor economic outlook, but think they now offer adequate compensation for downgrade and default risk over the cycle. That is particularly true in the European and sterling investment grade markets, in our view.

China’s economy is currently very weak due to its zero-COVID strategy and ongoing stress in the property market. Steps towards easing those restrictions will probably need to progress much further if recovery is to gain traction in 2023.

We are cautious on the outlook for emerging market (EM) equities and commodities, which tend to be dominated by the fortunes of China. Though the Chinese cyclical outlook might improve in 2023, the structural headwinds are increasing. These risks need to be viewed against a background of a deepening cold war between China and the US. Hostility towards the former is a rare area of bipartisan agreement in the US, with the Trump administration’s trade wars followed by chip regulation under Joe Biden.

Other parts of EM have got ahead of the Fed in tightening policy early and aggressively, most notably in Latin America. That should offer support to EM currency markets in the year ahead. More broadly, we think that the end of the dollar bull cycle is likely to arrive as the end of the US tightening cycle approaches. European currencies, including sterling, are set to find some much-needed support in 2023 if that is the case.

This text is an extract from our CIO 2023 outlook.

Disclaimer: Views in this blog do not promote, and are not directly connected to any Legal & General Investment Management (LGIM) product or service. Views are from a range of LGIM investment professionals and do not necessarily reflect the views of LGIM. For investment professionals only.