01 Jun 2021

Katie Deal, Associate Analyst | Chris Kushlis, Credit Analyst

Tensions remain elevated, but expect a return to more multilateral negotiations

China remains keen to engage and trade with the rest of the world, but we anticipate technology competition and supply chain self‑security tensions to continue between the U.S. and China.

We believe the Biden administration brings a more strategic and holistic approach to the U.S.‑China relationship. We expect the U.S. to rely on diplomacy and the development of allies in negotiating with Beijing.

Public concerns over China provide U.S. lawmakers with the political incentive to pursue tougher measures. As a result, decisions like tariff relief may not prove viable in the near term.

Market participants have closely monitored China’s constantly evolving relationship with the United States. Tensions between the U.S. and China have been exacerbated by trade wars, sanctions, human rights violations, and threats of delisting of Chinese companies on U.S. exchanges.

Despite signs of economic protectionism, China continues to express a desire to engage with the rest of the world. The recent 14th Five‑Year Plan (FYP) (2021–2025) finalized at the National People’s Congress in March 2021 called for promoting a high‑level opening of the Chinese economy, targeting new trade pacts, and aggressively recruiting foreign investment both in industrial and financial services. These opposing dynamics have led investors to question whether further escalation in geopolitical tensions will detract from China’s efforts to pursue new relationships alongside a more developed economy by its 2035 goal.

...[President Biden] has explicitly and implicitly communicated the importance of national security and economic competition with China.- Katie Deal, Washington Analyst, U.S. Equity Division

The early months of Joe Biden’s presidency prioritized recovery from the coronavirus pandemic—both through vaccine rollout and significant fiscal relief spending (USD 1.9 trillion). Though the pandemic represents President Biden’s first and foremost priority, he has explicitly and implicitly communicated the importance of national security and economic competition with China. Although the Biden administration has signaled a clean break with its predecessor on most issues, its rhetoric on the U.S.‑China relationship has often sounded familiar.

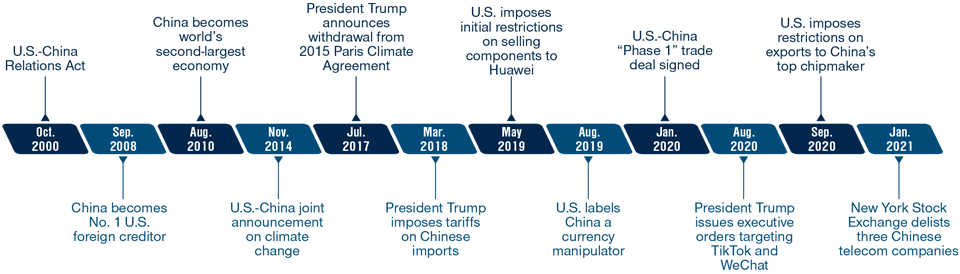

Timeline of U.S.-China Relations

The Biden administration will likely bring a more strategic and holistic approach, while highlighting America’s competitiveness

The new administration, however, is likely to take a more deliberate and multilateral approach to trade negotiations, meaning that U.S. trade policies may become more rules‑based and predictable—lowering the market risk premium. But a more thoughtful approach will not completely remove the risk of escalation, particularly given continued skepticism felt by both the White House and Congress.

While President Biden’s approach toward China as a “strategic adversary” reflects some of the concerns held by Trump administration officials, the Biden White House will likely employ a broader, more coordinated set of policy tools in addressing different facets of the relationship. Congress likely will continue bipartisan scrutiny over Chinese market practices, government actions, and geopolitical risks in the region—likely pursuing a new legislative package related to the U.S.‑China relationship in the near term. Public opinion further supports this more assertive posturing, providing lawmakers political room to pursue tougher measures. As a result, decisions like tariff relief may not prove viable in the near term—particularly without a more comprehensive series of negotiations between the U.S. and China.

Throughout the Trump administration, U.S.‑China relations were marked by pugilistic rhetoric from the White House. We anticipate the Biden administration’s messaging will veer from open hostility and confrontation toward diplomatic negotiations that incorporate regional allies and partners. Additionally, we could see the Biden administration pursue distinct areas of cooperation with China, particularly related to climate change and specific matters of national security.

To accomplish its goal of negotiating effectively with China, the U.S. must partner with the European Union (EU) while finding common ground in its relationship with Beijing—a complex and nuanced foreign policy challenge. While opinion toward China has hardened in many countries, European allies seem reluctant to get drawn into a cold war‑style confrontation with China. Although we have seen a broad desire for dialogue and discussion, most EU member states have supported a careful, step‑by‑step approach, especially as they seek to engage with China on upcoming infrastructure projects like 5G rollout. After Biden spoke at a recent Munich conference, Chancellor Angela Merkel and President Emmanuel Macron both gave remarks with more emphasis on the need to cooperate with China, signaling that an incremental approach may be the best method to develop a U.S.‑EU partnership.

...the U.S. delay to reengage in more substantive talks with China is an attempt to establish a broader public‑facing front among allies...- Katie Deal, Washington Analyst, U.S. Equity Division

We believe that the U.S. delay to reengage in more substantive talks with China is an attempt to establish a broader public‑facing front among allies, enabling more leverage in any talks when contrasted with a bilateral approach. Generally, we anticipate that U.S. officials will pursue accord with Europe on issues such as Beijing’s treatment of Muslim Uighurs, the government’s actions in Hong Kong, and market access issues facing multinational firms. But technology issues, such as the 5G debate that strained transatlantic relations during the Trump administration, have the potential to stall progress and buy‑in.

While the Biden administration views China with a critical eye, Beijing has also taken a more careful approach with Washington, suggesting that relations will remain choppy. China is acutely aware of the current U.S.‑China dynamic, and these tensions were visible during the first high‑level meeting between Chinese and U.S. officials in the new administration.

Though Beijing hopes to benefit from a change in rhetoric from the Biden administration, it is unlikely to make any major unilateral concessions—particularly without comprehensive negotiations. It is also important to recognize that Beijing has undergone a strategic shift in technology and innovation policy, with a more open discussion of longer‑term rivalry with the U.S.

More broadly, China is seeking to build its position within the global economy. Beijing sees a large and well‑developed renminbi‑denominated onshore financial market as crucial for its long‑term plan of currency internationalization. Capital markets reform is a core part of the 14th FYP, and the prospect of larger foreign inflows is crucial to achieving that goal.

China Seeking to Build its Position Within the Global Economy

Securing trade pacts and forging new partnerships to help open up their economy

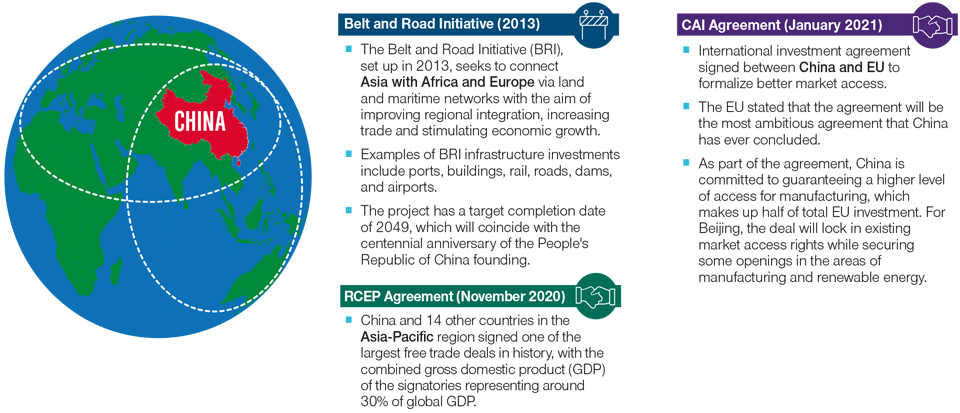

The FYP, despite external challenges, also calls for promoting a high‑level opening of the Chinese economy—through more trade and investment liberalization—to “enhance global cooperation.” Beijing has been stepping up its efforts to secure trade pacts with other countries while aggressively opening sectors for foreign investment. Recent agreements include the Regional Comprehensive Economic Partnership (RCEP), signed between 15 Asia‑Pacific countries in November 2020, and the EU‑China Comprehensive Agreement on Investment (CAI). The CAI agreement is particularly important for the EU as it significantly opens China’s internal market to EU companies.

Beijing has been stepping up its efforts to secure trade pacts with other countries while aggressively opening sectors for foreign investment.- Chris Kushlis, CFA, Asia Sovereign Credit Analyst

This is all on top of the already‑established plan to build influence in the EM world via the Belt and Road Initiative (BRI). The BRI itself is evolving from a heavy focus on infrastructure to more economic connectivity via supply chain integration and digital/IT integration. Cooperation on vaccine distribution is another area that can be incorporated under the flexible BRI header. China has embarked on vaccine diplomacy pledging 500 million doses of its vaccines to more than 45 countries. Four of China’s vaccine producers have asserted that they could produce at least 2.6 billion doses this year.

Despite escalated tensions over the past several years, China’s role in the global economy remains prominent, presenting a significant opportunity for investors. However, the geopolitical environment is both fluid and prone to escalation, requiring consistent monitoring over time. Businesses exist within the backdrop of geopolitical risk; and when relationships are tense, it can be more difficult to navigate normal operations. With most international companies seeing Asia—particularly China—as their main growth opportunity going forward, assessing China’s role in global diplomacy will prove valuable in risk assessment.

Market fundamentals remain encouraging for further investment, and we continue to see several elements of the Chinese economy reopening after the coronavirus pandemic, along with an increasing number of international companies expanding their operations in China. Ultimately, the economic opportunity presented by investment in China may incentivize improved relations with other global partners, especially as other economies begin to recover from the pandemic. In an increasingly integrated global economy, the prosperity of countries depends not only on the progress of their own economies, but also on global economic development.

This is part of a series of TRP Insights focusing on China. The aim in our series Investing in China is to explore the key drivers for China’s economy, market opportunity, outlook, and our strategy for investing.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.