11 Feb 2022

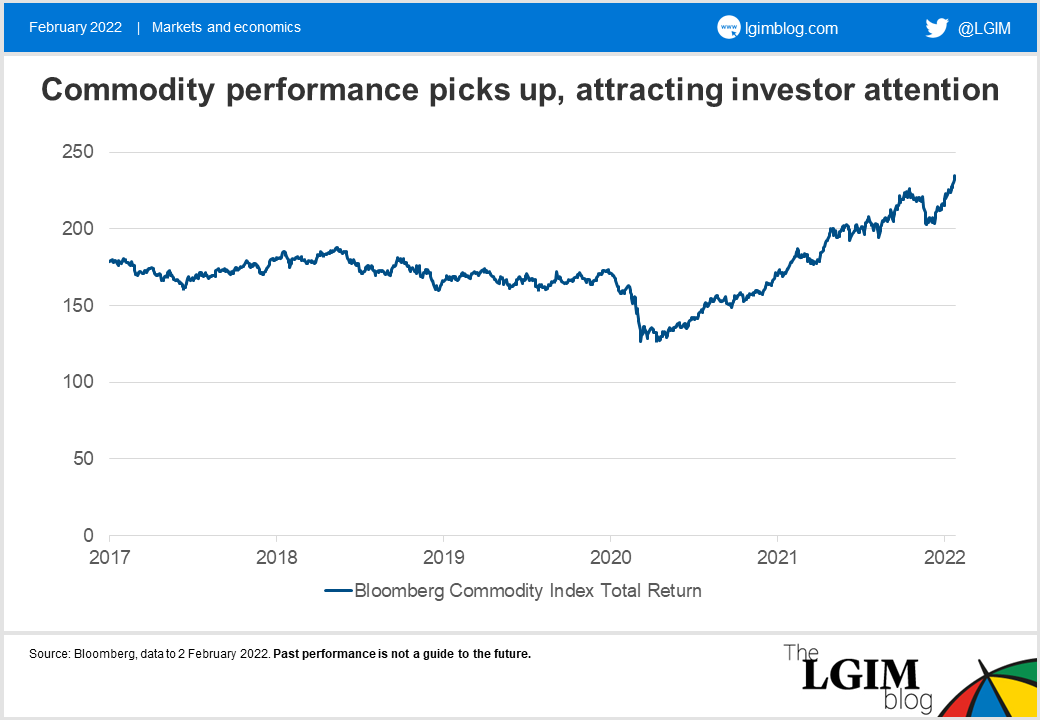

Commodities as an asset class have drifted in and out of favour. Having grown in popularity during the China-led supercycle in the early 2000s, commodities fell out of favour in the 2010s. Recent high inflation and strong commodity performance have led to a resurgence in interest.

A key feature of commodity exposure is inflation hedging. There is a lot of research on the inflation hedging properties of commodities. But it isn’t enough to look at others’ work; we also do our own analysis. Combining the two suggests commodities provide a short-term inflation hedge, able to protect against unexpected inflation, but the amount of protection commodities provide has varied over time.

The relationship between commodities and inflation has been strongest when commodities themselves are the source of the inflationary shock. Owning energy commodities during an energy price spike is a direct way to offset the rise in consumer prices. Both academic research and our own efforts are murkier, though, on the benefit of inflation hedging against core inflation shocks. Although history suggests periods of high core inflation have seen higher commodity returns, the relationship is variable and may not be reliable.

Commodity exposure also provides diversification across business-cycle phases. Commodities tend to do well later in business-cycle expansions, when demand is strong and commodity producers are bumping up against capacity constraints. The late stage of the business cycle is often associated with central-bank tightening and greater uncertainty, so this can provide valuable diversification for a multi-asset portfolio.

These helpful hedging and diversification properties are balanced against low return expectations. Commodities do not generate a cashflow or have an associated return premium. In real terms, spot prices for some commodities trend downwards over long time periods, as technology improvements lead to more discoveries and cheaper production. To be clear, supercycles (like the one seen in the early 2000s) can cause prolonged and significant price gains, but supercycles cannot be relied upon for strategic allocation horizons.

In addition, investors cannot rely on other sources of historical commodity returns. When the spot price is above the price of longer-dated contracts (backwardation), buying the longer-dated contract can generate a roll yield (the price gain from future contracts converging to the spot price as they approach expiration date). Historically, this added to commodity returns but over the past 10 years this roll yield has been negative (-4.5% p.a. using the BCOM index). Enhanced commodity strategies might avoid some of this negative return, but not infallibly.

The role of commodities is to help a portfolio in periods of unexpectedly high inflation and provide strategic diversification. However, the lower long-term return expectations mean we do not expect commodities to provide meaningful inflation protection over longer horizons. This combination (short-term protection and lower long-term returns) will work better in some portfolios than others; each portfolio needs to be considered in its own context.

But overall, we believe commodities are a useful option to have. When used in small doses, they can add hedging and diversification benefits, without lowering the expected return of the portfolio too much.

Unless otherwise stated, data are sourced from Bloomberg as at 2 February 2022.

Disclaimer: Views in this blog do not promote, and are not directly connected to any Legal & General Investment Management (LGIM) product or service. Views are from a range of LGIM investment professionals and do not necessarily reflect the views of LGIM. For investment professionals only.