05 Jun 2023

Rates offer alpha opportunities, dollar at risk of depreciation

Arif Husain, Chief Investment Officer; Head of International Fixed Income; Co‑portfolio Manager, Dynamic Global Bond Strategy

Scott Solomon, Co‑portfolio Manager, Dynamic Global Bond Strategy

Quentin Fitzsimmons, Co‑portfolio Manager, Dynamic Global Bond Strategy

Key Insights

Bond volatility is likely to persist as concerns continue over sticky inflation, slowing growth, the banking sector, and the U.S. debt ceiling standoff. Through this volatility, we are finding potential attractive alpha opportunities in the rates space amid increased dispersion in central bank policy. In risk markets, the window of opportunity to add credit risk may have passed for now. While fundamentals continue to be supportive, we feel that risk markets may face challenges ahead from slowing growth or further market stresses, which is a possibility given the sheer number and pace of interest rate hikes since 2022.

Overall, we believe this environment will suit the Dynamic Global Bond Strategy, which has a strong emphasis on active duration management and is flexible with the ability to tactically respond to different market environments.

Conditions Ripe for Potential Alpha Opportunities in Rates

In rates, we believe that the current landscape is more conducive for generating alpha as heightened volatility creates dislocations that we can potentially take advantage of. One example here is the U.S., where banking turmoil led to markets pricing in multiple interest rate cuts later this year. While the Federal Reserve may pause rate hikes soon, we believe it is unlikely that it will then switch to cutting interest rates so quickly given the current U.S. inflation and labor market dynamics.

Our base case is for U.S. rates to stay higher for longer than markets currently anticipate.

- Scott Solomon, CFA Co‑portfolio Manager, Dynamic Global Bond Strategy

Our base case is for U.S. rates to stay higher for longer than markets currently anticipate. Why? Price pressures are cooling, but only moderately and not likely fast enough to force the Fed into an early cutting cycle given that inflation remains materially above its 2% target. It is a similar story in the labor market, which may be loosening, but only gradually and from a position of extreme tightness. With this backdrop, U.S. rate cuts are probably off the table for 2023, so we expect the two‑year U.S. Treasury yield to reprice higher. Eventually, the Treasury curve is likely to steepen or normalize as the current hiking cycle comes to an end. This is a long‑term view that we believe will play out over several quarters.

Tactical Themes in Bond Markets

(Fig. 1) Four key themes to monitor

As of April 30, 2023.

Source: T. Rowe Price.

Dispersion in the Monetary Policy Cycle

Another key trend that we believe is conducive for potential alpha generation in rates is dispersion in the monetary policy cycle. Not all countries are at the same point—emerging market central banks, for example, started raising interest rates earlier and are therefore either close to the peak or finished their hiking cycles. The focus in emerging markets is now on the sequencing—i.e., how long central banks keep rates on hold before moving to cutting cycles. Broadly, we feel that a select few countries may be able to start easing later this year.

In developed markets, we are seeing some central banks, such as Australia, soften their guidance around future tightening, while others, such as the European Central Bank, remain hawkish in their battle to bring down inflation. Then there’s the Bank of Japan (BoJ), which remains something of an outlier in its accommodative monetary policy stance. However, we do feel that at some point this year the BoJ may adjust its yield curve control policy and believe this is most likely to happen when market conditions are calmer and there’s downward pressure on global yields.

Overall, we feel these divergences in monetary policy are conducive for us as we can implement both long and short duration stances in the portfolio. At the end of April, our preferred long positions were expressed in New Zealand, Australia, Canada, and select emerging market local currency bonds. By contrast, our preferred short positions at the end of April were predominately expressed in the eurozone and the short end of the U.S. curve as we believe that interest rate cuts are unlikely in 2023.

U.S. Dollar at Risk of Weakening

After a period of multiyear strength, we believe that the U.S. dollar is at risk of weakening.

- Quentin Fitzsimmons, Co‑portfolio Manager, Dynamic Global Bond Strategy

After a period of multiyear strength, we believe that the U.S. dollar is at risk of weakening. There have been a few signs this year that the currency has hit a natural resistance after it failed to appreciate at times of heightened volatility in markets, such as the recent banking turmoil. Going forward, several indicators, including the U.S. economy moving into the late cycle before other countries and the likelihood that the Federal Reserve pauses hiking sooner than most peers, point to a period of dollar weakness. Accordingly at the end of April, we expressed an overall short bias in the U.S. dollar against a range of developed and emerging market currencies, including the euro and the Brazilian real.

Heightened Volatility in Bond Markets

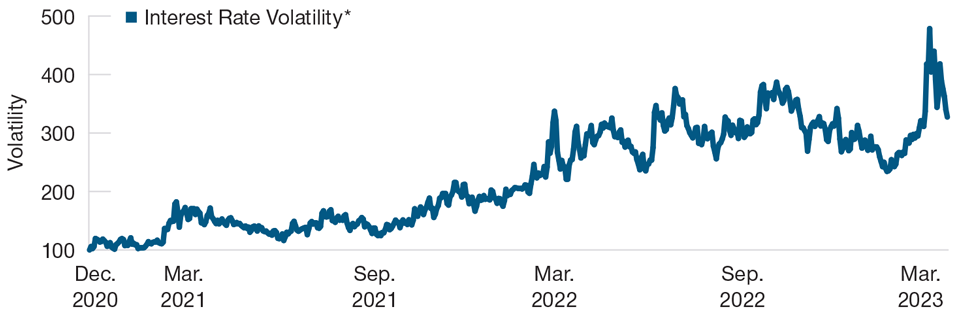

(Fig. 2) Levels of the MOVE Index since December 2020

As of March 31, 2023.

Past performance is not a reliable indicator of future performance.

*Rebased to 100 as of December 1, 2020. Interest Rate Volatility = ICE BofA MOVE Index represents implied volatility on 1‑month Treasury options.

Source: Bloomberg Finance L.P.

Importance of Flexibility

...volatility can often result in dislocations that we can potentially take advantage of thanks to our portfolio flexibility and active management approach.

- Arif Husain, CFA Chief Investment Officer; Head of International Fixed Income; Co‑portfolio Manager, Dynamic Global Bond Strategy

Going forward, we expect volatility to remain elevated in the fixed income market amid sticky inflation, slowing growth, ongoing geopolitical risks, and worries over the financials sector. There is also the political standoff over the U.S. debt ceiling—the longer this persists, the higher the risks. While this environment is likely to be challenging, volatility can often result in dislocations that we can potentially take advantage of thanks to our portfolio flexibility and active management approach. For example, the dislocations created by volatility in March opened up a window to add select credit risk driven by our bottom‑up research process.

With heightened volatility likely to persist, we anticipate that more opportunities will emerge in the future to add credit, but for now we feel the window has passed. Although robust credit fundamentals continue to be supportive, risk markets could face some challenges later this year. The impact of monetary policy tightening usually comes with a lag, so it is possible that other stresses could emerge at some point, particularly given the aggressive pace of rate hikes since 2022. Furthermore, we are conscious that recent banking sector turmoil may lead to tighter credit conditions in the future, adding another headwind to the global economy.

Overall, we believe that the current environment of elevated volatility, economic uncertainty, and the approaching turning points in interest cycles around the world lend themselves well to our actively managed global bond strategy, which is flexible and has a strong emphasis on managing duration dynamically.

The specific securities identified and described do not represent all of the securities purchased, sold, or recommended for the portfolio, and no assumptions should be made that the securities identified and discussed were or will be profitable.

General Portfolio Risks:

Capital risk—The value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

Counterparty risk—An entity with which the portfolio transacts may not meet its obligations to the portfolio.

ESG and Sustainability risk—May result in a material negative impact on the value of an investment and performance of the portfolio.

Geographic concentration risk—To the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—A Porfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—The investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—Operational failures could lead to disruptions of portfolio operations or financial losses.

Additional Disclosure

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.