28 Apr 2022

Inflation is driven by the intersection of supply and demand. Before COVID‑19 entered our lives, it was clear that supply exceeded demand in many parts of the world—and there was little impulse for strong inflation. We had lots of energy, lots of labor, and not enough growth. Technology was unlocking capacity in every sector, which had a deflationary effect. Add to this the fact that there were changing demographics—with decreasing populations—and large amounts of debt, and it is clear why generating inflation was a challenge for the global economy.

Russia‑Ukraine conflict creates further complexity

For Illustrative Purposes Only.

The global spread of COVID‑19 had a huge impact on demand and supply. On the demand side, the U.S. Federal Reserve took extraordinary measures to stabilize the global economy, lowering the fed funds rate to 0% and rolling out massive monetary stimulus to support a global economy that would otherwise have faced serious problems. The Fed effectively backstopped risk. Private equity, venture capital, cryptocurrencies, and hyper‑growth technology companies received unprecedented flows of capital. Extreme valuations emerged for the most speculative areas, and these are now unwinding—putting pressure on growth stocks. Elsewhere, governments transferred cash to private sector savings and investment.

...the pandemic and related lockdowns dramatically changed people’s behavior...

On the supply side, the pandemic and related lockdowns dramatically changed people’s behavior—from halting travel abroad to forcing many people to work from home. The pandemic also paralyzed global supply chains, partly due to workers dropping out of the workforce either voluntarily or involuntarily. Looking back, this has turned out to be one of the most important economic consequences of COVID‑19 due to its inflationary effects as we emerge from the worst of the pandemic.

It is still too early to say we have entered a post‑coronavirus world. However, in recent months, many countries (with the exception of China) are coming to terms with the idea of living with the virus. So, what does this mean from a supply and demand perspective?

...demand is contracting in areas most distorted by the pandemic‑Fed combination.

First, demand is slowing. The Fed is in the process of removing excess stimulus by ending quantitative easing and raising the fed funds rate. This will introduce risk, but it will also stem the wild flow of funds to private equity, venture capital, financial fads, and certain nascent digital businesses. Furthermore, multiples have contracted, and demand is contracting in areas most distorted by the pandemic‑Fed combination. This is where the pain is being felt most at present.

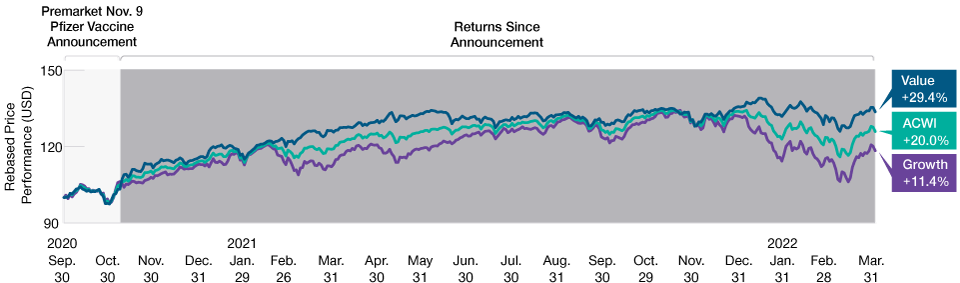

(Fig. 1) Headwinds for growth stocks as inflation and rising rates negatively impact sentiment

As of March 31, 2022.

Past performance is not a reliable indicator of future performance.

“Value” is represented by the MSCI ACWI Value Index (USD), “Growth” is represented by the MSCI ACWI Growth Index (USD), while ACWI is the MSCI ACWI Index (USD).

MSCI ACWI price returns September 30, 2020, through March 31, 2022.

Source: MSCI (see Additional Disclosure). T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

At the same time, healing supply chains have had a positive effect across several areas—such as oil, semiconductors, cars, and housebuilding materials. There are few large‑scale shortages in the world if supply chains are functioning.

China’s handling of infection will be critical.

In many parts of the world, COVID‑19 infection levels remain high but vaccination programs have helped reduce hospitalization and death rates. China’s handling of infection will be critical. If China can successfully manage COVID‑19 cases and the world does not see a more severe COVID‑19 mutation, supply chains are likely to steadily recover over the next year or two. Moreover, in the U.S., we are seeing strong signs of workers returning to work, and this should ease labor market tightness in time.

Prior to Russia’s troubling invasion of Ukraine, inflation was peaking globally—and likely to decline into 2023. The scenario that we have been working with is that demand for specific sectors that benefited from pandemic‑related behavior is set to slow as high inflation and rising inflation rates pinch. Simultaneously, supply chains begin to function more normally. As a result, both trends would likely lead to lower inflation.

However, in the wake of Russia’s invasion of Ukraine, the inevitable and necessary sanctions imposed by the West have added further complexity; essentially creating a “shock on top of a shock.” Unfortunately, logical economic incentives are poor tools when it comes to predicting this kind of global entanglement. Will the West strike oil deals with Iran or Venezuela? Could the current conflict escalate? What about a possible Russia‑Ukraine peace deal? I think it’s safe to say that these are all completely unpredictable scenarios.

What we do know is that inflationary shocks such as this have almost always led to deflation through the subsequent supply response and the slowing of demand. High prices should force substitution, new relationships, accelerated investment, and changes in consumption.

With all of this in mind, what are we investing in on behalf of clients? In short, we are focused on where the fading of pandemic behavior and Fed distortion could open new return drivers. What is interesting is that many investors are trying to make money from the same stocks that were distorted so positively in the COVID‑19 world. We believe that idiosyncratic stocks offer solid upside potential—even in this challenging environment. We continue to like the expansion of travel and tourism. We have also been adding to capital markets stocks that are beneficiaries of market volatility and are looking to be carefully contrarian in select emerging markets, including China and Brazil.

We are steering clear of the extremes of the pandemic era in tech....

There are certain areas that we are avoiding. We are steering clear of the extremes of the pandemic era in tech, as well as the extremes of a commodity price rally that would seem unsustainable. We think it would be wise to avoid allocating to the extremes of value or growth in this environment, given the challenges apparent in both ends of the distribution.

If pushed to argue for growth over value, it’s worth pointing to the apparent risks if we are wrong about inflation and the interest rate cycle—and that we see an acceleration over the medium term, as opposed to a fading of extremes. This would likely act as a source of economic headwinds. In this scenario, earnings durability and idiosyncratic growth could be better defense mechanisms than owning the source of possible maximum pain in the market found in deep cyclicals during a cyclical downturn.

This is a matter of duration and time horizon—but we are much more comfortable taking a growth orientation into the next stage of the market cycle. While the probability of stagflation and/or a recession is higher than six months ago, one scenario is still more likely than the many others that could play out. This includes our expectation that interest rates move higher, but not by an extreme amount, especially as supply chains heal and as inflation subsides. Under this scenario, the world evolves around Russia’s behavior, new supply emerges from existing and new sources, and a new equilibrium is reached in Ukraine. Meanwhile, we learn to live with COVID‑19, which also unlocks supply chain tightness.

Uncertainty remains over China, but the Chinese authorities’ message has changed in recent weeks, erring toward intervention, stimulus, and support for its own economy (when necessary)—especially if its COVID‑19 journey is a difficult one. Of course, there are many more potentially negative scenarios, with the escalation of the Russia‑Ukraine conflict being arguably the worst.

In the current market environment, we remain committed to our investment framework and to focusing on the future where we see improving economic returns. Our strategy has always been built around a world that is changing. We embrace this and the potential to discover new ideas that deliver value for our clients. Ultimately, while we are not trying to make the case that all growth will work over the next year or so, we are less concerned about a value factor headwind after the rotation we have seen over the past 12 months.

Risks—The following risks are materially relevant to the portfolio:

Country risk (China)—All investments in China are subject to risks similar to those for other emerging markets investments. In addition, investments that are purchased or held in connection with a QFII licence or the Stock Connect program may be subject to additional risks.

Country risk (Russia and Ukraine)—In these countries, risks associated with custody, counterparties and market volatility are higher than in developed countries.

Currency risk—Changes in currency exchange rates could reduce investment gains or increase investment losses.

Emerging markets risk—Emerging markets are less established than developed markets and therefore involve higher risks.

Small and mid‑cap risk—Stocks of small and mid‑size companies can be more volatile than stocks of larger companies.

Style risk—Different investment styles typically go in and out of favour depending on market conditions and investor sentiment.

General Portfolio Risks

Capital risk—The value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

Equity risk—In general, equities involve higher risks than bonds or money market instruments.

ESG and Sustainability risk—May result in a material negative impact on the value of an investment and performance of the portfolio.

Geographic concentration risk—To the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—A portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—The investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—Operational failures could lead to disruptions of portfolio operations or financial losses.

Additional Disclosure

MSCI and its affiliates and third‑party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.