11 Apr 2022

Michael Walsh, Solutions Strategist

While Russia’s invasion of Ukraine has brought added uncertainty to an already volatile period in markets, the determination of central banks to tackle rising inflation risk is unlikely to change. After a long period of very low yields, interest rates are expected to surge. This is presenting bond investors with an age‑old problem: How can you add yield to a portfolio in a way that does not bring too much exposure to rate risk?

Over the next few months, we will be exploring the search for yield from several angles. In this article, we will focus on how fixed income investors can potentially boost yield by abandoning home bias and diversifying across countries. For most portfolio managers, bonds issued by their home country’s government are seen as key low‑risk building blocks for multi‑asset portfolios. Such bonds are easily understood by end investors, provide an anchor for riskier assets within a portfolio, and avoid currency risk. However, we believe that investing more globally in fixed income markets comes with significant benefits—not least because it increases diversification.

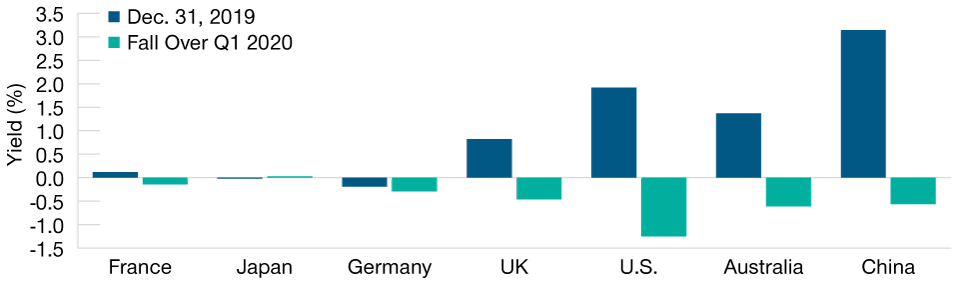

(Fig. 1) How the yields of different bonds declined in Q1 2020

As of March 8, 2022.

Past performance is not a reliable indicator of future performance.

Sources: Bloomberg Finance L.P. Analysis by T. Rowe Price. Yields used are for the generic 10‑year government bond for each currency.

For much of the period since the global financial crisis, yields on eurozone government bonds have been among the lowest in the world. European Central Bank policy rates have remained at or below zero since 2012, and this has tended to pull even long‑dated government bond yields substantially lower over time.

...low yields have limited the capacity of these bonds to act as “safe havens...

Such low yields have limited the capacity of these bonds to act as “safe havens” in times of market stress as well as reduced income for investors. During the pandemic outbreak in the first quarter of 2020, for example, yields on many benchmark government bonds fell sharply (meaning the prices of those bonds rose, protecting the value of portfolios in a difficult period). However, the yields on bonds that were already very low yielding fell by significantly less than higher‑yielding bonds from other countries (Figure 1). This illustrates that investors are reluctant to purchase large amounts of low‑ or negative‑yielding government bonds, even in times of crisis; it also shows why higher‑yielding, nondomestic government bonds can act as a useful “shock absorber” in periods of market turmoil.

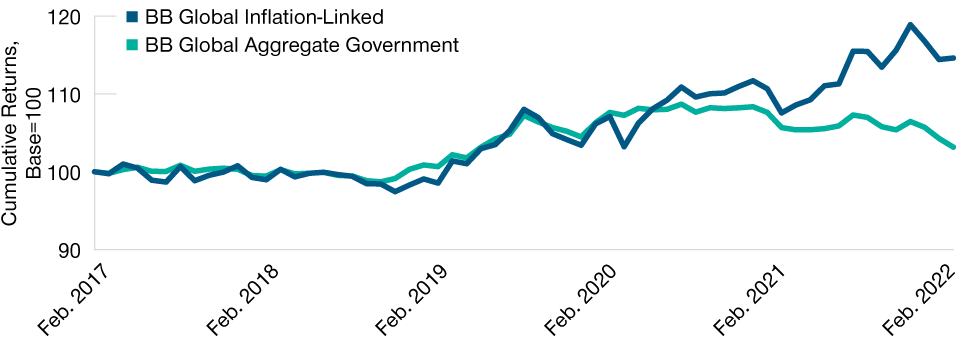

(Fig. 2) They have fared well on an absolute basis and relative to fixed rate sovereigns

As of February 28, 2022.

Past performance is not a reliable indicator of future performance.

Sources: Bloomberg Global Inflation‑Linked Index hedged to EUR, Bloomberg Global Aggregate Government Index hedged to EUR. Analysis by T. Rowe Price.

However, the value of government bonds as safe havens has been questioned more recently. Since the start of 2022, investors have seen the value of equity holdings fall sharply as sentiment has soured due to accelerating inflation and Russia’s invasion of Ukraine. Growing inflation expectations have driven bond yields higher and resulted in a more positive correlation between equities and fixed income—at just the wrong time for investors seeking diversification.

In this situation, the low‑risk asset of choice may well be inflation‑linked government debt, where the value of coupon and maturity payments increases with measures of domestic inflation. Such bonds have fared well in recent months, both on an absolute basis and relative to fixed interest government bonds.

...looking beyond the domestic market can bring opportunities....

Again, looking beyond the domestic market can bring opportunities as the current inflation wave is increasingly an issue across much of the globe. The UK, U.S., Japan, Canada, and Sweden are all sizable issuers of inflation‑linked government debt.

From a portfolio management perspective, the freedom to invest in global bond markets offers opportunities to take advantage of scenarios where monetary policy is diverging, as it is now. We are finding potentially attractive positions in select emerging markets, where central banks had to tighten monetary policy in the aftermath of the pandemic due to rising inflation. These countries are further progressed in their hiking cycles relative to major developed markets such as the U.S., eurozone, and UK, where tightening of policy is only beginning.

China’s local currency debt is another example. Rather than hiking rates, the Bank of China is expected to continue easing to support growth, while Chinese bonds are also benefiting from inclusion in major global fixed income benchmarks. We see a global investment platform and specialist skill in assessing a wide range of fixed income instruments as being key to selecting exposures to help meet investors’ requirements against the current volatile backdrop.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.