13 Jun 2023

Macro risks have risen, but the outlook for Japan appears bright.

The uncertain global macro environment has understandably dominated investor thinking and press reporting over the past 12 months—from heightened geopolitical tensions to rising inflation and interest rates, to the stress in the U.S. banking system and fears of a potential U.S. recession. One market that has perhaps flown under the radar amid all the macro noise is Japan, with the broad TOPIX Index hitting a 33‑year high in May.1 The post‑pandemic reopening of the Japanese economy, ongoing structural market reforms, and the fact that many of the global macro risks appear to be fully priced into Japan market valuations have all played a part in driving Japan’s strong performance year‑to‑date. What’s more, the Japan story is gathering momentum, and the outlook appears positive.

The Path to “Normalization”

Relative to other major world economies, Japan remains a policy outlier. In a global environment of heightened inflation and rising interest rates, the Bank of Japan (BoJ) continues to hold short‑term interest rates at ‑0.1% while reiterating its 0% target for 10‑year Japanese government bond (JGB) yields. It continues to adhere to its large‑scale bond‑buying yield curve control (YCC) strategy, with 10‑year JGB yields allowed to fluctuate in the range of around +/‑ 0.5% from the target 0% level.

The idea behind the strategy is to control the shape of the yield curve, specifically to suppress short‑ to medium‑term rates, which affect corporate borrowers, without depressing super‑long yields too much and reducing returns for pension funds and life insurers. YCC worked well when inflation was low; however, as inflation has started to rise, investors have sold low‑yielding bonds, forcing the BoJ to ramp up its buying to maintain its yield range target. Amid growing criticism of distorting market pricing, the strategy has caused the value of the yen to fall sharply and, in turn, inflated the cost of raw material imports.

On April 9, 2023, Kazuo Ueda was announced as the new governor of the BoJ in a surprise move that raised hopes of a potential shift toward policy normalization in Japan. Such a move would be significant for Japan, unwinding policies that have kept the yen depressed for years, while higher rates would also help to encourage the trillions of dollars of Japanese cash back onshore, having been lost to higher overseas rates. In the short time since his appointment, Ueda has acknowledged that the bank’s current ultra‑loose policy is not sustainable; however, he has also indicated that the BoJ is in no rush to push through changes.

Sustainable Inflation Is Key

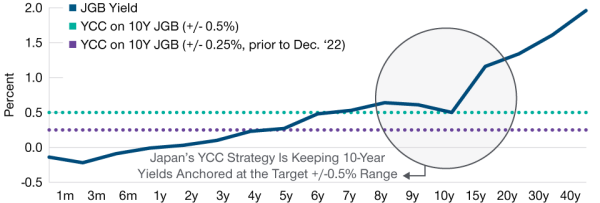

A prime consideration for any potential shift in policy is inflation. Core consumer price index (CPI) inflation rose at an annual rate of 3.4% in April, above the BoJ’s target 2% rate but sharply down from the multi‑decade‑high 4.2% recorded in January. However, the preliminary outcome of the annual spring wage negotiations between company management and labor unions, known as shunto, offer encouragement that inflation may at last be sustainable. Initial data point to an overall year‑over‑year wage increase in the range of 3%, which would be the highest number since the early 1990s. Such a wage increase will put pressure on the newly appointed BoJ governor to move forward with the normalization of Japanese monetary policy—the likely first step being the removal of the current yield curve control policy (Figure 1).

Bank of Japan’s Yield Curve Control Strategy in Action

(Fig. 1) 10‑year government yields remain anchored at the bank’s curve control range

As of May 15, 2023.

Japan government bond yield curve 1m—40y issuance. Yield curve control policy in action as the BoJ focuses on buying 10‑year bonds to peg yields to a target range of +/‑0.5% of 0%. Prior to December 2022, the target range was +/‑0.25%.

Source: Eikon Refinitiv. © 2023 Refinitiv. All rights reserved.

At its policy meeting in December 2022, the BoJ shocked the market by announcing a tactical change to its yield curve control strategy, shifting the band from +/‑ 0.25% of its target 0% interest rate to +/‑ 0.5%. This was a hugely unexpected policy change. The BoJ remains adamant that this is not a precursor to a broader policy pivot (yet) and insists that it wants to see durable signs of inflation above 2% before it tightens policy.

1 TOPIX Index, in local currency terms, as of May 15, 2023. Source: Refinitiv Eikon. © 2023 Refinitiv. All rights reserved.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

EEA – Unless indicated otherwise this material is issued and approved by T. Rowe Price (Luxembourg) Management S.à r.l. 35 Boulevard du Prince Henri L-1724 Luxembourg which is authorised and regulated by the Luxembourg Commission de Surveillance du Secteur Financier. For Professional Clients only.

Switzerland - Issued in Switzerland by T. Rowe Price (Switzerland) GmbH, Talstrasse 65, 6th Floor, 8001 Zurich, Switzerland. For Qualified Investors only.

UK - This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.