25 May 2022

By Erik Lueth

The taper tantrum of 2013 showed how sensitive emerging markets (EMs) were to higher US rates, but there are some important differences this time around.

A strong dollar and rising US interest rates are typically feared by EM investors – for good reasons. This combination drains liquidity out of emerging economies, tightens financial conditions, weighs on growth and in the worst-case scenario may lead to a financial crisis. This time, though, EMs are in a relatively strong position, as we will show from the angle of a local currency debt investor.

We focus on eight emerging markets that constitute more than three-quarters of the GBI-EM index, the benchmark for local currency debt. These are Indonesia, China, Mexico, Thailand, Brazil, Malaysia, South Africa and Poland.

For starters, the (weighted) average current account of these countries is balanced. This sets them apart from the “fragile five” which saw their currencies plummet during the taper tantrum of 2013. In aggregate, they run a commodity surplus of 1% of GDP, which makes them beneficiaries of sky-high commodity prices.

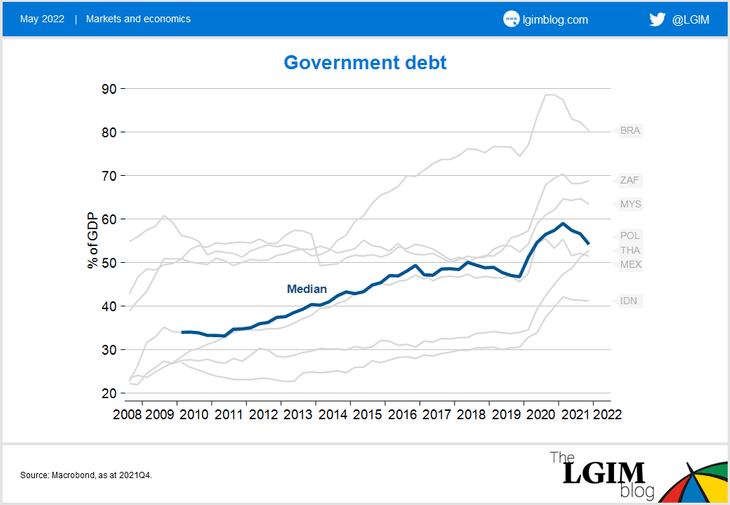

While stronger commodity prices have helped on the fiscal front, an even bigger factor was the inflation surprise, which boosted revenues more than expenditures and reduced debt-to-GDP ratios. The median fiscal deficit improved from 8% of GDP in late 2020 to 4.5% in early 2022, according to IMF data, and debt fell by five percentage points within three calendar quarters. While this windfall will not be repeated, it may not be reversed.

Inflation has accelerated in our eight emerging markets under review as it has everywhere else, but median inflation of 5.8% is below the US inflation rate. Furthermore, those EMs with notably low inflation – Indonesia, China and South Africa – have big weightings in the GBI-EM index.

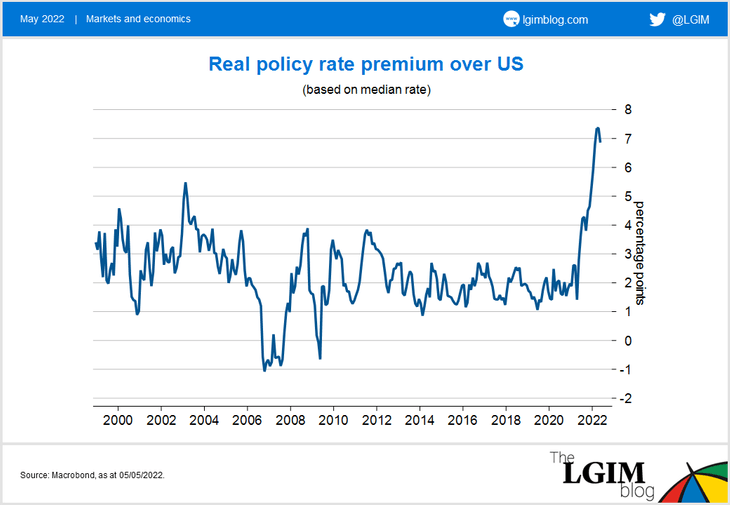

In addition, we believe EMs have been well ahead of developed markets in responding to inflationary pressures. While the median real policy rate is still marginally negative, it is a significant seven percentage points above its US counterpart. This should provide a welcome buffer when the US Federal Reserve accelerates hikes this year.

Valuations are also favourable, both on a FX-hedged and unhedged basis. Only on very few days over the past 10 years (1% of observations) has the countries’ median yield curve been steeper than today. Currencies are also cheap. Using the workhorse model of currency valuation which estimates fair values based on inflation differentials, relative productivity gains, terms of trade, and government spending, we find that our eight currencies are undervalued by 10% on average.

Finally, international investor positioning is light. The median share of local currency bonds held by foreigners has fallen to 18% from a peak 35% in 2016, according to IMF data.

In summary, we believe EMs are comparatively well positioned for higher US rates, and in our view this supports the outlook for local currency debt.

Disclaimer: Views in this blog do not promote, and are not directly connected to any Legal & General Investment Management (LGIM) product or service. Views are from a range of LGIM investment professionals and do not necessarily reflect the views of LGIM. For investment professionals only.