14 Aug 2024

The US has pivoted towards protectionism and industrial intervention. The presidential election will help determine the speed of deglobalisation.

In Trump’s first term, the US began shifting away from the six decades of rules-based, multilateral and tariff-reducing trade policy toward a more nationalist approach. China was judged to be not adhering to the rules and bore the brunt of the changes.

Under Biden, rather than reverse the tariffs on China, the administration maintained all the China tariffs and recently announced some new ones, including 100% tariffs on Chinese electric vehicles. It has also increased restrictions in technology trade under national security concerns and launched more Section 301 investigations, which could lead to additional tariffs. Perhaps even more significantly, the US launched a fiscally expensive domestic industrial policy via the Inflation Reduction Act and CHIPS Act. The EU sees these polices as violating WTO rules.

With ‘America First’ now standard policy across both political parties. Trump is likely to position himself and his team even more aggressively. If elected, he might appoint his first term US Trade Representative Robert Lighthizer as Treasury Secretary. This would give Lighthizer far greater authority to pursue the radical agenda outlined in his latest book, ‘No Trade is Free’.

How will Trump view the impact of his first round of tariffs?

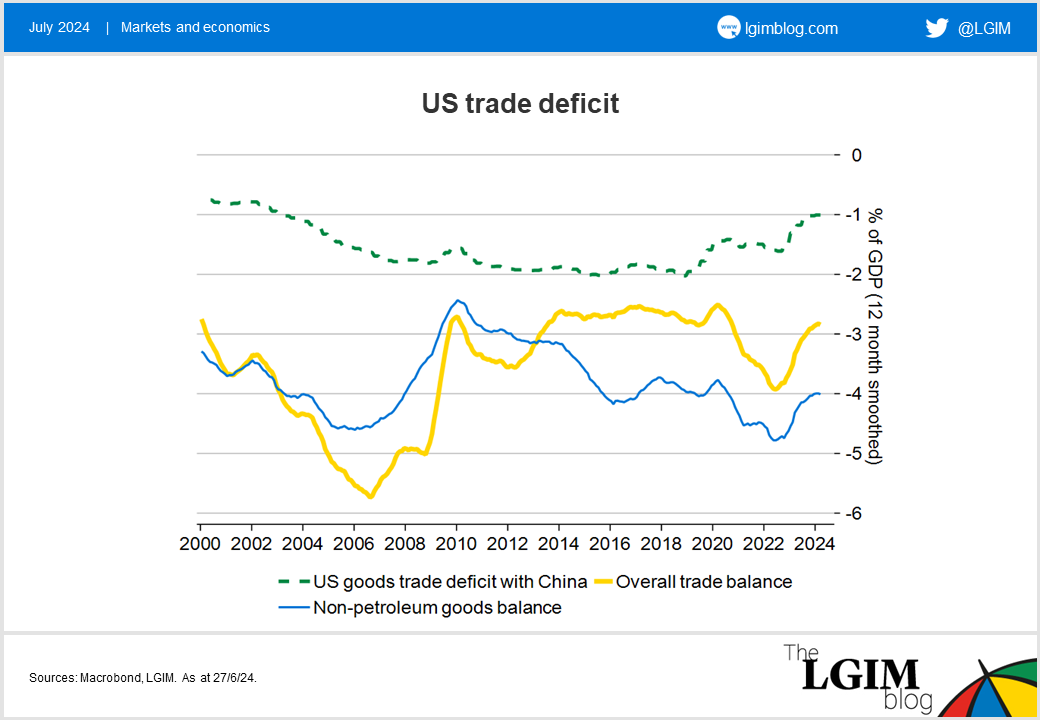

First, the polices were seen as successful in reducing the trade deficit with China, but the overall trade deficit did not improve as production shifted to other countries, though some of this could still be made in China and re-routed. Second, the policies did not appear to create inflation.

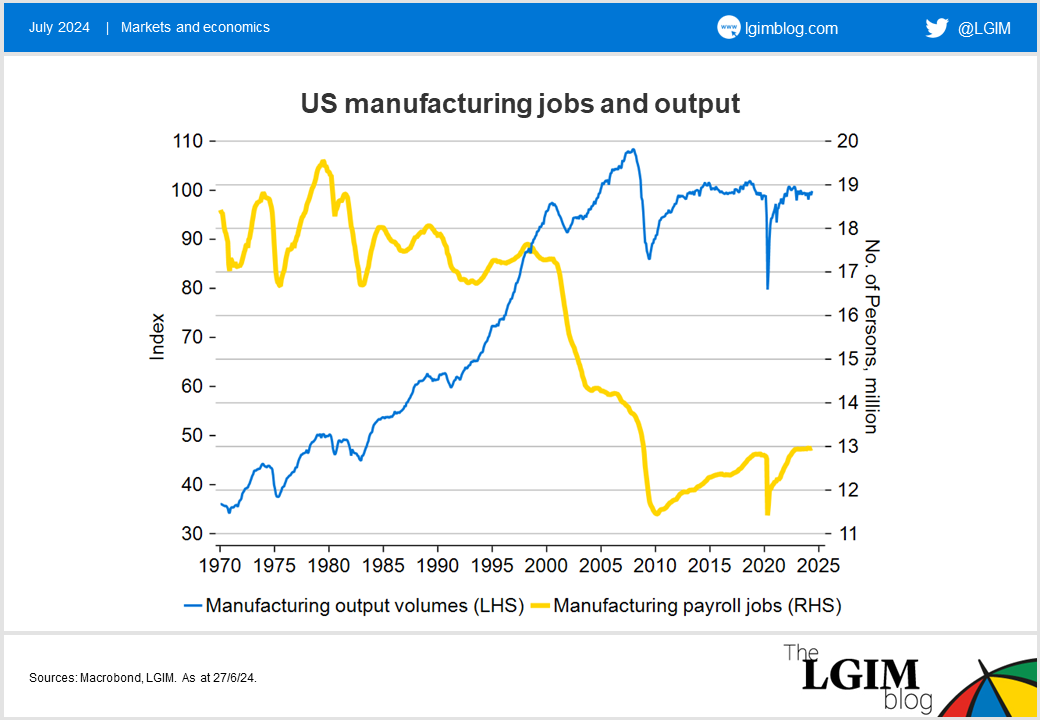

So far, the policies have not done much if anything for US manufacturing output, which has continued to stagnate after no growth for the past 25 years. However, there has been a surge in construction of manufacturing facilities due to the CHIPS Act, so output should improve in future. We will see what level of protection or subsidies are required to make these semiconductor factories viable in the long run.

Listening to speeches from Lighthizer, the policy goal appears to go well beyond securing supply chains and friendshoring to growing domestic manufacturing and balancing the trade deficit not just with China, but with the rest of the world. There is a belief that a strong manufacturing sector is vital for economic success, including basic industries such as steel. Manufacturing is thought to create better-paid jobs and support lower-skilled workers with an inference that many services jobs are a direct result of building a manufacturing base.

Many economists challenge this perspective. They support free trade and see the trade deficit primarily driven by the US savings and investment imbalance which is currently dominated by large government borrowing. Economists also wonder why US manufacturing productivity has been so weak if unfair foreign competition is to blame for the malaise.

So what policies are being proposed?

To achieve a trade balance will likely require widespread global tariffs or countries to take steps to revalue their currencies against the dollar. There could also be renewed discussion of a border adjustment tax. This taxes imports and subsidies exports. The de minimis provision (anything below $800 is exempt from customs) could be drastically reduced to curb international online ordering. Regulation could be increased to ensure imports adhere to the same rules as US domestic producers.

China is likely to face an extremely hostile environment. China is now seen as an economic adversary with a US goal to slow its development of technology. This is also linked to fear of a future military conflict and means there could even be a push for full economic decoupling.

The age of cheap imports could be over. Producers over consumers, manufacturing jobs over profits. National security over US and global growth. The US might be in the process of pulling off a soft landing, but structurally higher inflation and interest rates and greater economic volatility could lie beyond the election.

Disclaimer: Views in this blog do not promote, and are not directly connected to any Legal & General Investment Management (LGIM) product or service. Views are from a range of LGIM investment professionals and do not necessarily reflect the views of LGIM. For investment professionals only.