24 Oct 2023

Everyone knows that the best way to kill a Zombie is to smash its brain. For Zombie firms, that killer blow is higher interest rates.

Zombie firms are essentially companies that exist on borrowed time. They struggle to generate enough profits to cover their debt obligations, yet manage to stay afloat thanks to lenient borrowing conditions. The prolonged period of ultra-low interest rates following the 2008 financial crisis played a significant role in sustaining these firms, allowing them to refinance their debts at favourable terms. As a result, many of these entities have been able to continue operating, albeit with weakened balance sheets and limited growth prospects.

Implications for the Economy

The persistence of zombie firms has implications beyond individual company struggles. These entities tie up resources that could otherwise be invested in more productive and innovative ventures. Resources such as labour, capital, and market share are effectively locked within these stagnant firms, inhibiting the overall efficiency of the economy. This phenomenon can contribute to sluggish economic growth, reduced job creation, and a less dynamic business landscape.

The Looming Threat: Higher Interest Rates

One of the key factors enabling zombie firms to survive has been the availability of cheap credit. As central banks increase interest rates in response to improving economic conditions and/or inflation, the environment that has sustained these firms has shifted dramatically. Higher interest rates will lead to increased borrowing costs for these entities, potentially pushing some of them over the brink and into insolvency.

While the removal of zombie firms might seem like a logical outcome, it is important to acknowledge the potential challenges that could arise from their mass extinction. A sudden wave of business closures could lead to a spike in unemployment and financial instability. Additionally, sectors that have relied on these firms for business relationships and transactions could experience disruptions, further rippling through the economy.

How does the transmission work in the US?

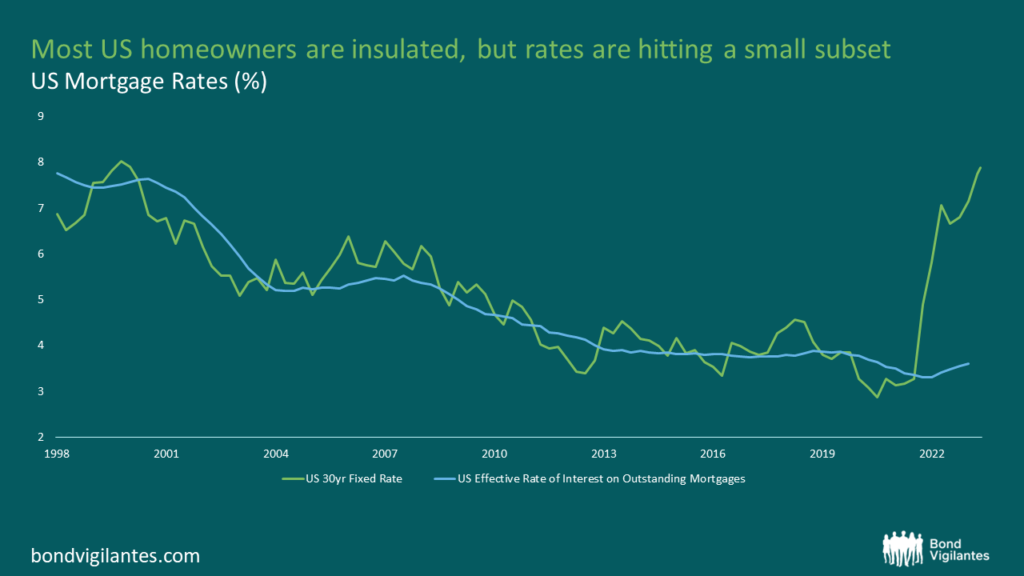

If we think about the consumer, the first avenue to explore would be the mortgage market. With the vast majority of the US market fixing for 30 years, any impact from rising interest rates on existing mortgaged homeowners is limited. The increase in rates will, however, hit a small subset of new buyers. The below chart shows the current 30 year fixed rate mortgage versus the average rate of interest on mortgage debt outstanding.

It’s clear that the mortgage market is largely immune in the short to medium term. Increased interest rates will, however, hurt those consumers with short term debt exposure, credit cards, car financing etc.

Where I see the transmission mechanism at work is through the corporate sector and its impact on employment. Here I am going share some research from the team at Soc Gen which presented some interesting charts.

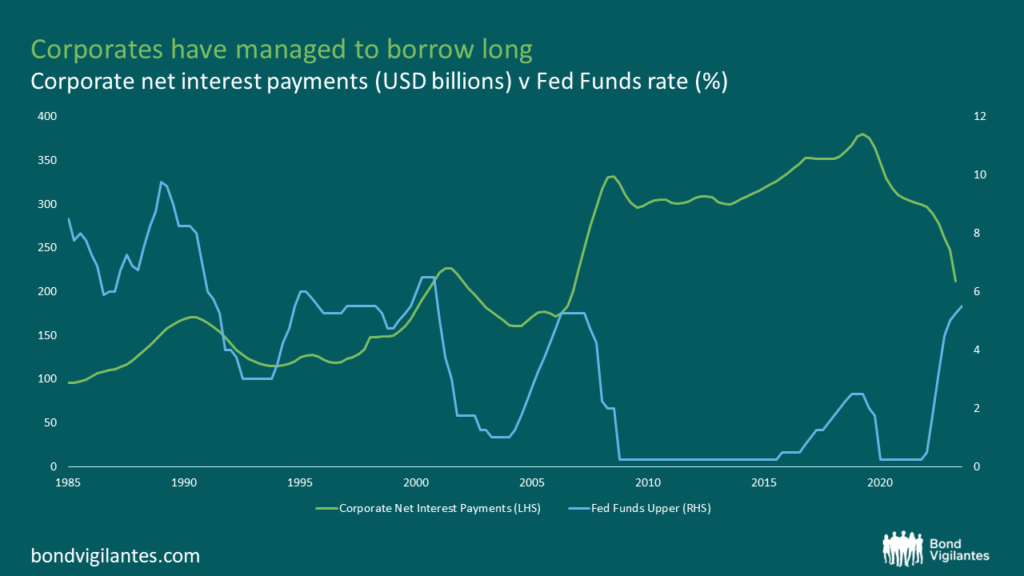

The above chart is somewhat counterintuitive. As interest rates have increased meaningfully, net interest payments have in fact come down. The conclusion or explanation is that corporates have managed to borrow long, take these proceeds and invest in short dated government bonds or money market funds. Not ideal for business investment but a great carry trade. This is essentially the reverse of the banking model where banks borrow on short term variable rates and lend at long term fixed rates. It hasn’t worked particularly well for the regional banks but as always finance is a zero sum game.

However, we need to take a look under the bonnet as there is more to this than meets the eye.

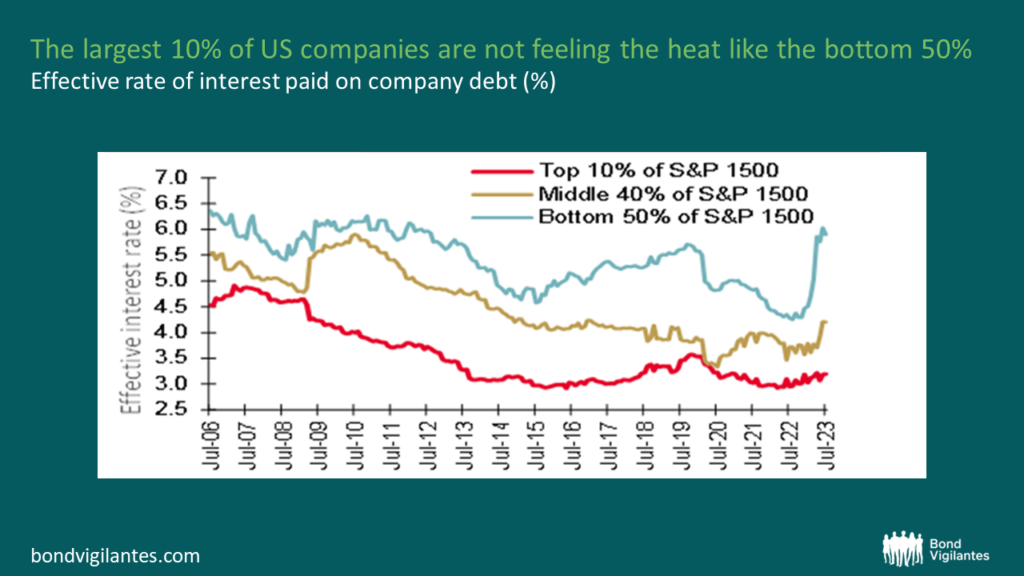

Soc Gen’s research suggests that the largest 10% of companies have thus far been insulated from the effect of higher rates given they have been able to borrow long term at better rates. This is perhaps why we have not seen the effects as profoundly in the headline data. However, the bottom 50% of companies have seen a meaningful impact from higher interest rates. Despite the bottom 50% representing a minority of the overall non-financial market cap, this will have a significant impact in the real economy, as these firms – large employers in the US economy – suffer with debt burdens at increased interest rates.

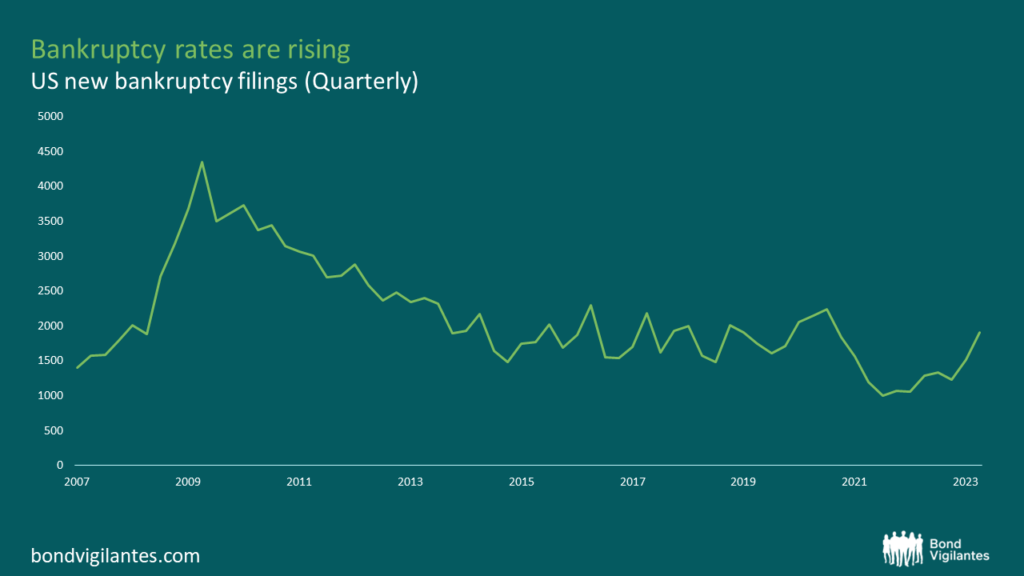

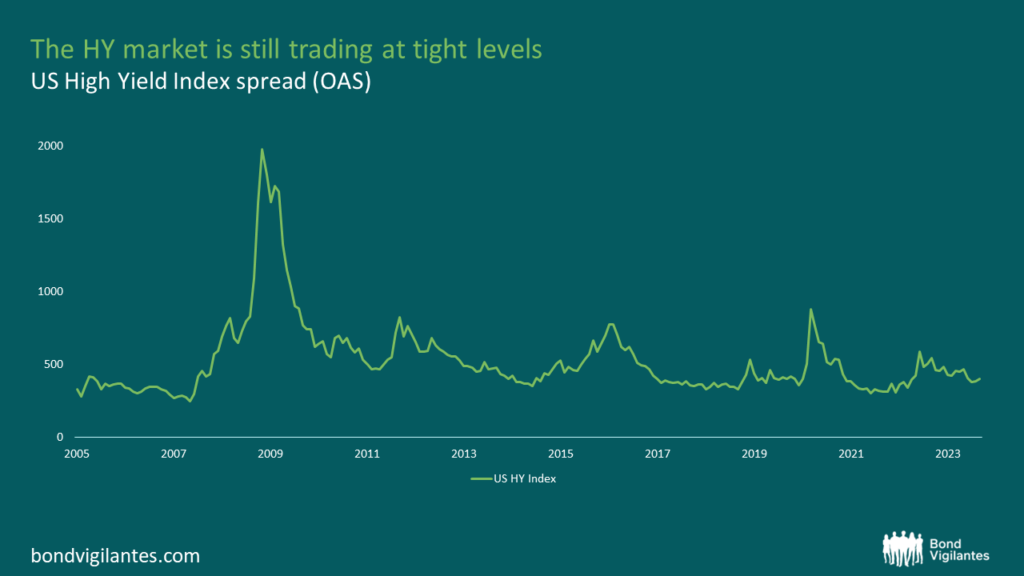

Bankruptcies are beginning to rise but the market remains relatively calm to date with high yield spreads to government bonds at the lows.

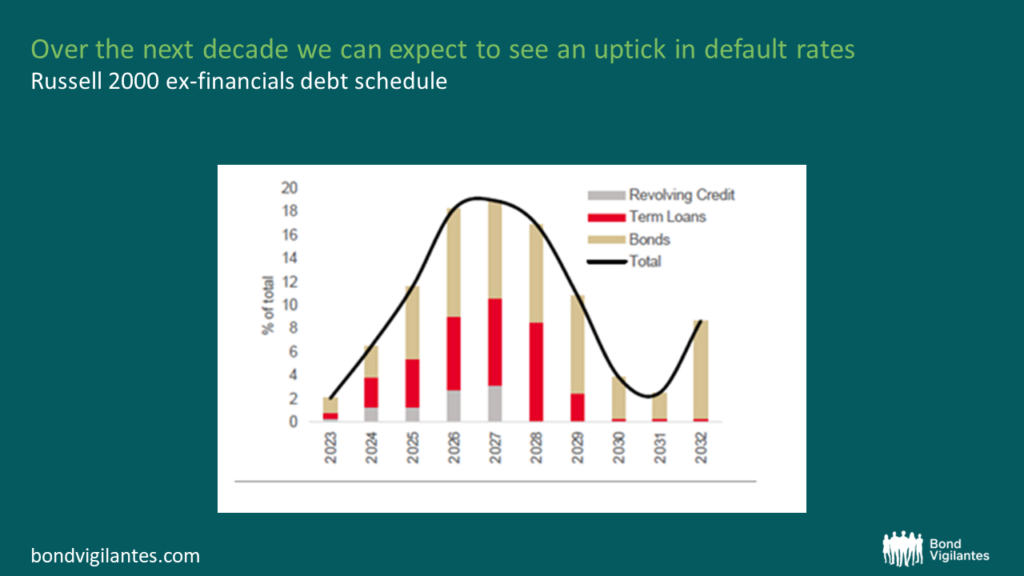

Small businesses are incredibly important to the economy as they employ almost 50% of all US employees. Any significant impact to these companies will have a material impact on employment. The concern is that higher rates will start to hit home from 2025 when large swathes of outstanding debt comes up for renewal. The below chart shows the debt schedule of the Russell 2000. As these firms begin to roll their outstanding debts at significantly higher rates, we should see defaults continue to tick up. The below schedule suggest this could be a few years out.

Perhaps for now the Zombies sleep, but beware, night is upon us.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.