04 Apr 2022

In the fourth part of our series exploring the asset-allocation response to inflation, we look at the role of currencies.

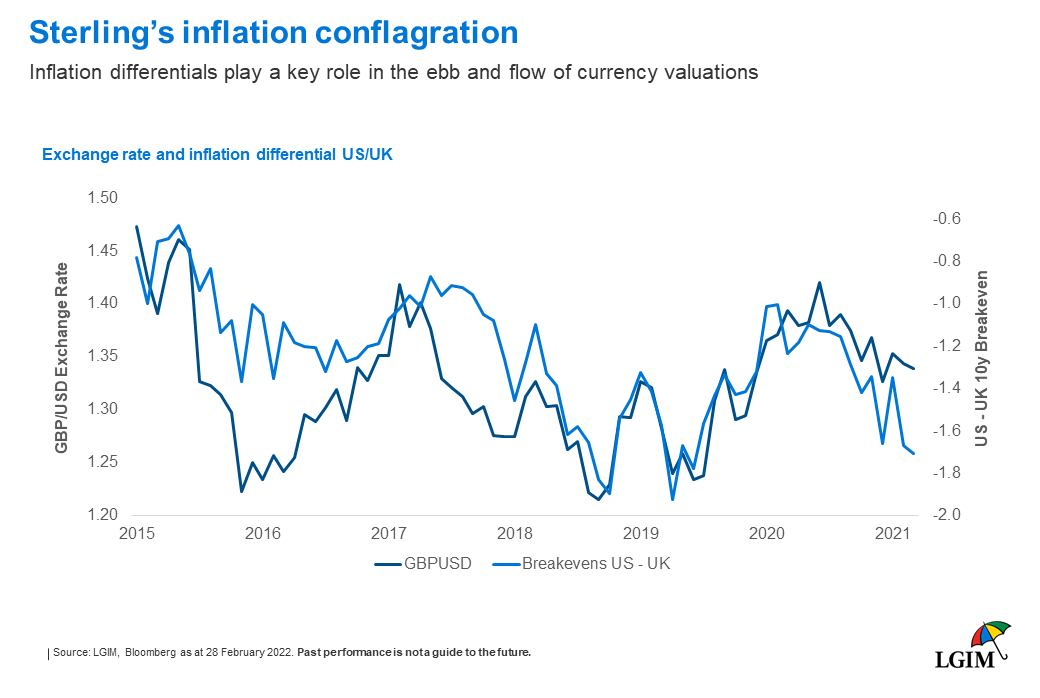

Exchange rates are by definition relative prices: one currency against another. As such it’s not always global inflation that matters, but the difference in domestic inflation between the two countries.

Our multi-asset portfolios typically hold strategic foreign-currency exposure, as this exposure can protect against unexpected inflation at home, which typically impacts domestic assets negatively. With the UK’s long history of high inflation compared with the rest of the world, a pick-up in global inflation may still be an acute problem for sterling-based investors, warranting holding foreign currency exposure more structurally.

But this is a statement about domestic inflation in the UK, against inflation elsewhere, not about global inflation. FX protection against global inflation requires finding the winners and losers.

Global inflation will often go hand in hand with higher commodity prices. Countries exporting commodities will benefit from this via positive terms of trade (i.e. a country’s export prices go up more than the prices of its imports) while commodity importers will have negative terms of trade. Terms of trade are related to current accounts and the balance of payments of a country; favourable improvements in the terms of trade should lead to upside pressure on its currency.

Many commodity-exporting countries can be found in emerging markets. For example, Russia is a big exporter of energy, South Africa exports metals, while Brazil exports agricultural goods. Within the developed world, the well-known commodity currencies are the Australian dollar (metals), New Zealand dollar (agricultural goods), Canadian dollar (energy) and the Norwegian krona (energy). These commodity currencies should do relatively well when commodity prices are on the rise – the winners.

The losers tend to be countries that are rather dependent on others for their commodity consumption. In emerging markets, Turkey and India are large energy importers, while China is basically a net importer of all commodities. In developed markets, Europe and Japan are not energy self-sufficient.

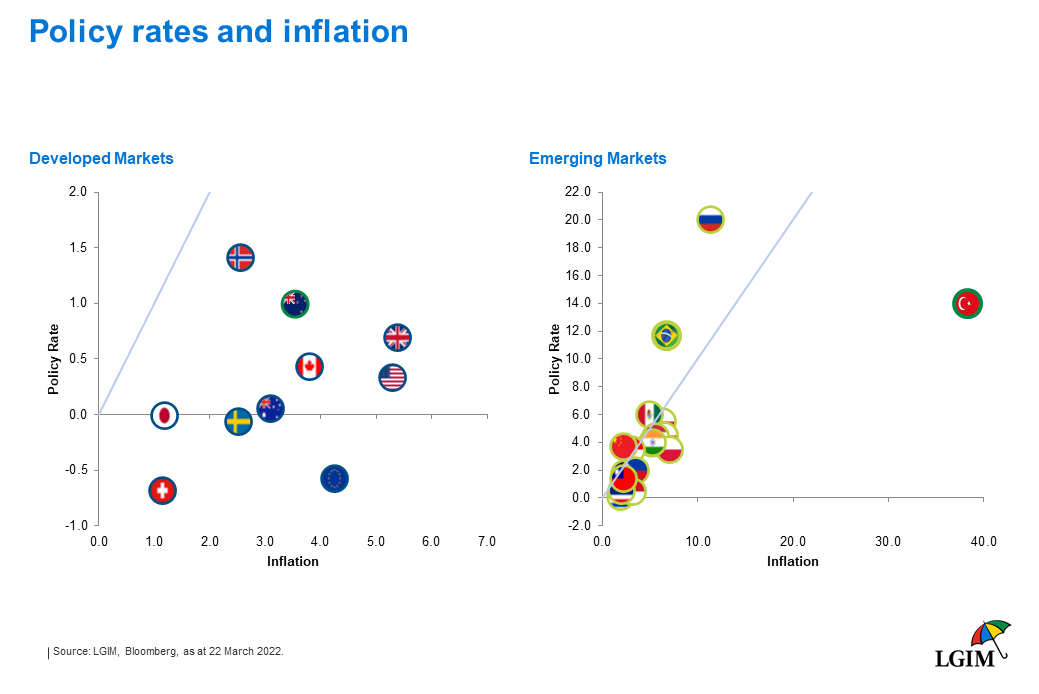

Besides the terms-of-trade angle, for a currency to be a winner when global inflation is on the rise, the inflation-fighting credentials of the central bank also matter. Here, we see a split between developed and emerging markets.

Developed central banks are typically trusted to raise rates when inflation rises persistently, so real interest rates don’t decline when inflation goes up. This is usually less so for emerging markets’ central banks, and so emerging currencies have a history of weakening in the face of higher inflation.

But within developed and emerging markets, the central banks don’t respond uniformly to higher inflation; there will be hawks (proactively raising rates) and doves (behind the curve). As discussed in Chris Jeffery’s blog, emerging-market central banks have actually been ahead of developed markets in this inflationary episode. One of the more hawkish central banks and credible inflation fighters is the Czech central bank, while it has taken the Polish and Hungarian central banks a long time to admit they were having an inflation problem.

Of course, these two angles are not the only ones driving exchange rates, but 2022 so far is a good example of how terms of trade and the central bank’s inflation-fighting credentials can interact. The Brazilian real has been the strongest currency year to date. It has benefited from rising commodity prices as a commodity exporter, while the central bank has firmly pushed up the policy rate, making Brazil’s real interest rate now one of the highest among its peers. The Turkish lira, on the other hand, is one of the weakest currencies; with Turkey being a commodity importer and the central bank having cut rates in the face of higher inflation, this is not too surprising.

So, we draw two main conclusions when it comes to foreign-exchange markets and tackling inflation:

Unless otherwise stated, all information is sourced from LGIM analysis as at 22 March 2022.

Disclaimer: Views in this blog do not promote, and are not directly connected to any Legal & General Investment Management (LGIM) product or service. Views are from a range of LGIM investment professionals and do not necessarily reflect the views of LGIM. For investment professionals only.